The Asia-Pacific data center market is expected to grow rapidly over the remainder of this decade. This will be due in part to the deployment of artificial intelligence, which took off in 2023, and will lead to greater demands for computing power, in a trend similar to that in other regions of the world.

To meet demand, regional data center providers will need to adapt to challenges including the availability and location of data centers, changes in regulatory regimes, considerations such as power and sustainability, and whether they are designed to handle the growth of AI workloads.

Asia-Pacific Data Center Market Expected Growth

The Asia-Pacific data center market is expected to grow to be worth $53.58 billion (A$81.1 billion) by 2028, according to data from Renub Research, with an expected annual capital growth rate of 12% annually between 2023 and 2028 (Figure A).

With an estimated inventory of 14.27 thousand megawatts in 2024, another report from MordorIntelligence predicts that the region's data center market will expand to 23.2 thousand MW by 2029, or a CAGR of 10.21% in computing capacity during the report forecast period.

SEE: Rising computing power may put Australian data centers at risk of power outages.

According to CBRE's Global Data Center Trends 2023, “data center inventory is growing rapidly across Asia-Pacific, reaching an impressive scale.”

Top data centers in the Asia-Pacific region

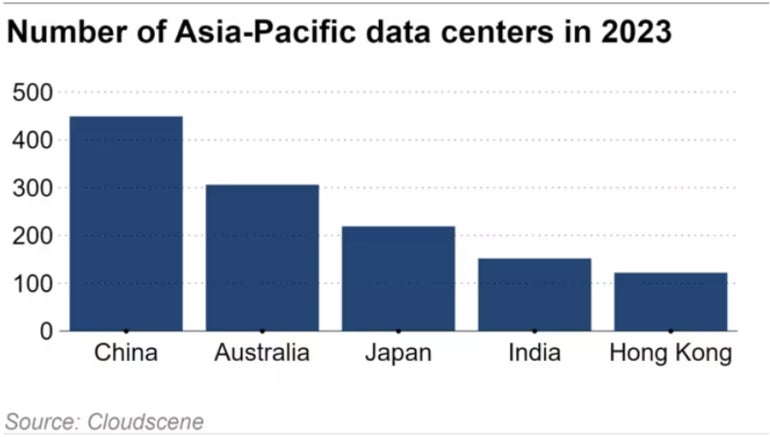

The leading data center location in terms of numbers is China, with an estimated 449 data centers according to the latest data available from Cloudscene (Figure B). They are followed by Australia with 306, Japan with 219 and India with 152.

However, the top data center locations preferred by global companies for consolidating their regional data center operations are typically Singapore, Australia and Hong Kong. Recent moves by some jurisdictions such as China and Vietnam to tighten regulations on data exports for national security reasons would only reinforce this trend among global companies.

Singapore

Singapore accounts for 60% of Southeast Asia's data centers. Following the lifting in 2023 of a moratorium on new data center capacity, driven by the sector's voracious energy demands and sustainability concerns, Singapore has recently been revealed as a leading buyer of NVIDIA chips as it positions itself for a future rise in computing with AI. .

Australia

Sydney has seen what CBRE's 2023 trends report calls a “'second wave' of interest from global cloud service providers”, which has increased capacity by 30%. It now has more than half a GW of live power capacity, placing it alongside Tokyo and Singapore as regional leaders.

Hong Kong

Although it has traditionally been a competitor to Singapore, the Hong Kong market may become less popular with Western companies. According to CBRE, Hong Kong will be seen as a riskier location for data amid growing geopolitical concerns following China's crackdown.

Data Center Market Growth Drivers in Asia-Pacific Region

A key driver of Asia-Pacific regional growth and the use of data center services is the digitalization and digital transformation of regional and global companies. As organizations look to make their operations more efficient through digitalization and use their data to drive growth in digital services and innovation, demand for cloud computing is on the rise.

However, there are a variety of factors driving data center growth. China's leadership in pure data center numbers, for example, comes after it has deliberately encouraged a 30% growth rate in the country's “big data” sector for several years, driven by its world-leading deployment of 5G networks. This will be followed by the commercial launch of 6G by 2030.

Growth in other markets and hotspots in the region is driven by broader trends, such as increased demand for digital services among the region's 1.2 billion internet users and an expansion of the Internet of Things. Growing demands include gaming and streaming, while new technologies include augmented reality and artificial intelligence.

AI computing will play an important role in the future

The International Data Corporation projects that AI spending will reach $78.4 billion by 2027 and 80% of CIOs in the region will take advantage of organizational changes to leverage AI, automation and analytics by 2028.

SEE: AWS predicts generative AI will remain a focus until 2024 for Australia.

The rise in AI-driven applications, which demand greater computing power in the form of graphics processing units, is expected to drive a new phase of growth for the data center industry. However, it will also raise more questions for data center providers about where they should be located and drive new options when it comes to the technical design of data centers.

For example, EY-Parthenon research argues that generative AI can serve to change the format and location of future data center infrastructure, moving them away from large cities towards second-tier cities and outskirts of cities, as that will require access to more electricity and water. .