Intuit QuickBooks is known for its accounting software, but it also offers a suite of other business tools, including QuickBooks Payroll. While QuickBooks Payroll is a trusted brand, it comes with a slightly higher price and additional fees for additional services. OnPay has a unique and affordable pricing plan, but can its features compare to QuickBooks?

OnPay is less scalable than QuickBooks Online Payroll, but includes more payroll and HR features at a more affordable price and with fewer additional fees than QuickBooks Payroll. Along with competitors like Gusto and SurePayroll, OnPay easily offers the best value for money of any payroll software provider.

However, QuickBooks Payroll is a good option for businesses that already use QuickBooks Online to manage their books and don't mind paying more to integrate the top-of-the-line benefits of QuickBooks.

In this review of OnPay vs. QuickBooks Payroll, we delve into the strengths, weaknesses, features, and pricing of each payroll software solution to help you compare these two payroll software platforms.

Paycor

Employees by company size

Micro (0-49), Small (50-249), Medium (250-999), Large (1000-4999), Business (5000+)

Micro (0-49 employees), small (50-249 employees), medium (250-999 employees)

Micro, Small, Medium

Characteristics

API, check printing, document management/sharing and more

Recommended Alternative: TasteSPONSOREDGusto is easily the most popular payroll software for small and medium-sized businesses, making it one of the top competitors to QuickBooks and OnPay. With automatic payroll runs, optional employee benefits, and built-in time tracking options, it's the ideal alternative to OnPay or QuickBooks. |

QuickBooks Payroll vs OnPay: Comparison Table

| QuickBooks Payroll | in payment | Taste (sponsored) | |

|---|---|---|---|

| Prices | From $45/month. + $5/employee/month. | From $40/month. + $6/person/month. | From $40/month. + $6/person/month. |

| Benefits management | Yeah | Yeah | Yeah |

| Employer Mobile App | No | No (site optimized for mobile devices) | No (site optimized for mobile devices) |

| Automated tax filing | Yeah | Yeah | Yeah |

| Third Party Integrations | QuickBooks online | 12+ | dozens |

| Built-in time tracking | Yes (additional cost) | Third Party Integrations | Yeah |

| HR Compliance Tools | Yeah | Yeah | Yeah |

| Same Day Direct Deposit | Yes (Premium and Elite plans only) | No | No |

| Try QuickBooks Payroll | Try OnPay | Taste Test |

QuickBooks Payroll vs OnPay: Pricing

QuickBooks Payroll

QuickBooks Payroll offers three pricing tiers to choose from:

- Center: Starts at $45 per month plus $6 per employee per month.

- Premium: Starts at $80 per month plus $6 per employee per month.

- Elite: Starts at $125 per month plus $8 per employee per month.

Like other QuickBooks products, QuickBooks Payroll lets you choose between a 30-day free trial or 50% off the first three months. You should choose one or the other, but not both.

For more information, check out our full review of QuickBooks Payroll and our roundup of QuickBooks payroll alternatives.

in payment

OnPay offers a single pricing plan: $40 per month plus $6 per employee per month. This is quite comparable to the cheaper QuickBooks Payroll plan, but covers everything OnPay has to offer; There is no need to upgrade to a higher plan to get more features. OnPay also offers a 30-day free trial so you can try out the service before committing.

For more information, check out our full OnPay review and our roundup of OnPay alternatives.

QuickBooks Payroll vs OnPay: Feature Comparison

Payroll (Winner: OnPay)

QuickBooks payroll software offers unlimited payroll runs and the option to set up automatic payroll so you don't have to run it manually. QuickBooks will also calculate, file, and pay your payroll taxes for you so you don't have to worry about it. Once tax season hits, you'll be able to generate and file unlimited 1099 forms for your employees. It also offers the option of same-day direct deposit so your employees can get paid faster. However, you'll need to upgrade to the more expensive Payroll Premium plan to get same-day direct deposit.

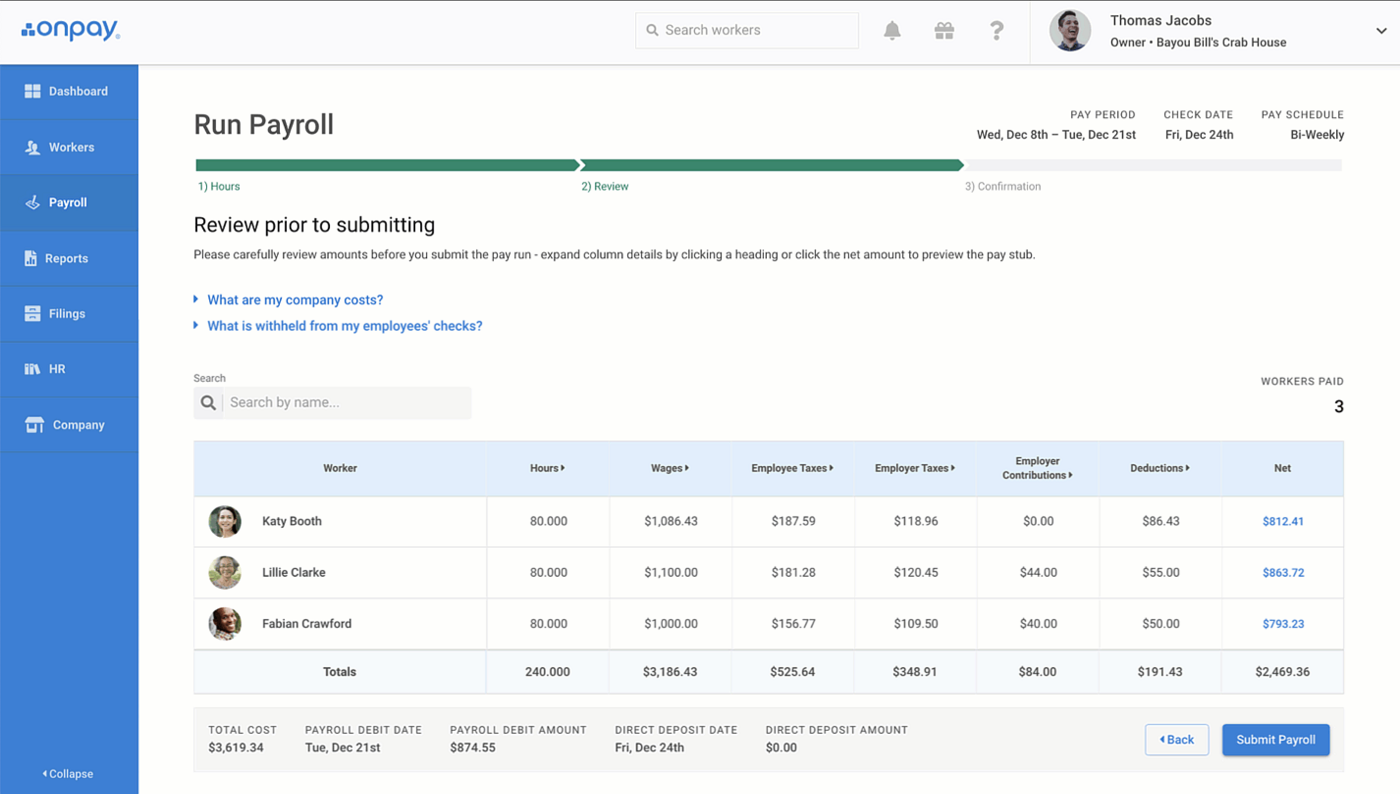

OnPay offers unlimited payroll runs as part of its one-price plan. But it doesn't offer automatic payroll, so you'll have to log in and run it every time you want to pay your employees. OnPay also handles the calculation and filing of federal, state, and local taxes as part of its payroll software features. It also allows you to generate and file W-2 and 1099 forms once tax season arrives. You can pay employees via direct deposit, debit card, or check, and the turnaround time for direct deposit is typically two to four days, longer than in QuickBooks.

Crucially, OnPay offers unlimited payroll runs in multiple states at no additional charge. It also includes more payroll features at a lower cost than QuickBooks Payroll, including wage garnishment, multiple employee payment options (direct deposit, check, and debit card all included), end-of-year W-2 and 1099 generation. year at no additional charge and more.

Time Management (Winner: QuickBooks Payroll)

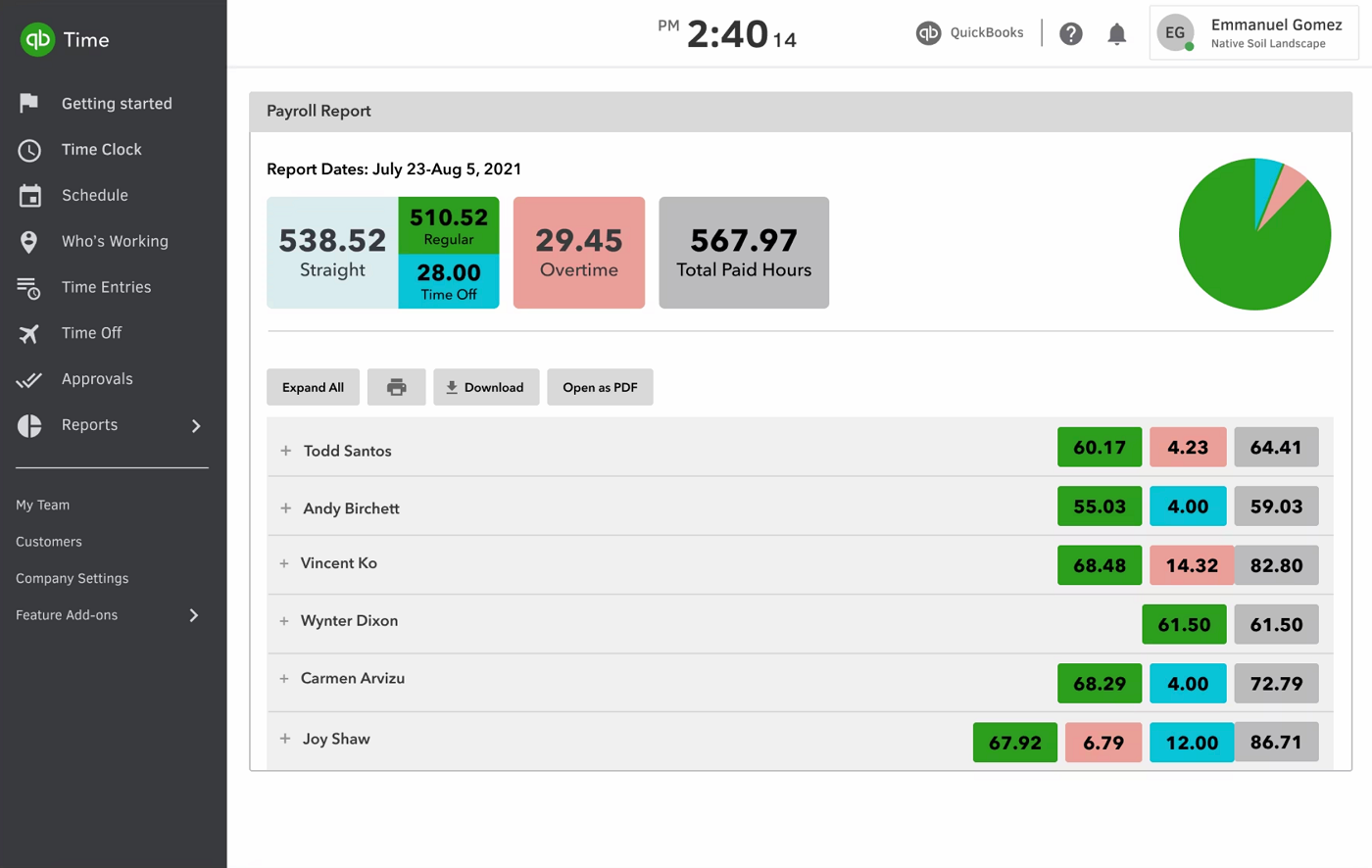

With QuickBooks Payroll, free built-in time tracking is not available with the cheapest plan. Instead, you should upgrade to at least the Payroll Core plan if you want to enter employee time by client or project and automatically add those entries to invoices. If you want to track time on the go using the QuickBooks Workforce app, you'll need to upgrade to the Payroll Premium plan. You can also choose to add the standalone QuickBooks Time module, which starts at $40 per month plus $10 per user, to create schedules, manage time off, set up geofences, and more.

OnPay focuses primarily on PTO management and offers the ability to set custom paid time off policies and up to three accrual levels. Employees can make requests and managers can approve them all within the app, and employees can also view their PTO calendar and reminders whenever they want. However, OnPay does not offer timesheet or scheduling support, so you will have to rely on an external tool for this. But if you still want to use OnPay, we have recommendations for the best time tracking apps to get you started.

Benefits Administration (Winner: OnPay)

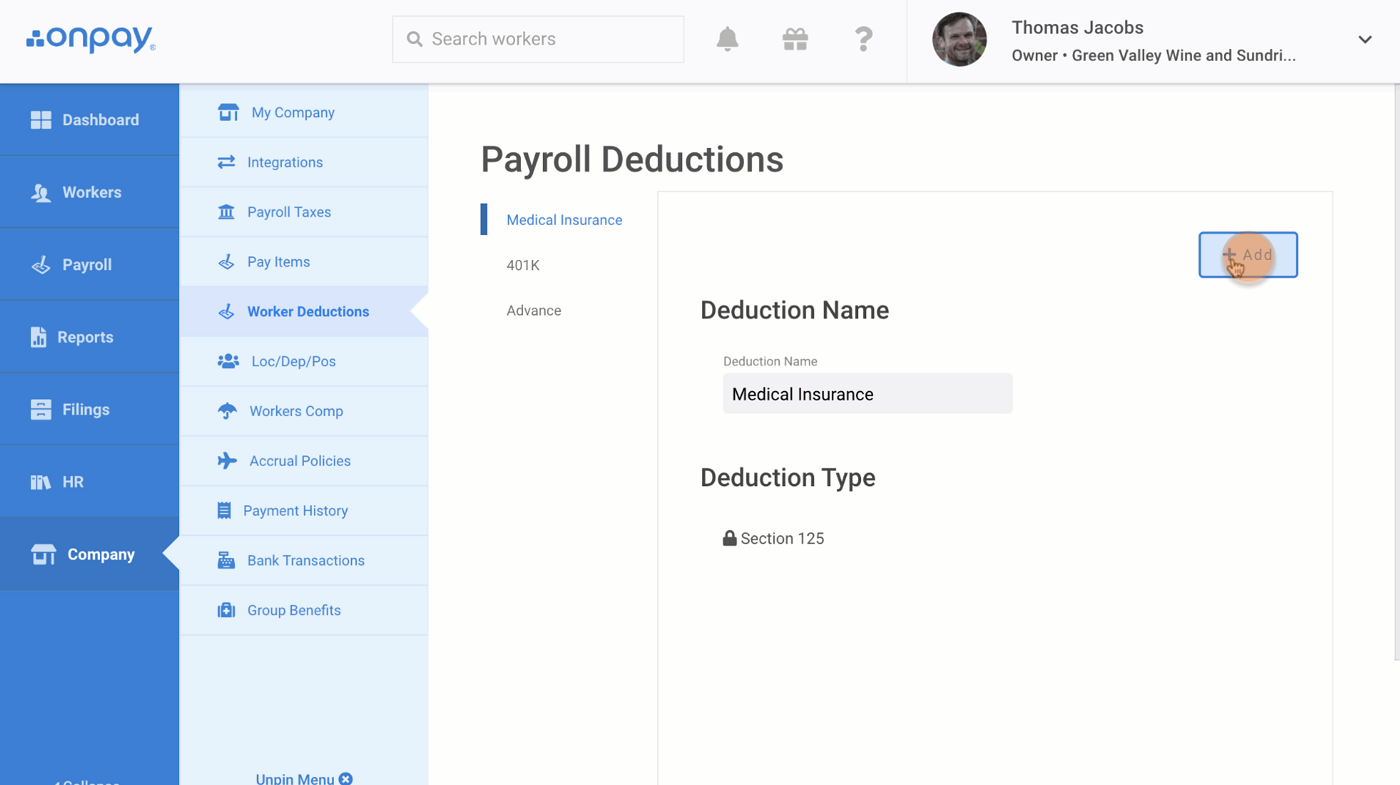

QuickBooks partners with SimplyInsured to offer medical, dental and vision insurance packages. It also offers 401(k) plans through Guidelines and workers' compensation policies through NEXT insurance. These benefits management features are offered on all pricing plans, but you may be charged an additional monthly fee if you choose to take advantage of them. However, as a bonus, QuickBooks will handle all the calculations and deductions for you and add them directly to your payroll software.

OnPay offers dental and health benefits in all 50 states. Connects with most major providers, including Humana, CIGNA, Blue Cross, Blue Shield, Aetna, and United Healthcare. It also offers delivery workers' compensation insurance plans, as well as the option to offer 401(k) savings plans to its employees. You can also choose to add other benefits, such as life insurance, disability insurance, liability insurance, and HSA and FSA accounts. If you already have your own benefits set up, OnPay can also ask your registered broker to manage any existing plans, if you wish.

Pros and Cons of QuickBooks Payroll

Advantages of QuickBooks Payroll

- Seamless integration with QuickBooks accounting.

- Many different payroll reports to choose from.

- More robust scheduling and time tracking features.

- Automatic payroll option.

Disadvantages of QuickBooks Payroll

- More expensive than OnPay.

- Certain features are limited to more expensive plans.

- Extra fees for benefits administration.

Pros and cons of OnPay

Advantages of OnPay

- Unique and transparent pricing plan with minimal additional fees.

- Manage health and dental benefits in all 50 states.

- Unlimited payroll runs supported in multiple states.

- Free account setup and migration.

- No additional fees for benefits administration, workers' compensation, wage garnishment or multi-state payroll.

Disadvantages of OnPay

- No time tracking or scheduling included.

- No automatic payroll option.

- The single pricing plan may not be scalable for all businesses.

Should your organization use QuickBooks Payroll or OnPay?

Choose QuickBooks Payroll yes. . .

- You have the budget to pay for more expensive payroll software.

- You want many additional features, such as time tracking and scheduling.

- You need automatic payroll.

- You already use QuickBooks Online for accounting and want to continue using the same software.

- You agree to pay additional fees for benefits administration, time tracking (with the cheapest plan), multistate payroll, and more.

Choose OnPay yes. . .

- He likes the idea of a single, transparent pricing plan.

- You are a smaller company with a limited budget.

- Automatic payroll doesn't matter to you.

- You are willing to use a third-party solution for time tracking and scheduling.

- You don't want multiple scalable pricing plans.

- You handle payroll in several states and don't want to pay more to do it.

Methodology

To compare OnPay vs. QuickBooks Payroll, we looked at product documentation and user reviews. We consider features like payroll, benefits administration, time and attendance, and more. We also weigh factors such as price, user experience, customer service and transparency.