A third-grade teacher in North Carolina has been teaching her students finances by making them pay rent.

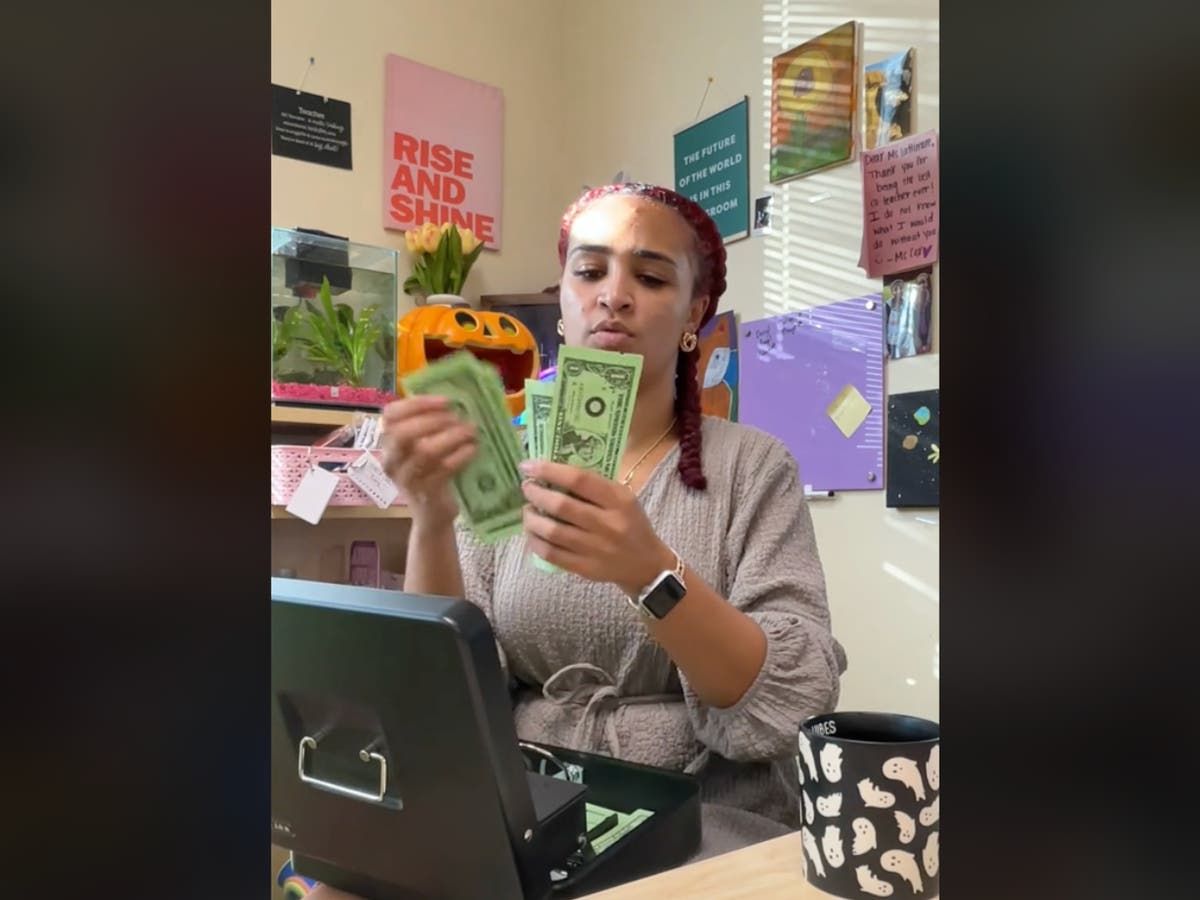

Teacher Shelby Lattimore has gone viral on social media for teaching financial literacy to her third graders. And with over 25 million likes and 793,000 followers on TikTok, fans loved tuning in to her classroom antics. In her classroom, her students follow a system that requires them to pay rent for classroom essentials, from pencils to their desks. They must “pay” $7 in counterfeit money each week to rent their desk and chair.

“Just like I have to pay the bills, they have to pay the bills,” he said. NBC News of the lesson plan.

After reviewing the daily announcements, Mrs. Lattimore has the “class banker” give all the students their wallets: small envelopes adorned with animals, stars, hearts, and cars filled with “Miss Lattimore Bucks” they have earned. throughout the school year of their work in the classroom. Mrs. Lattimore explained, “We have a teacher's aide, a line leader, a door stand, a recess basket, and a lunch basket. “We have a cleaning team.”

“Not all jobs pay the same,” he added. “Jobs that are every day, like line leader and teacher assistant, like those jobs where you have to do something constantly, pay more than jobs that are like once in a while or once in a while.”

Students are paid at the end of each week and are given the decision to spend or save their money. They can use the money they've earned to buy rewards like candy for $2 or a homework pass for $3. They can also pay $5 to have lunch with a friend, while lunch with Miss Lattimore costs a little more: $7. The grand prize is “be a teacher for a day” for $30.

“They have to budget for it, but they love the responsibility of taking roll call, telling them when to stand in line, when to get up, things like that,” Lattimore said, noting that students are never allowed to spend more than they have. Through this exercise, Lattimore says he is trying to instill practical skills in his students. She said: “Seeing my students now appreciate what their guardians are possibly going through, of course in a safer environment, gives them that responsibility to move forward when they become adults.”

In the United States, many adults lack financial literacy, which consists of the ability to make budgeting, saving, investing, and other smart financial decisions. According to the 2023 TIAA-GFLEC Institute Personal Finance Index, a survey that assesses financial literacy, the average adult answered only 48 percent of 28 questions correctly. That statistic was even lower among black and Hispanic adults, who averaged 34 percent and 38 percent respectively.

Lattimore explained that as a Black educator teaching at a school with a predominantly Black and Hispanic population, she hoped to give her students the foundation they need to become financially literate.

“Charlotte is known for its generational poverty,” Lattimore told the outlet. “A lot of my students of color, Hispanic, black, whatever, they see their parents, they see their guardians, they see their grandmothers, grandfathers, whatever, they may be living on the edge. They see money management by not necessarily thinking about the long term and the consequences of that.”

Her creative teaching methods have become a hit on TikTok, leading Lattimore to collaborate with brands and monetize her videos through TikTok's creator program. “Last year I made six figures, which is crazy, because my teacher salary isn't even half of that,” she said. As her account has grown in popularity, her fans have sent her everything from school supplies, books, care packages to snacks for her class.

At the end of the day, though, for the third-grade teacher, it's not about the money or the followers. She looks forward to working every day for one reason: “It's going to sound really cheesy, but it's them.”