The pair rises again this Wednesday, recovering more than half of its previous losses despite continued warnings from Japanese authorities about sharp fluctuations in the yen. Finance Minister Shunichi Suzuki reiterated today that the government is prepared to act against excessive monetary volatility. Additionally, Bank of Japan Governor Kazuo Ueda noted that the Bank of Japan is evaluating the impact of yen movements on inflation to better inform future decisions.

Last week, the yen strengthened 5.2%, a move the market largely attributes to financial interventions. While there has been no official confirmation of these measures, the market interpretation is reinforced by data from the Bank of Japan, which indicates approximately $60 billion in spending. These actions are likely aimed at stabilizing the value of the national currency.

However, these interventions only provided a brief respite for the authorities. The fall of the yen continues to be influenced mainly by the significant interest rate differential between the United States Federal Reserve and the Bank of Japan. With interest rates at 5.5% and 0% respectively, this disparity continues to put downward pressure on the yen and, as long as it persists, the currency is likely to remain weak.

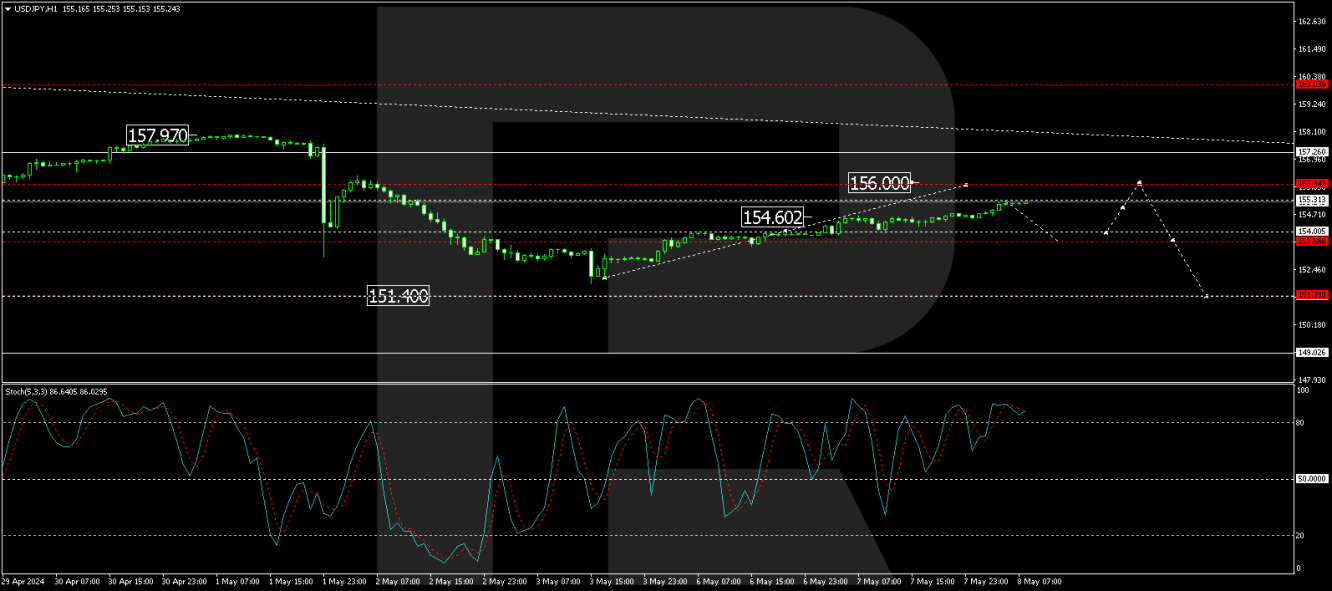

USD/JPY Technical Analysis

On the H4 chart, USD/JPY is currently forming a falling wave towards 151.40. The local target of 151.86 has already been reached. The market is now correcting from the previous wave of decline and is expected to reach at least 156.00. After this correction, a new phase of decline towards 151.40 may begin. This scenario is technically supported by the MACD oscillator, whose signal line is below zero but directed upward.

On the H1 chart, USD/JPY has formed a consolidation range around the 154.00 level, with a bullish break expected to lead to a correction towards 156.00. Currently, a growth link is forming up to 155.88. After this, a possible drop back to 154.00 (testing from above) may occur before possibly rising back to 156.00. The stochastic oscillator confirms this technical outlook, with its signal line above 80 and about to fall.

By RoboForex Analysis Department

Disclaimer

Any forecast contained herein is based on the author's personal opinion. This analysis cannot be considered trading advice. RoboForex assumes no responsibility for trading results based on the trading recommendations and reviews contained herein.

Remove ads

.