Californians have accumulated billions of dollars in medical debt. Two years ago, Gov. Gavin Newsom and the Legislature granted authority to a new agency, the Office of Health Care Affordability, to control health costs that were above residents' ability to pay. But this effort risks being diluted before it can benefit them.

This month, the Office of Health Care Affordability proposed limiting the growth of health spending at no more than the projected growth in household income: 3% annually for the next five years. For comparison, the median household income in California has grown an average of 3.5% since 2013while health care spending in the state during the same period grew an average of 5.5%.

The agency will accept public comments until March 11 and plans to announce a final cap on health care spending on June 1. If the state's medical and hospital associations have their way, things will ultimately be very different.

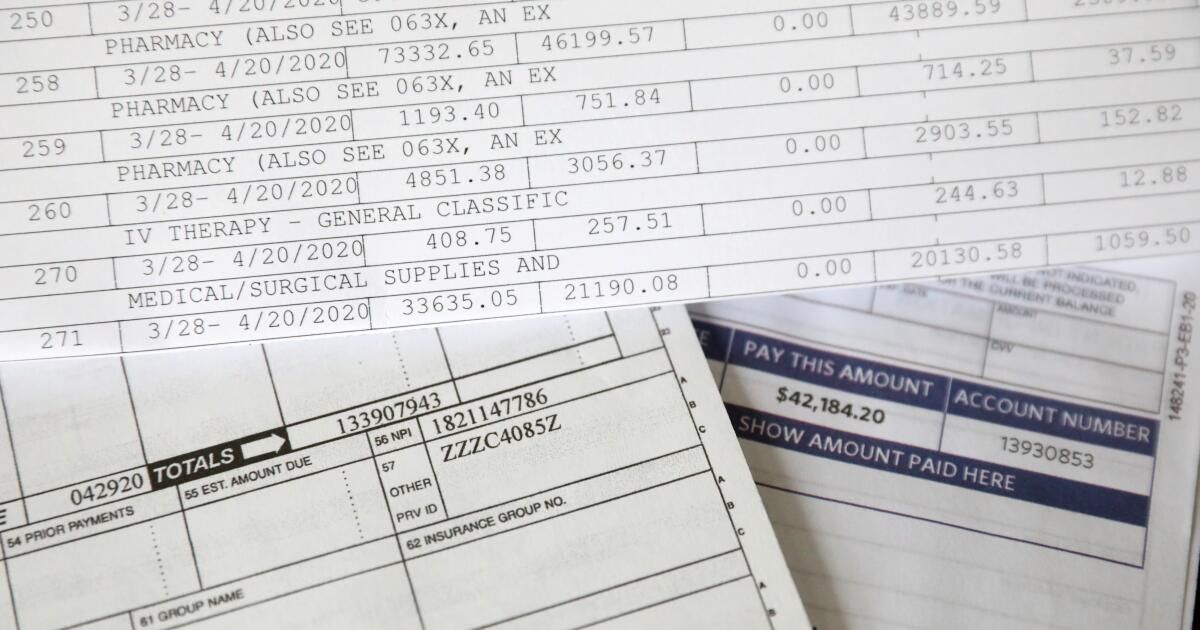

I study health care markets, but California families don't need a professor to tell them that health care costs can be ruinous. Last year, the California Health Care Foundation found that more than half of the state's residents had skipped or postponed some form of health care in the previous 12 months due to cost.

Many of those who sought care incurred costs they could not afford. Thirty-eight percent of Californians and more than half of those with low incomes report that you have medical debt. TO A 2023 study found that medical debt contributed to 41% of personal bankruptcies in the US.

Health care providers seem to feel that all of this economic pain is unfortunate but not their fault. They argue that if California limits spending increases to 3% annually, will reduce services, increase wait times and discourage referrals. They argue that the Office of Health Care Affordability is too willing to sacrifice access and quality in the name of limiting costs.

Health care providers would prefer that any spending limits be based on their costs of providing services. But that would effectively reward providers for higher costs and California residents would be subject to continued, unsustainable growth in health care spending. A limit tied to household income fairly reinforces affordability and pressures providers to limit excessive costs that unfairly burden residents with high premiums and deductibles.

Most economists prefer to rely on competition and market forces to determine the supply and demand of services. It is clear, however, that California's healthcare system is not subject to the competitive forces necessary to ensure that it functions as a normal market.

California is not alone in trying to limit health spending through regulations. Eight other states (Connecticut, Delaware, Massachusetts, Nevada, New Jersey, Oregon, Rhode Island and Washington) have established benchmarks for cost growth. One lesson emerging from these states is that greater transparency about how the new system works and benefits residents will encourage participation. California can learn from this as it implements its limit.

The public comment period on the state's proposed spending cap provides an opportunity to ensure policymakers listen to everyone and not just special interests. The Office of Health Care Affordability needs the participation and support of California health care consumers to ensure that, as policies evolve, they achieve the goal of aligning spending growth with economic growth and the ability to resident payment. Motivated by a state mandate, California providers are fully capable of meeting the challenge.

Glenn Melnick is a professor at the USC Price School of Public Policy.