The pair held steady around 1.1077 on Thursday morning, following a steady growth in the previous session but still confined to a sideways channel. Investors are holding back and conserving their energy in anticipation of crucial US employment data, which begins with today's ADP private sector employment report. Although the ADP report does not directly correlate with Friday's highly anticipated non-farm payrolls (NFP) report, it provides a general idea of market sentiment.

Additionally, the market will be keeping a close eye on the release of weekly jobless claims data today, especially given the Federal Reserve’s focus on employment indicators. These releases are expected to increase EUR/USD volatility as the day progresses.

Attention will soon turn to key employment indicators due out on Friday, including nonfarm payrolls, the unemployment rate and average hourly earnings for August. These indicators are critical ahead of the Federal Reserve's September meeting. Strong employment data may support a minimum 25 basis point rate cut by the Fed, while weaker labor market figures could raise the possibility of a 50 basis point cut.

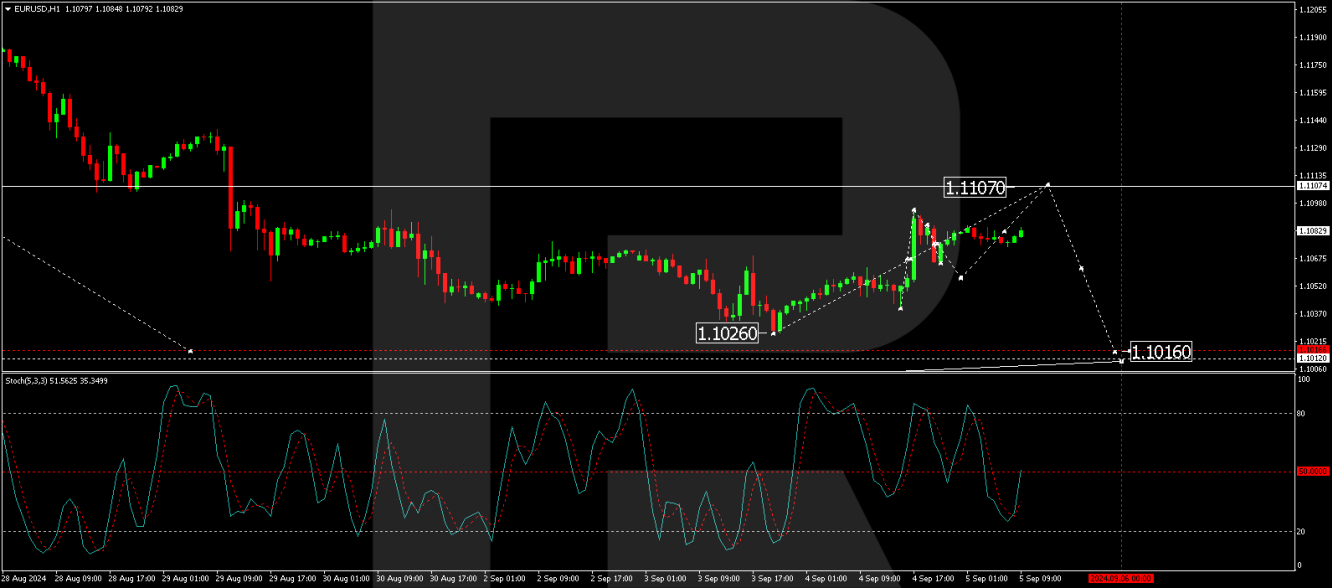

EUR/USD Technical Analysis

The pair is currently consolidating around the 1.1065 level. The market could test up to 1.1107 today, which is considered a correction phase against the backdrop of a broader decline. Following this possible rise, a further decline to 1.1060 is anticipated. A break below this level could signal a continuation of the downtrend, potentially reaching 1.1016. The MACD indicator supports this bearish outlook, with its signal line below zero and pointing down.

On the H1 chart, EUR/USD continues to consolidate around 1.1065. A slight drop to 1.1056 could occur, followed by an extension towards 1.1107 as part of a corrective pattern. Once this correction phase is complete, the downtrend is expected to resume. The Stochastic oscillator, which is currently just above 20, suggests a possible rise to 80, indicating that there is scope for a short-term bullish move before the broader downtrend continues.

By RoboForex Analysis Department

Disclaimer

The forecasts contained in this document are based on the author's personal opinion. This analysis cannot be considered as trading advice. RoboForex does not assume any responsibility for trading results based on trading recommendations and reviews contained herein.