The UK Tech Cluster Group, which brings together technology groups from across the country, has published a report outlining the steps the next government needs to take to ensure businesses across the country can take advantage of digital innovation.

The report makes these four general recommendations for the government:

- Create a globally competitive technology talent pipeline across all UK regions.

- Promote digital transformation strategies at the local level.

- Develop a “UK innovation policy” that puts technology at the heart of regional development strategies.

- Do more to financially support new startups in the regions.

How big is the UK tech market?

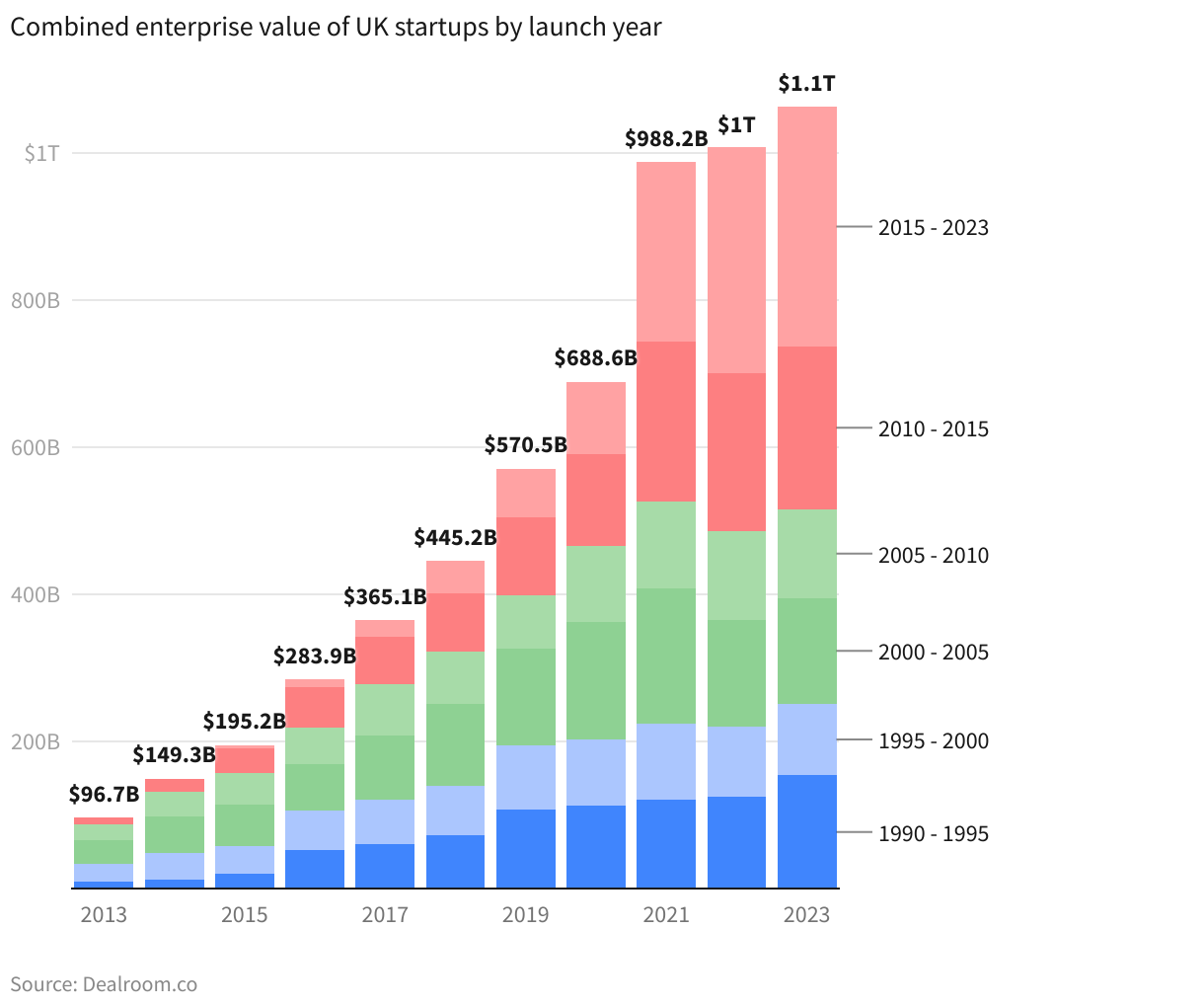

The UK has a strong tech ecosystem; In fact, the startup ecosystem was worth around $1.1 trillion in 2023 (£897 billion), according to data from Dealroom (Figure A). Fintech is the largest sector for venture capital investment, followed by healthcare and transportation.

However, this investment is distributed very unevenly; The vast majority of funding goes to companies in London and the south-east, including the so-called Golden Triangle formed by London and the university cities of Oxford and Cambridge. London has 87 unicorn companies worth more than $1 billion (£788m), according to Dealroom data, while the whole of Scotland only has four unicorn companies.

That digital economy is increasingly driving the UK's economic growth. According to research by the Computer and Communications Industry Association, the UK's digital economy and online retail support £227 billion ($288 billion) in economic activity and more than 2.6 million jobs in the world. United Kingdom, making it the most advanced digital economy in Europe. The average salary in the digital economy is around £45,700 a year ($58,000), more than £12,000 ($15,000) or 37% more than the £33,400 ($42,000) seen in the UK in his set. Part of the challenge is helping tech companies thrive more broadly.

“While money and opportunities are not equally distributed, talent is,” said Katie Gallagher, Chair of UKTCG and CEO of Manchester Digital.

“We chose to focus on the four areas that we believe impact the regions the most. This is about ensuring that each region has a competitive technology talent pipeline. This is about ensuring that digital innovation is driven from the ground up and ensuring that every company has the opportunity to understand the benefits of integrating digital and technology into their business,” Gallagher told TechRepublic in a Zoom interview.

SEE: Impact of AI on UK jobs: 10% to 30% of jobs could be automated with AI (TechRepublic)

Around 70% of AI companies are in London and the South East, with just 30% in the rest of the country, and that starts to give “some idea of the imbalance” in terms of the tech ecosystems across the country. , said. .

Driving digital transformation in the UK

The UKTCG report says more needs to be done to address tech skills in the UK. There are a number of different initiatives in the UK such as apprenticeships, T Levels and coding bootcamps that promise to give workers the right tech skills, but it's difficult for businesses. to understand which of these schemes to pay attention to. “The skills landscape is very noisy,” Gallagher said.

UKTCG said that was particularly the case for technology SMEs, which are typically start-ups and do not have established HR functions or integrated industry networks to turn to for advice. SMEs need incentives to recruit new talent so more students from skills programs can adapt to roles in the industry, she said.

The report also says that while early adoption of digital technology can drive long-term regional productivity growth, efforts to encourage this at a central level have largely failed, while noting that “efforts to do so at local level they have had great success.”

He said more needed to be done to encourage digital adoption and innovation, but this should be done at a local level. “The need to boost productivity through digital innovation has not and will not disappear,” the report notes. He also said the UK government should invest in leadership and management training for tech SMEs.

“Technology companies that have started and grown in our ecosystems should not lose support to develop their leadership and management capacity,” the report says.

“It's also about understanding that not all companies are looking to go out and become unicorns. It is about building some of these companies until they reach sustainable sizes that generate good quality jobs. Those medium and small businesses in general are driving regional economies,” Gallagher said.

Building a wider digital economy in the UK

Looking at UK innovation policy, the report says the government should also work to develop programs that encourage collaboration between local businesses, local institutions such as universities and ambitious technology companies that can foster regional innovation and business growth.

The report also calls for more financial support for technology companies outside the south east of England.

“Not everyone can afford to experiment in a new company after graduating, with financial support and connections. “The government can encourage a stronger pipeline of new startups by considering enhancing the R&D tax credit and subsidizing support funds for innovative companies and spin-outs outside the Golden Triangle,” the report says.

Providing targeted tax incentives and support schemes for runways would help more innovative ideas become commercial value and good jobs, as noted in the report.

While fostering the growth of the tech industry beyond the Southeast may be a challenge, the rewards could be significant. Research by industry body techUK found that in London the “gross value added” of the digital sector (a measure of productivity) was £9,083 ($11,500), while in the West Midlands it was £2,055 ($2,605), and in Wales was only £1,348 ($1,709).

According to techUK, if the six regions with the lowest gross digital value added (those regions are the South West, East Midlands, Yorkshire and Humber, the North East, Northern Ireland and Wales) could achieve roughly the same level as the average UK region , could bring an additional £4.8 billion ($6.1 billion) to the UK economy, generating new jobs, opportunities and growth.