Java is one of the most popular programming languages in the world. Platform-independent, easy to learn, simple to use, and secure, this object-oriented language is among the top four developer languages in the world and has found its way into enterprise applications around the world.

However, since 2019, Java Development Kit vendor Oracle’s moves to impose multiple licensing changes on new releases are causing organizations to pay attention to Java. Many companies in APAC are changing course in favor of OpenJDK options such as Azul Systems.

Gil Tene, CTO of Azul, whose Java offering powers organizations including Netflix, Mastercard, Salesforce, Workday and Adobe, said its Java management options are also helping customers optimize cloud costs and efficiently reduce the risks of Java vulnerabilities.

What changes have been made to Oracle's Java licensing and pricing?

Oracle has made a number of changes to Oracle JDK licensing and pricing since 2019. These changes have primarily been aimed at getting commercial users of Oracle's Java to pay something for commercial use of the previously free open source development language.

Updates in 2019 and 2021

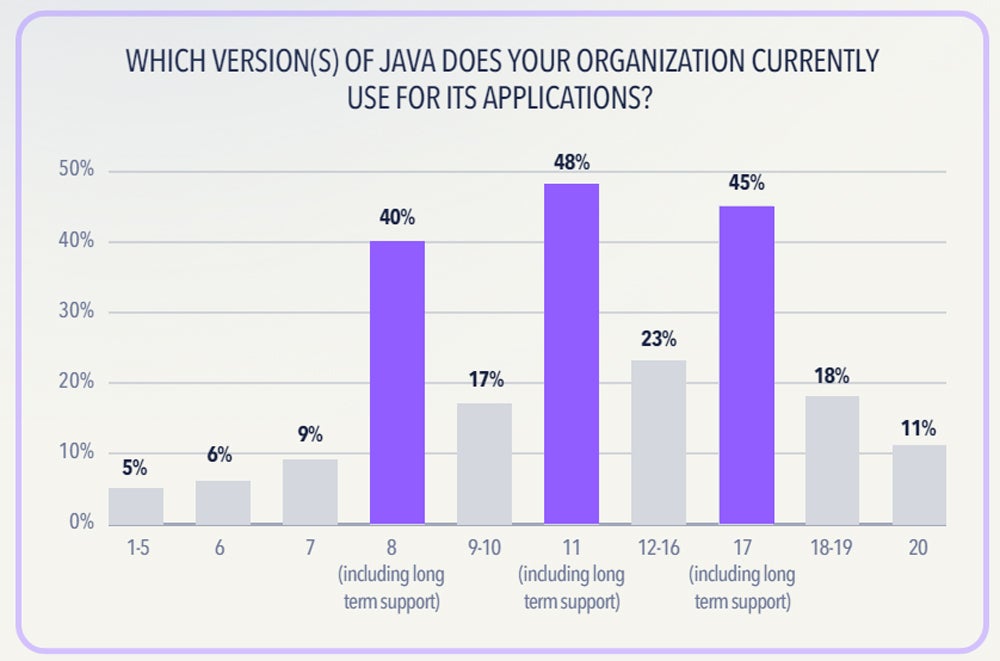

With the 2019 update, starting with Oracle JDK 8, Oracle intended that those using Oracle Java in commercial production would purchase an Oracle Java SE subscription. In 2021, a backlash caused the company to reverse course and allow commercial production starting with Oracle JDK 17.

The 2021 changes only included updates for Java versions that are long-term supported for at least a full year after the next LTS release, a shorter period than competing OpenJDK vendors. The new license terms also did not allow redistribution for a fee.

The recent 2023 update

In 2023, Oracle announced that it would require organizations using Oracle Java to purchase a license for all employees if even one employee or server had installed a licensed version of Java.

Because the pricing change was not dependent on the actual number of Java users and even included contractors working for an organization, the change entailed significant cost increases for companies that chose to continue with Oracle Java.

What are the results of Oracle's Java pricing and licensing changes?

As Oracle looks to organizations to use Oracle JDK, many are considering or opting for alternatives. According to New Relic’s State of the Java Ecosystem 2024 report, Oracle’s Java market share fell from 75% in 2020 to 21% in 2023, including a 29% drop in one year.

SEE: Our Guide to Navigating Directories in Java Like a Pro

“There was a notable move away from Oracle binaries following the more restrictive licensing of its JDK 11 distribution (before returning to a more open stance with Java 17), and we have seen a steady decline year over year since then,” New Relic wrote.

Azul’s 2023 State of Java Survey and Report, which polled 2,000 enterprises using Java, found that Oracle’s market share fell from 75% for Java Development Kit distributions in 2020 to 42% using at least one instance of Oracle Java in 2023.

In the report, Azul found that Oracle’s latest licensing and pricing update for 2023 had sparked “widespread apprehension.” It said 82% of businesses expressed concern about the change and nearly three-quarters (72%) were actively exploring alternatives to Oracle Java.

Amazon stepped in to capture Java users, with Coretto rising to 31% of the market in 2023, though this had fallen to 18% again by 2024. A variety of other vendors, such as community-maintained Eclipse Adoptium and Azul Systems, have also been attracting interest.

Search for alternative JDK providers in APAC suits Azul Systems

Azul’s APAC business is benefiting from the shift away from Oracle JDK. The company offers both a reliable replacement for OracleJDK, which it calls Azul Platform Core, and a premium offering, Azul Platform Prime, designed for high performance, consistency, and efficiency.

Dean Vaughan, Azul's vice president for the APAC region, told TechRepublic that since Oracle's last licensing change in 2023, the company has seen an increase in growth in Australia, Malaysia, India, Taiwan, and the Philippines. More recently, it has also onboarded global Japanese multinationals.

Three benefits of taking a closer look at Java usage

The widespread use of Java in the enterprise is what has made Oracle’s licensing changes so concerning to many. However, organizations that are forced to take a hard look at how they use Java can also benefit from optimizing cloud costs, improving security, and making their organizations more competitive in their industry as well as in the competition for developer talent.

1. Optimizing Java Asset Costs in the Cloud

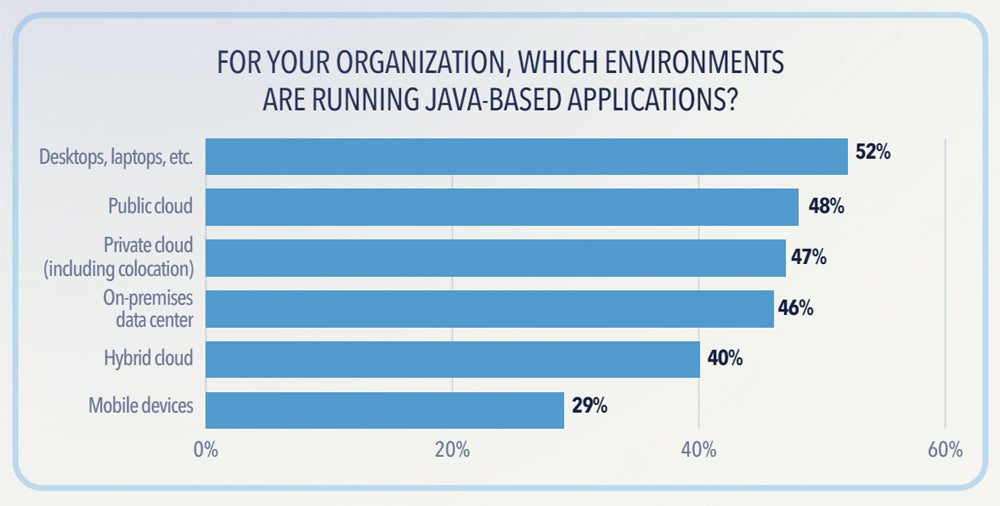

Azul’s Vaughan said organizations that have expanded into the cloud in APAC are seeing dramatic increases in cloud costs through the use of hyperscalers like AWS or Azure or regional players like Tencent or Alibaba. While some cloud providers are working hard to help customers rationalize workloads to reduce costs, he said they don’t spend time “looking at the stack.”

Azul is seeing growth in cloud-native companies in markets such as ASEAN, India and China. He said these countries have developed their own predominantly local tech industries and compared to global companies, they are willing to think outside the box when it comes to OpenJDK providers or optimising Java to “dramatically reduce” the cloud costs they incur.

2. How to deal with vulnerabilities in older versions of Java

Security, compliance, and governance are other key drivers for increased attention to Java. With the risk of vulnerabilities and exposures common in older versions of Java and recent events such as the Log4Shell vulnerability that affected 80% of Java users, organizations want to ensure they practice good hygiene by upgrading to newer versions of Java, according to Azul.

A feature of Azul’s Intelligence Cloud offering, which adds to its Platform Core and Prime Java options, is the ability to identify and classify vulnerabilities detected in Java versions. By determining which identified vulnerabilities have been pushed into production, an organization can ensure that DevOps teams are spending time on the right things.

3. Improve competitiveness with newer or premium versions of Java

Many organizations want to modernize by migrating to newer versions of Java. This can have advantages such as attracting younger, more talented developers and equipping development teams with the latest Java advancements. “Java has evolved in exciting ways over the past decade, so for some companies it may be worth investing in it,” Tene said.

Azul’s premium version of Java, called Java Prime, has attracted a large following in sectors such as financial services in the APAC region. Tene said these companies are attracted to an enhanced version of Java that is faster, more consistent and can “handle huge workloads.” This ensures they are able to stay competitive with their peers in their vertical market.