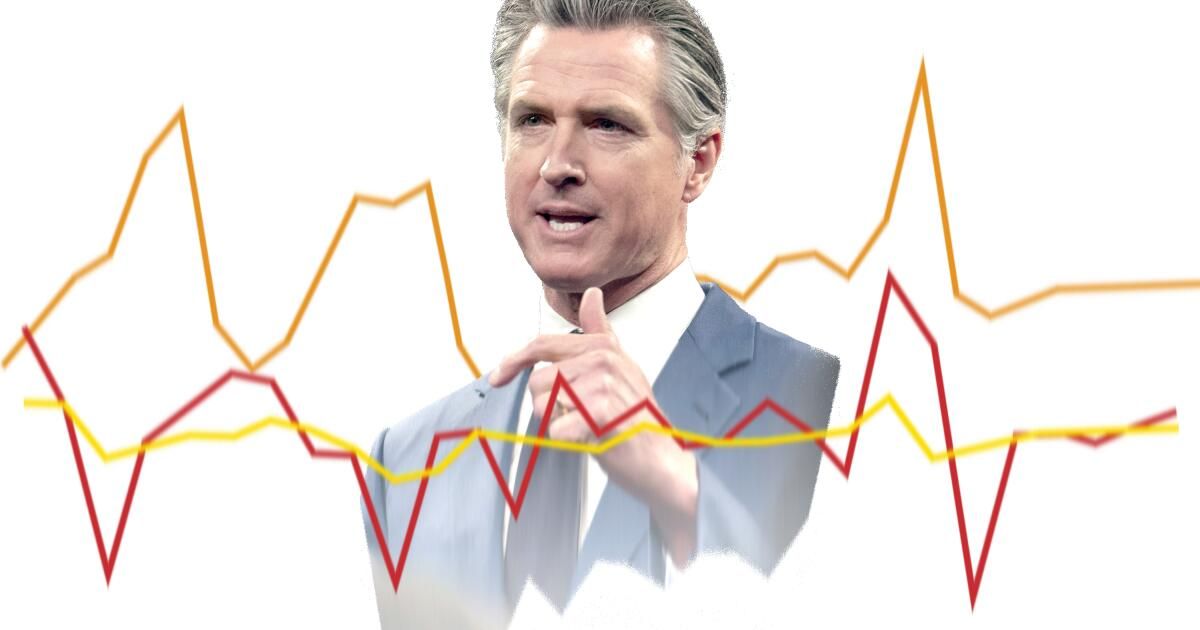

California has until Saturday to balance a budget that is billions of dollars out of balance, and not in a good way. Ambitious and valuable programs implemented in 2022, when Governor Gavin Newsom projected a record surplus, are being paused or cut, and state reserves are being reduced. California is awash in red ink.

We asked Chris Hoene, executive director of the progressive California Budget and Policy Center, and Joshua Rauh, a Stanford economist and scholar at the conservative Hoover Institution, how the state could avoid the whiplash of budget surpluses and deficits in the future.

By Chris Hoene

California leaders are negotiating a serious budget shortfall. They must balance the budget, fund essential services that keep the state and its infrastructure running, and protect the well-being of Californians through investments in education, health care, child care and more.

State revenue volatility is normal. The rapid move from a budget surplus to the deficit we face today is predictable and manageable. But structural reforms to the tools authorities can use to balance the budget would make the process even more manageable.

California's progressive income tax structure, which taxes higher earners more, is an equitable approach to taxation that has long been supported by voters. However, this structure creates income volatility because high earners tend to receive a greater portion of their income from capital gains and stock-based compensation rather than salaries. When economic conditions tighten and the stock market fluctuates, so do California's resources. That is why this year we are facing a considerable deficit.

Compared to what happened during the Great Recession, when the state had no available reserves, California is much better prepared to meet the deficit challenge. Thanks to a decade of prudent budgeting and the efforts of former Governor Jerry Brown, Governor Gavin Newsom and state legislators to stockpile rainy day funds, today's leaders can take advantage almost 30 billion dollars in reserves. Those funds will allow them to avoid deeply damaging cuts to services and sustain investments in critical programs and infrastructure, especially for low-income Californians and communities of color.

Despite the progress made in managing changing budget conditions, state leaders need to have more freedom when it comes to making significant investments, increasing revenues, and adding to California's reserves.

For example, a two-thirds supermajority in the Legislature is required to raise taxes, making it difficult to make reasonable policy changes like Reduce or eliminate unnecessary and inefficient tax exemptions. for corporations and wealthy households, which persist even in a state as progressive as California. what lies ahead Taxpayer deception lawa ballot measure backed by big business and real estate interests that would make it harder for local governments and the state to raise taxes and other revenue, further hampering the state's ability to adapt to economic challenges, jeopardizing critical community services.

Although state leaders have maximized California's primary reserves over the past decade, they would have preferred to save even more during prosperous years. However, poorly structured spending limits demanded by voters in the 1970s Treat money in reserve funds the same as expenses. This blocks efforts to continue building state reserves and, not coincidentally, reflects the dangers of short-sighted ballot initiatives.

If we want our leaders to be able to govern and spend in the best interests of Californians (in good times and bad) we need to pass structural reforms that allow them to freely use all available tools to protect and fund vital programs, prevent deficits, and manage budget. This includes making the tax system fairer, ending limits on saving more during prosperous times, and rejecting efforts to restrict the options state and local leaders have to manage budget decisions to prioritize the well-being of all. Californians.

Chris Hoene is the executive director of the California Budget and Policy Center.

Upcoming budget cuts are just the beginning

By Joshua Rauh

Facing a huge budget shortfall for the next fiscal year, Gov. Gavin Newsom's revised 2024-2025 state budget addresses a $45 billion gap. Even as the Legislature debates the governor's proposals, which include significant cuts in priority areas such as homeless spending, the question remains whether California can return to a sustainable fiscal path.

Unfortunately, the cuts will do little to shore up the state's long-term fiscal health.

Newsom's proposal includes withdrawing billions from state reserve accounts. Additionally, most of the long-term spending plans enacted two years ago, when the government projected a $97.5 billion surplus by 2022-2023, remain in place, including investments aimed at addressing homelessness and climate change and establish universal childcare and healthcare for all. undocumented immigrants.

The root of California's budget problems stems from a significant increase in spending while relying on weak revenue assumptions, which is further exacerbated by a volatile revenue stream.

Half of California's personal income tax revenue comes from the top 1% of earners, whose income fluctuates along with the gyrations of the stock market. In 2021, fluctuations and federal pandemic funds played a major role in future surplus forecasts. But by 2024, the surpluses will have disappeared.

To avoid these boom-and-bust problems, the state must change its budget process to ensure that more of the revenue resulting from sudden and clearly unsustainable increases goes into reserve accounts. But you must also permanently reduce spending.

Public employee pensions continue to be an expanding money sink for the state. State contributions to California's defined benefit pension plans, which guarantee lifetime salaries and benefits to public employees regardless of the state's ability to pay, totaled $26 billion in 2022. That's a hefty 9% of the revised budget governor's $288 billion, and Using reasonable assumptions about state retirees, $26 billion significantly underestimates the true costs of government.

To protect future budgets, new state employees should join defined contribution plans, such as private sector 401k plans, rather than defined benefit plans. Even if these plans were more generous than those in the private sector, they would save the state considerable money, be desirable to many public employees, and end the defined benefit Ponzi scheme.

Similarly, health benefits for retired state employees cost the state more than $7 billion per year. In many cases, these are a duplication of benefits available to retired public employees through the Medicare exchanges and the Affordable Care Act and therefore could be eliminated.

While budget cuts may seem frightening to citizens who rely on public services, the bottom line is that state spending is unsustainable. Perhaps no group is a more egregious representation of the state's wasteful approach than corrections officials. Their total compensation increased 16% from 2021 to 2022, even as the prison population remains 25% lower than in 2018.

Even in the area of K-12 education, do we really believe that the problem is that the level of spending is too low? Per-pupil spending from all sources in California public schools is projected to be $23,878 for fiscal year 2024-2025, although satisfaction with public schools is low and enrollment has declined.

California's 2024-2025 budget will require painful cuts. Taxpayers need greater accountability in public spending and a better deal for their tax dollars.

Joshua Rauh is a professor of finance at the Stanford Graduate School of Business and a senior fellow at the Hoover Institution.