Paycor Quick FactsPrices: Contact for prices Key Features:

|

Paycor is a popular cloud-based payroll software used by over 2 million people at 40,000 different companies. Paycor is known for its payroll platform, but the software also offers human capital management (HCM) tools.

Let's dive into Paycor's pricing plans, features, pros, and cons to help you decide if this is the right payroll software for your business.

2

quick books

Employees by company size

Micro (0-49), Small (50-249), Medium (250-999), Large (1000-4999), Business (5000+)

Micro (0-49 employees), small (50-249 employees), medium (250-999 employees), large (1000-4999 employees)

Micro, Small, Medium, Large

Characteristics

24/7 Customer Support, API

3

Paycor

Employees by company size

Micro (0-49), Small (50-249), Medium (250-999), Large (1000-4999), Business (5000+)

Micro (0-49 employees), small (50-249 employees), medium (250-999 employees)

Micro, Small, Medium

Characteristics

API, check printing, document management/sharing and more

Paycor Pricing

Paycor does not disclose pricing on its website, so you must contact the sales team for a quote. It lists four different levels of plans for businesses with fewer than 50 employees and what features are included in each, and we'll get into those details below. TechRepublic's other picks for best payroll software are split on whether or not they disclose pricing, so this isn't completely unusual, but I prefer payroll software to be upfront about their pricing.

There's supposedly a 14-day free trial available so you can try before you buy, but it's very hard to find. However, I was able to sign up for a demo account with dummy data using just my email, and I appreciated that a credit card was not required to do so.

Paycor Basic Plan

The Basic plan includes classic payroll features such as wage garnishments, off-cycle payments, online pay stubs, and online reporting.

Paycor Essential Plan

In addition to all the features offered in the Basic plan, the Essential plan also includes a month-end accounting package, general ledger report, time off manager, onboarding tools, and more.

Paycor Basic Plan

In addition to all the features offered in the Basic and Essential plans, the Core plan includes expense management, employee surveys, and leadership tools.

Paycor Complete Plan

In addition to all the features offered in the Basic, Essential and Basic plans, the Complete plan includes career management, compensation planning and talent development functionality.

Paycor Plugins

Paycor also offers additional add-ons that are not included in any of their core payroll plans. Those additional features are:

- Workers' compensation insurance.

- Time and programming.

- Benefits administration.

- Recruitment and hiring tools.

Key Features of Paycor

Payroll and Tax Features

Paycor's payroll module offers unlimited payroll runs, so it won't charge you extra for out-of-cycle payments or other additional runs, which is useful if you need to make payments frequently. It also offers a useful payroll feature called AutoRun that can run payroll automatically at another date and time. All changes are made in real time, so there is no need to wait for them to load. Additional payroll features include direct deposit, federal and state tax filing, employee self-service, and check stuffing (the latter of which costs an additional feature).

Time management features

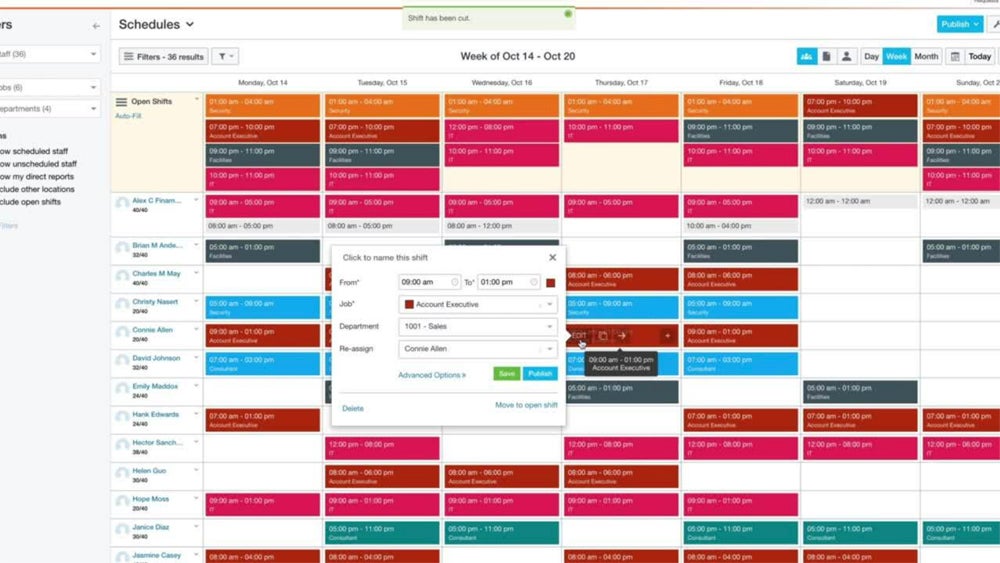

Paycor offers time and scheduling tools, but you'll have to pay an undisclosed amount to add them, even if you opt for the most expensive plan. Since many payroll platforms include scheduling and time tools in their higher-tier plans, I wasn't thrilled to see Paycor charging more for it, no matter what. Paycor offers a variety of clock options as well as time rules so your organization can customize how it calculates time balances. Paycor also offers a scheduling feature that allows you to assign shifts and see the entire team's schedule at a glance. All this time, data flows into the payroll module, eliminating manual calculations that can cause payroll errors.

human resources tools

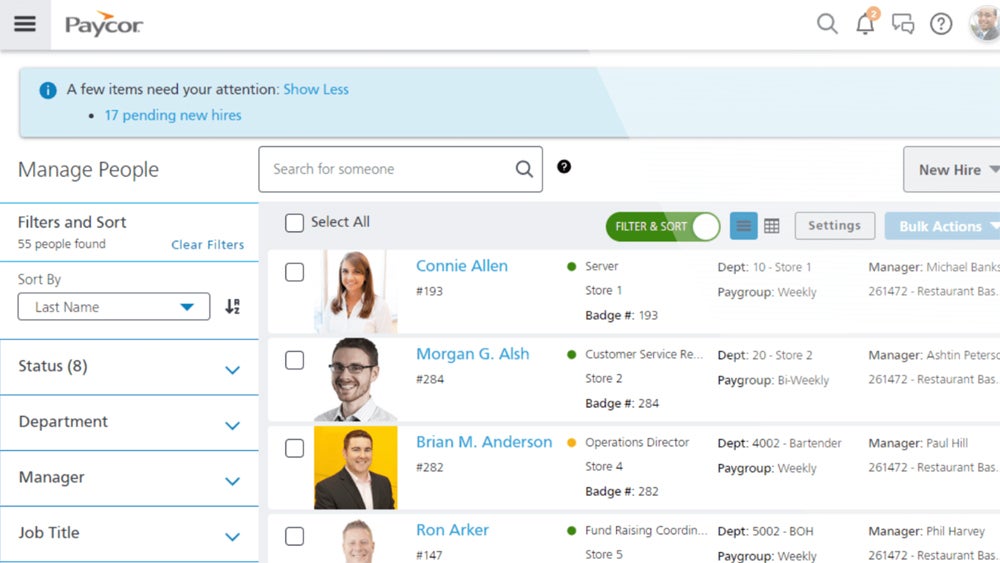

Paycor offers several tools to support the human resources department. The Leadership Insights module provides information to help managers improve their effectiveness. Paycor also creates an employee profile for each person, which centralizes all their information in one place. The software also offers a digital document creation and storage module, which can help your business go paperless if you haven't already. The software also offers some automation tools to eliminate manual workflows, reminders, and notifications.

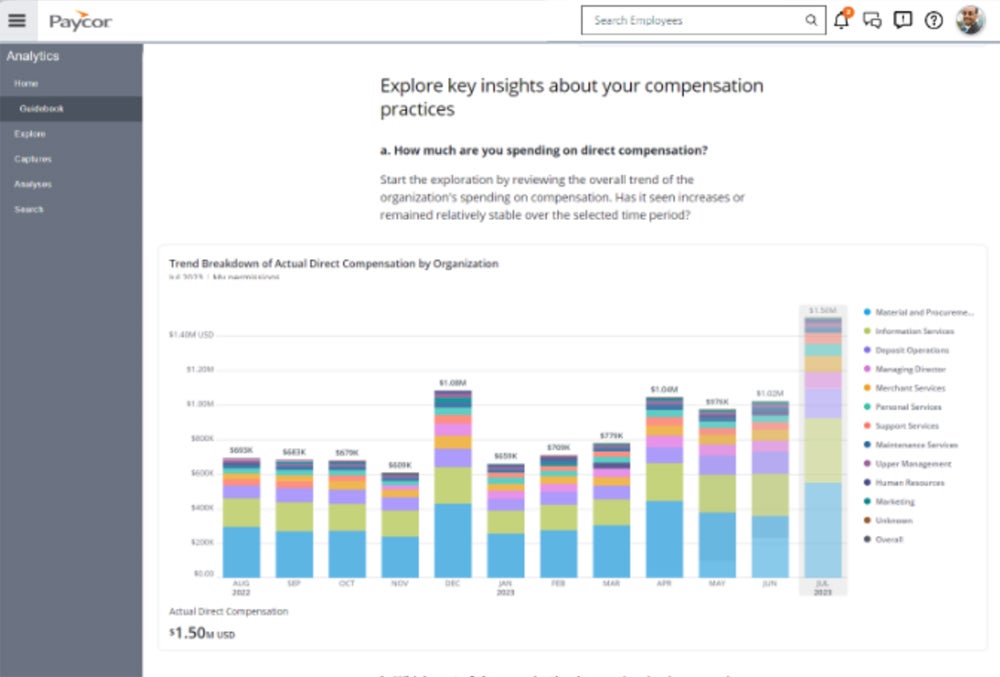

Reports and analysis

Paycor offers basic analytics on Essential and Core plans; You'll need to upgrade to the Complete plan if you want access to the full set of analytics features. You can import your HR data into over 30 standard report templates or create your own custom report. If you just need a quick answer, try sending your workforce data questions to Paycor's AI assistant, which should return an immediate response in natural language. These analytics and reporting features help your team evaluate payment practices, compare them to competitors, and make data-driven strategic business decisions.

Advantages of Paycor

- Unlimited payroll runs included in all plans.

- Option to automate payroll with the AutoRun feature.

- Custom reports plus more than 30 templates.

- Employee self-service portal.

Cons of Paycor

- The price is not transparent.

- It charges extra for many key add-ons, such as time tracking.

- Additional charges for certain payroll actions, such as check stuffing.

- It lacks some key integrations, such as QuickBooks.

Alternatives to Paycor

| starting price | ||||

| Unlimited payroll runs | ||||

| Automatic payroll | ||||

| Time Tracking | ||||

| Benefits Administration |

Undulation

If you're looking for a payroll platform with even more HR features than Paycor, check out Rippling. Rippling offers domestic and international payroll and health insurance benefits in all 50 states. Rippling also offers IT and finance management tools that Paycor doesn't, so you may be able to centralize even more functions into one software. Unfortunately, Rippling does not disclose their pricing information, so you'll need to contact their sales team for a quote.

To learn more, read the full Rippling review.

Enthusiasm

If you're looking for a payroll app with transparent pricing and basic HR features, check out Gusto, which starts at just $40 per month, plus $6 per employee per month for its basic plan. However, you'll need to upgrade to the Plus or Premium plans if you want access to all the HR features, such as native time tracking, PTO management, and performance reviews. Gusto integrates with QuickBooks Online, while Paycor does not.

To learn more, read the full Gusto review.

in payment

If you only need a payroll platform without additional HR features, consider OnPay. OnPay only offers a simple pricing plan, which costs $40 per month, plus $6 per employee per month. With this plan, you'll get unlimited payment runs and automated tax payments and filings. It also includes limited HR tools, such as PTO management and integrated 401(k) retirement plans. OnPay lacks some features that Paycor and other alternatives offer, but it will be more than enough for many small businesses.

To learn more, read the full OnPay review.

Review methodology

To write this review, I took an online tour of Paycor and also watched demo videos of various features. I also reviewed reputable ratings, customer ratings and testimonials and other expert reviews from credible sources.