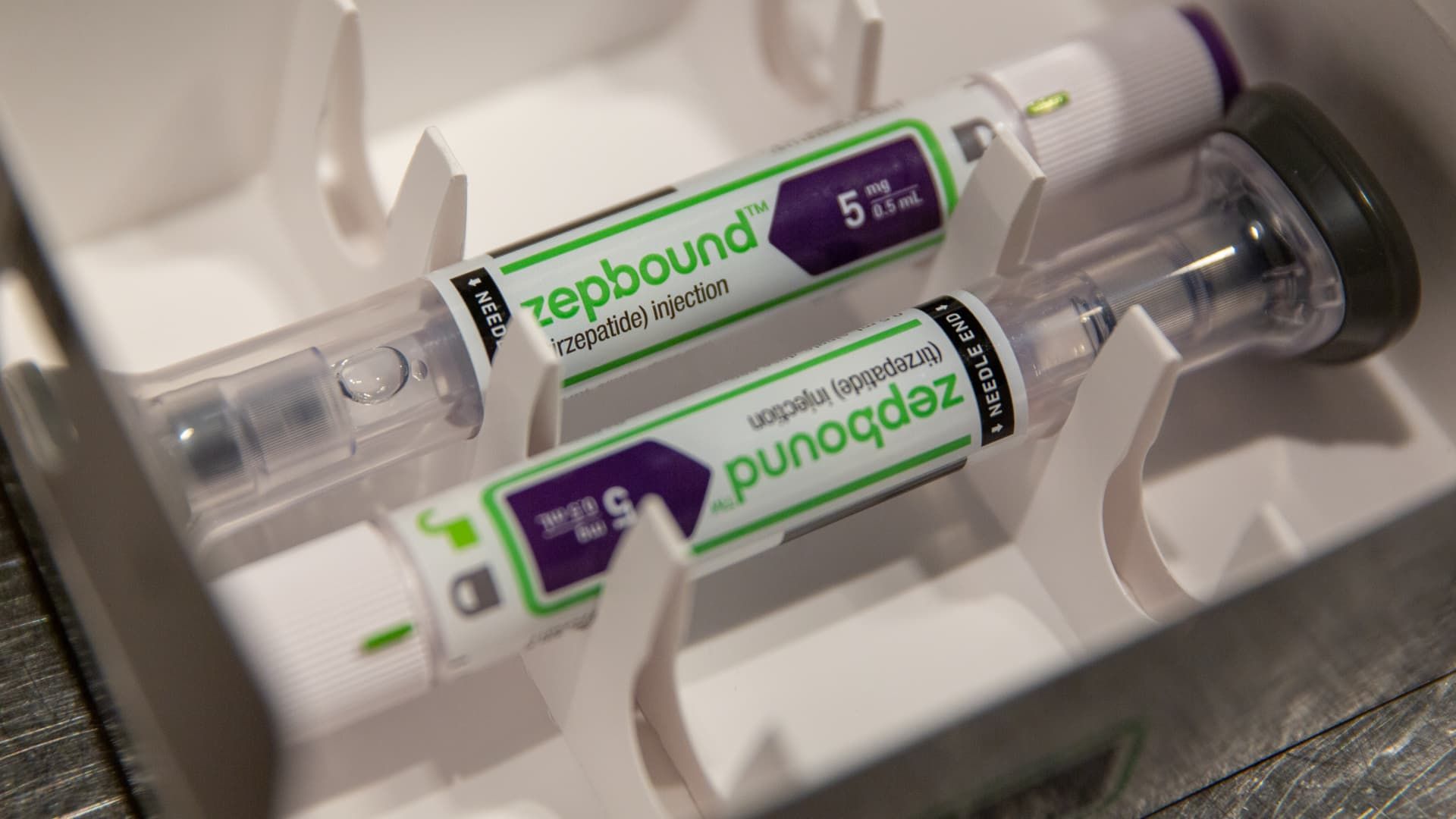

Eli LillyBlockbuster weight-loss drug Zepbound and diabetes treatment Mounjaro posted weaker-than-expected sales for the third quarter, even as supplies of both drugs have largely recovered from widespread shortages in the U.S.

The reason for the disappointing sales, according to the company, is neither a question of supply nor demand.

During an earnings call Wednesday, Eli Lilly blamed drug wholesalers who reduced inventory of Zepbound and Mounjaro. Wholesalers buy drugs from manufacturers and sell them to hospitals, clinics, pharmacies, and other health care providers.

Supply increases allowed Eli Lilly to meet outstanding orders from wholesalers in the second quarter, leading to increased Zepbound and Mounjaro inventory during the period, according to the pharmaceutical giant.

But those wholesalers took advantage of some of that existing stock in the third quarter instead of buying more from the company, reducing revenue for both treatments, Eli Lilly said.

Mounjaro's third-quarter sales of $3.11 billion were well below the $3.7 billion analysts were expecting, according to estimates compiled by StreetAccount. Zepbound's sales were $1.26 billion in the quarter, below the $1.76 billion expected by analysts.

“The main culprit was a hit to Mounjaro and Zepbound inventory…not weaker demand,” Citi analyst Geoff Meacham wrote in a research note on Wednesday.

Jared Holz, healthcare equity strategist at Mizuho, wrote in an email that “reducing stock” (or selling existing inventory of medications rather than stocking up on more) was a surprise, especially with the high level of demand. of the treatments.

But he said Eli Lilly has invested between $10 billion and $15 billion to expand manufacturing capacity for its injectable drugs this year alone, which should “help reverse some of the trends reported in this period.”

Still, some analysts wonder if the inventory issue can explain everything that happened to Zepbound and Mounjaro sales in the third quarter. That factor probably explains “only a fraction,” or about 20%, of the revenue lost from drugs, Barclays analyst Carter Gould wrote in a note Wednesday.

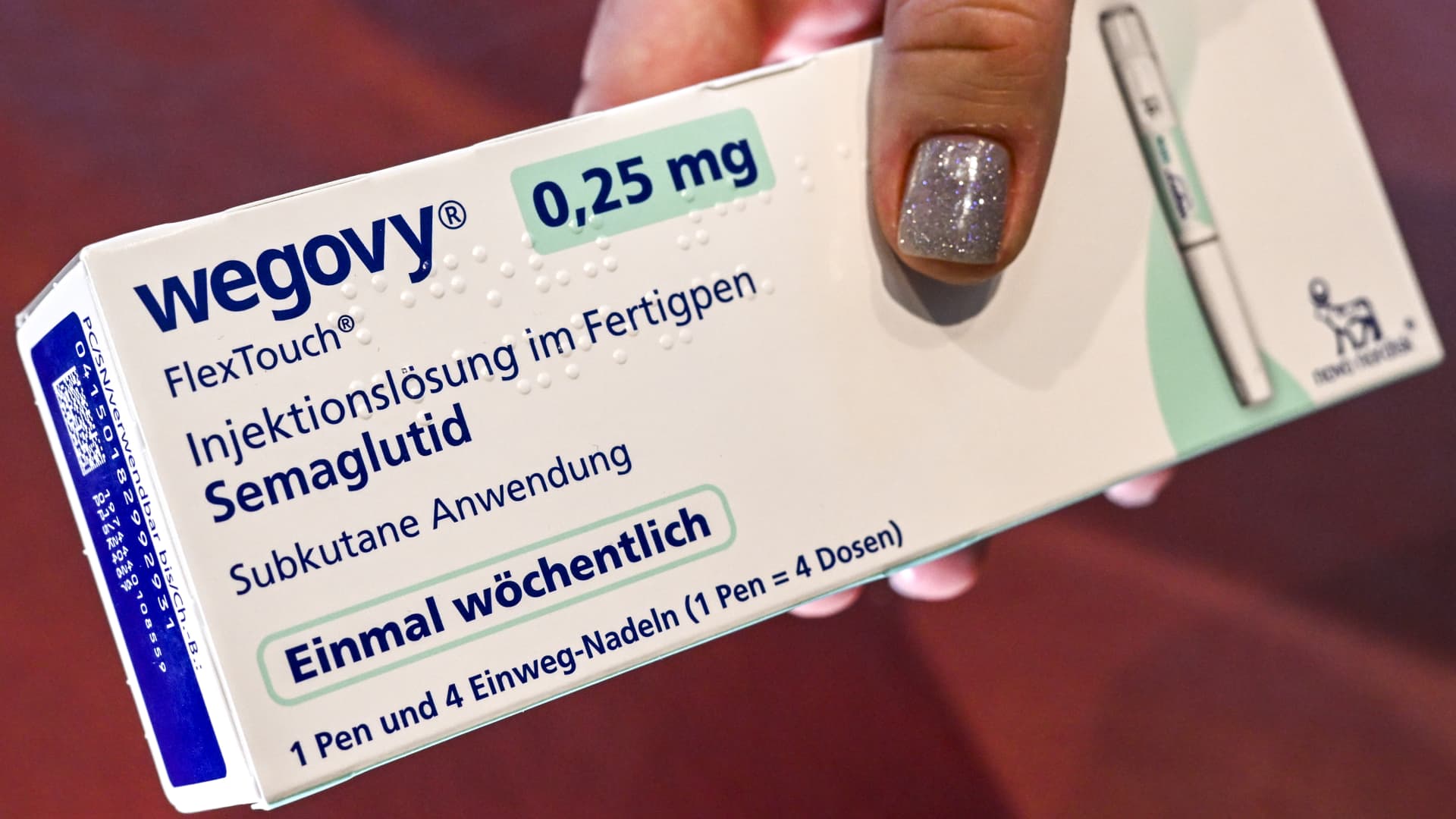

Demand for weight loss and diabetes injections has outstripped supply over the past two years.

But Eli Lilly's supply problems began to ease earlier this year, and the Food and Drug Administration removed tirzepatide, the active ingredient in Mounjaro and Zepbound, from its shortage list.

Earlier this month, a trade group representing compounding pharmacies, which make customized and often cheaper alternatives to brand-name drugs that are in short supply, sued the FDA. The group said tirzepatide is still in short supply and should therefore remain on the shortage list, prompting the agency to reconsider its decision.

On the earnings conference call, Eli Lilly executives insisted that underlying demand for the drugs remained strong.

“Is there a demand problem? No,” said Eli Lilly CEO Dave Ricks, pointing instead to “a lot of gaps in channel supply.”

“I think what we don't really control and we don't try to, but really is that Lilly's downstream customers, wholesalers and retailers, are making their own decisions about which of the 12 different dosage forms they want to stock at which level.” Ricks said.

He noted that wholesalers face some constraints, including financial pressures. They also have to deal with “cold chain” capacity constraints, or maintain a temperature-controlled supply chain that ensures drug quality from production to delivery.

Ricks said Eli Lilly had yet to begin what the company calls “demand stimulation activities,” or advertising and promotion, for Zepbound. The drugmaker will begin those efforts in November, he said.

That will include providing drug samples to healthcare providers.

Eli Lilly is also investing heavily in its direct-to-consumer website, which offers telehealth prescriptions and direct home delivery of certain medications to expand patient access, executives said during the call.

Ricks dismissed the idea that the quarter's disappointing sales were due to competition from the Mounjaro and Zepbound composite versions.

“We really don't see a financial impact on Lilly from the capitalization,” Ricks said.