Accounts payable and receivable are necessary to ensure that your cash flow and expenses are properly tracked. While these names sound very similar, it is essential to understand how these two account types differ so you don't accidentally mix them up.

In this guide, we explore the differences between accounts receivable and accounts payable and explain why they are so important to businesses.

QuickBooks can help you manage your accountsQuickBooks is our top pick for accounting software, with its numerous capabilities and features. To save you time and effort, QuickBooks can automatically pull information from your bank accounts and balance your books, so all you have to do is review your entries. |

Featured Partners: Accounting Software

What are accounts receivable?

Accounts receivable (often abbreviated to “AR”) is a general ledger account that captures short-term payments owed to your business. Accounts payable are considered a current asset because they represent outstanding payments and are listed along with other assets in the chart of accounts.

An accounts receivable entry is created when your company allows a person or organization to purchase your goods or services on credit. Some examples of accounts receivable entries include credit card purchases, unpaid invoices, and upcoming subscriptions or installment payments due in the coming months.

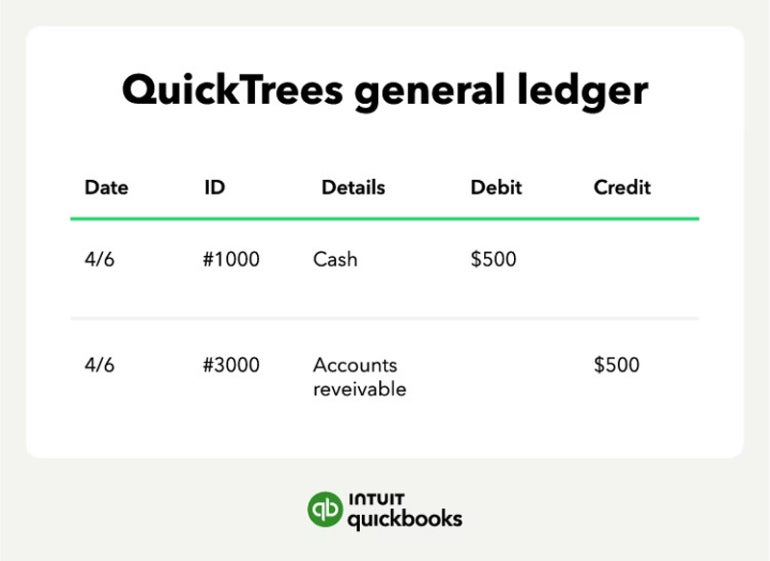

After receiving payment, the entry is credited (subtracted) from your accounts receivable and debited (added) to your cash account. You can learn more about the difference between debits and credits in our helpful guide. If you use accounting software like QuickBooks, you can link your bank accounts and the system will automatically post the appropriate credits and debits to the correct accounts. This graphic captures the accounts receivable workflow:

If the customer never pays the outstanding balance, it is written off as a bad debt expense or as a one-time charge. Your company could also resell the debt to a third party in a process known as AR factoring or accounts receivable discounting.

What are accounts payable?

Accounts payable (often abbreviated as “AP”) is a general ledger account that captures short-term payments owed to creditors, suppliers, and vendors. Accounts payable are considered a current liability because they represent outstanding payments and are listed along with other liabilities in the chart of accounts.

Some examples of short-term entries that could be recorded in accounts payable include raw materials, supplies, equipment, power and electricity bills, transportation costs, and utilities. Accounts payable entries must be settled within a certain period of time to avoid default on the debt. Some common payment terms for accounts payable entries are 30, 45, 60, and 90 days.

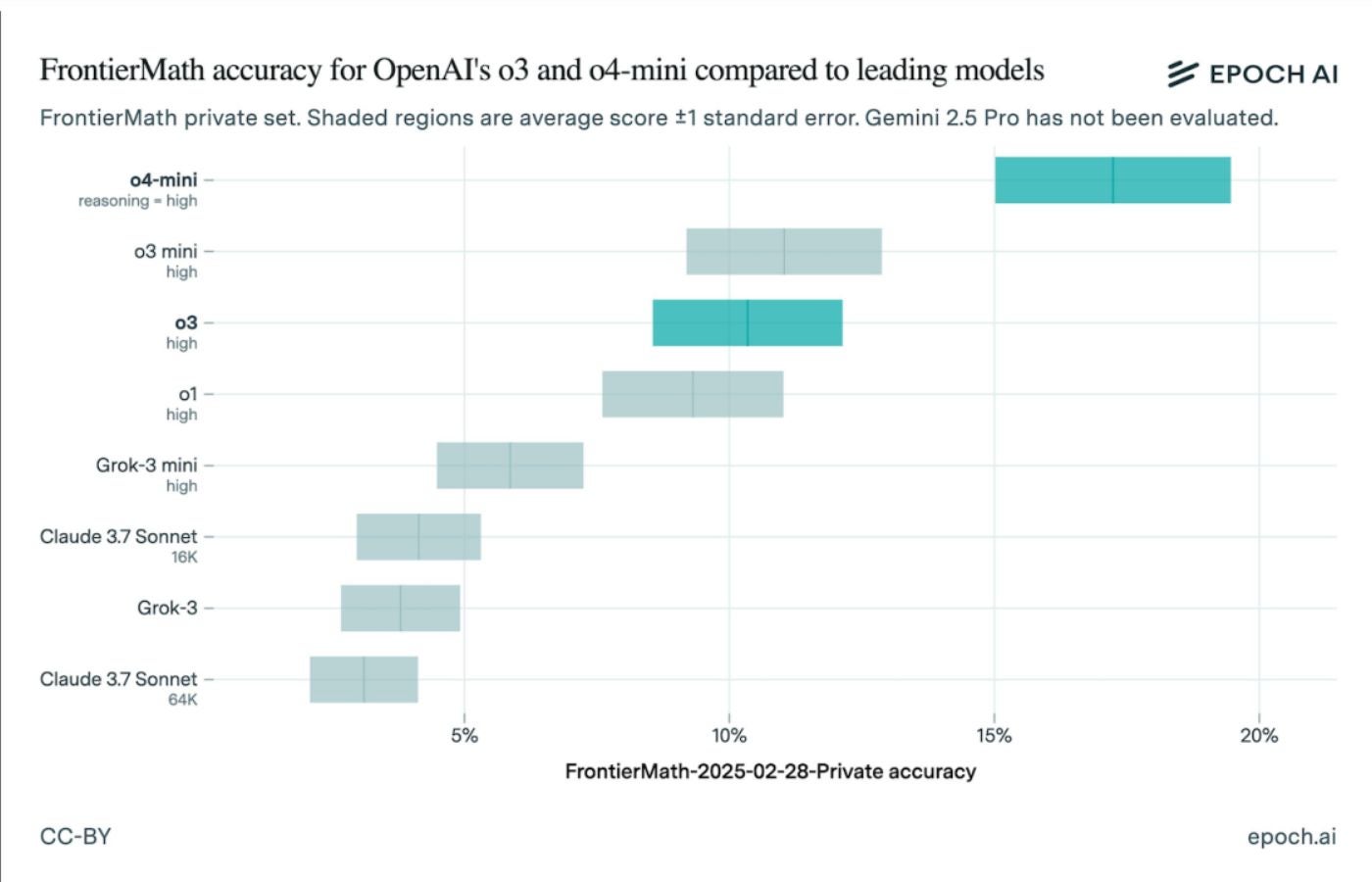

When you receive an invoice from a vendor or supplier, you will credit the amount to your accounts payable and debit the correct expense account. Accounting software like QuickBooks makes tracking accounts payable automatic and easy, just like accounts receivable. This graphic captures the accounts payable workflow:

Longer-term payments, such as mortgages, typically do not appear in accounts payable. However, the upcoming monthly payments on those mortgages (which are due soon) would be listed in the account payable, for example. Wages owed to employees are also typically recorded separately in a different account dedicated to payroll. Properly classifying and tracking payments is essential to optimizing accounts payable.

Key Differences Between Accounts Receivable and Accounts Payable

Accounts receivable are two sides of the same coin: they both record short-term transactions that have not been paid. The key difference is that accounts receivable captures money that third parties owe your company, while accounts payable captures money that your company owes other organizations. In other words, accounts receivable are incoming money that your business will receive in the future, while accounts payable are outgoing money that your business will pay in the future.

Importance of accounts receivable and payable for companies

By comparing accounts receivable and accounts payable together, you can get an idea of your company's short-term financial health. Digging deeper into each of these accounts will help you see how transactions occur in your company and discover the strategic value of accounts payable and receivable.

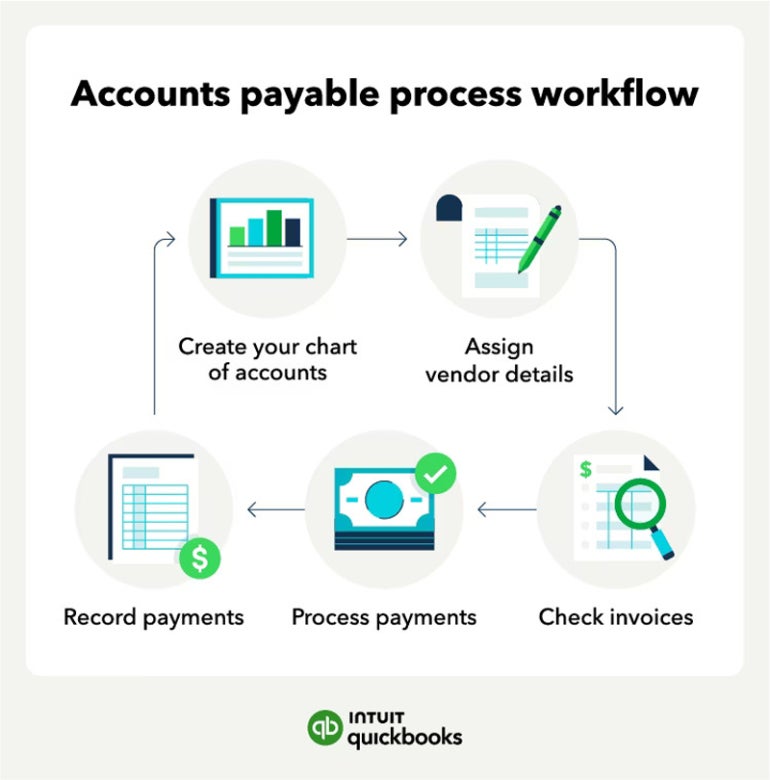

If your accounts receivable continues to increase from month to month or quarter to quarter, that could mean that you are making more and more sales on credit or that customers are not paying outstanding invoices. If accounts receivable are decreasing, that could mean your customers are paying outstanding invoices quickly or aren't making as many purchases on credit. Looking at the details of your accounts receivable is crucial to determining why the numbers are going up or down.

If accounts payable increases month to month or quarter to quarter, it means that a company is purchasing more goods and services on credit than it is paying for. If accounts payable decreases, it means that a company is paying off its outstanding short-term debts faster than it is accumulating them.

Reviewing historical accounts receivable and accounts payable data will also help you determine your own payment patterns as well as your customers' payment habits. Accounts receivable will show whether your customers pay on time or early, or if they tend to be late or only make partial payments. Accounts payable will reveal whether your company pays its own obligations early, on time or late. This information can help you take advantage of early payment discounts and avoid unnecessary late payment fees.

How to manage accounts payable and receivable

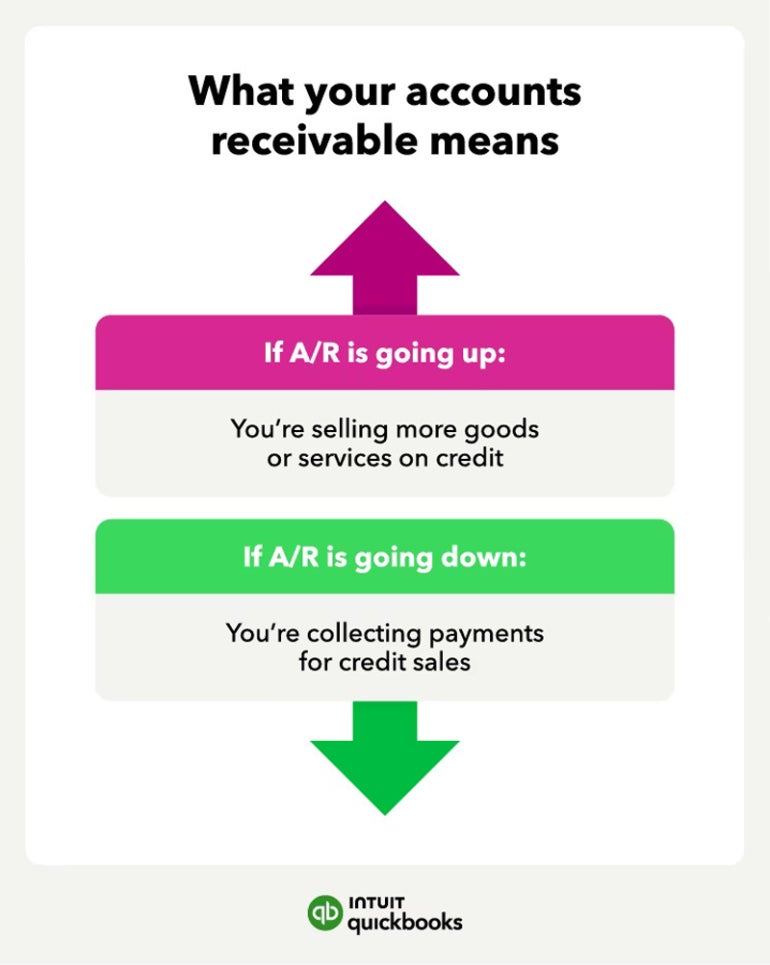

In double-entry bookkeeping, each transaction must have two matching entries: a debit (addition) and a credit (deduction). After you generate an invoice for unpaid goods or services you have provided to customers, you will debit that amount to your accounts receivable and debit the corresponding sales account, as demonstrated below:

Once the customer finally pays the invoice, you will credit your accounts receivable and debit your cash account to capture the incoming money, as shown here:

Increases in accounts payable are always recorded as a credit. After you receive an invoice for goods or services that your business purchased on credit, you will credit that amount to your accounts payable and debit the corresponding expense account. After you pay the outstanding invoice, you will debit accounts payable and credit your cash account to capture the outgoing money.