It has experienced a notable recovery, distancing itself from its recent monthly low. The USDCAD pair is now showing a stable trend around 1.3435.

Market analysts are revising their expectations for the Bank of Canada's interest rate decisions. The rate cut was initially expected to be significant, but is now expected to be more modest. The consensus is that any decision on rate adjustments will likely be postponed until June at the earliest, due to a pick-up in headline inflation. Recent data reveals that the Consumer Price Index (CPI) rose to 3.4% in December 2023, up from 3.1%, marking the first increase in the inflation rate in four months.

This inflation data comes after an earlier drop in retail sales, which fell 0.2% month-on-month in November. This decline had led the Bank of Canada to reconsider the desirability of a conservative monetary approach. However, the latest inflation figures have changed these considerations.

USD/CAD Technical Analysis

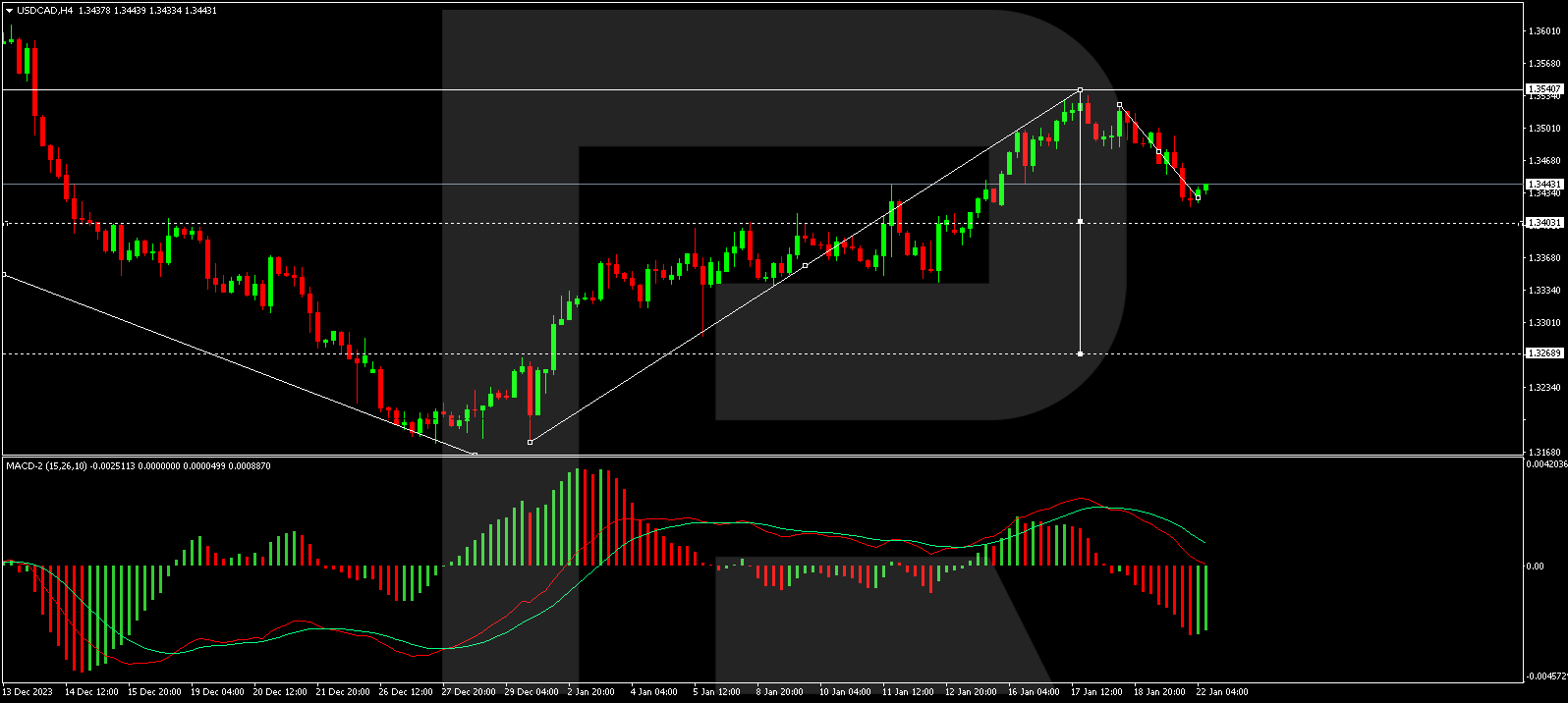

On the H4 chart of USD/CAD, a downward trend is evident, with the pair targeting 1.3403. The intermediate target of 1.3420 has already been reached. A corrective move towards 1.3476 is likely today. Once completed, the decline could extend to 1.3403 and breaking this level could lead to a further decline towards 1.3333. This scenario is supported by the MACD indicator, where the signal line is positioned above zero but pointing downwards.

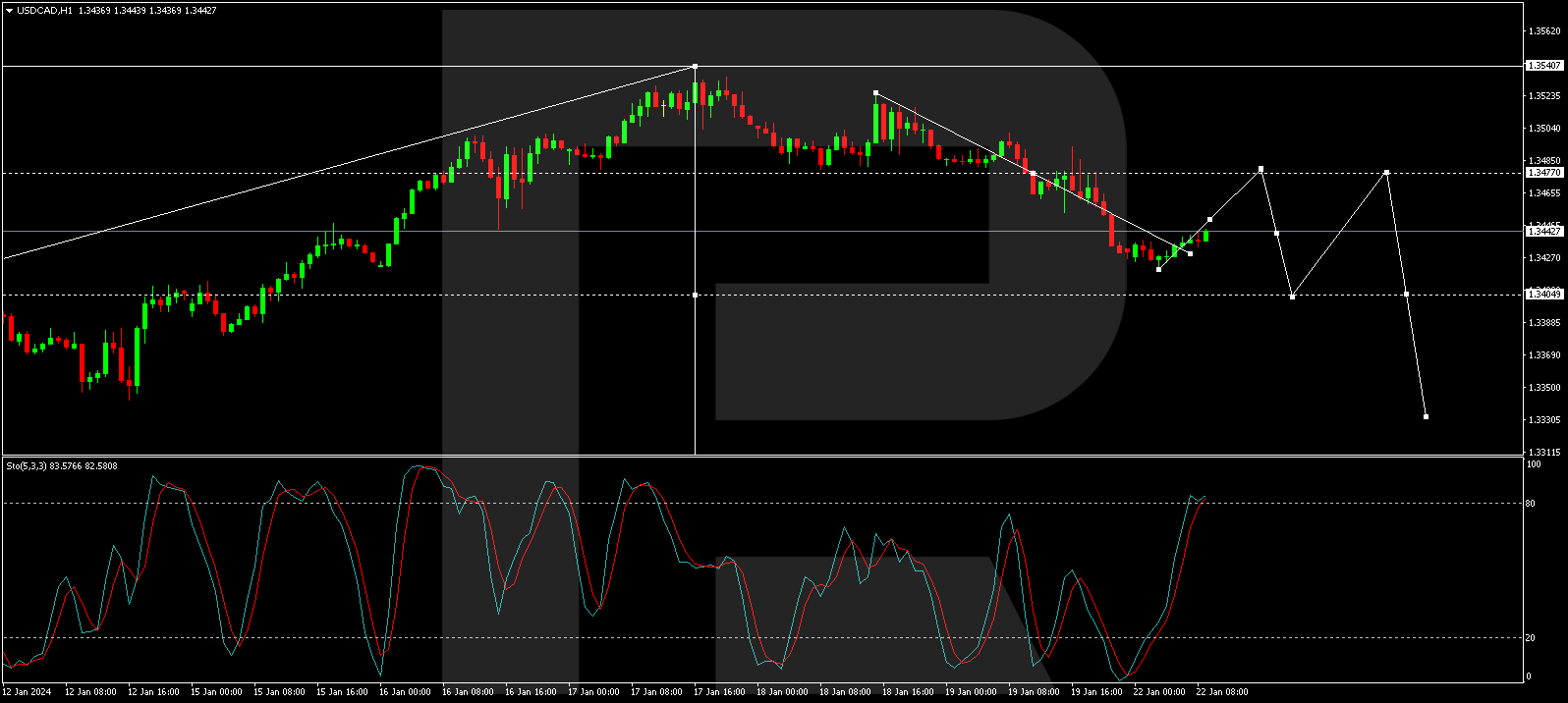

On the H1 chart, the pair is showing a consolidation pattern around 1.3477. Having fallen to a local low of 1.3420, today it is possible to see a new phase of consolidation above this mark. A bullish breakout is anticipated, which could push a corrective phase towards 1.3477 (testing from below). The stochastic oscillator, with its signal line above 50 and potentially rising to 80, corroborates this analysis.

By RoboForex Analysis Department

***

Disclaimer: Any forecast contained herein is based on the author's personal opinion. This analysis cannot be considered trading advice. RoboForex assumes no responsibility for trading results based on the trading recommendations and reviews contained herein.