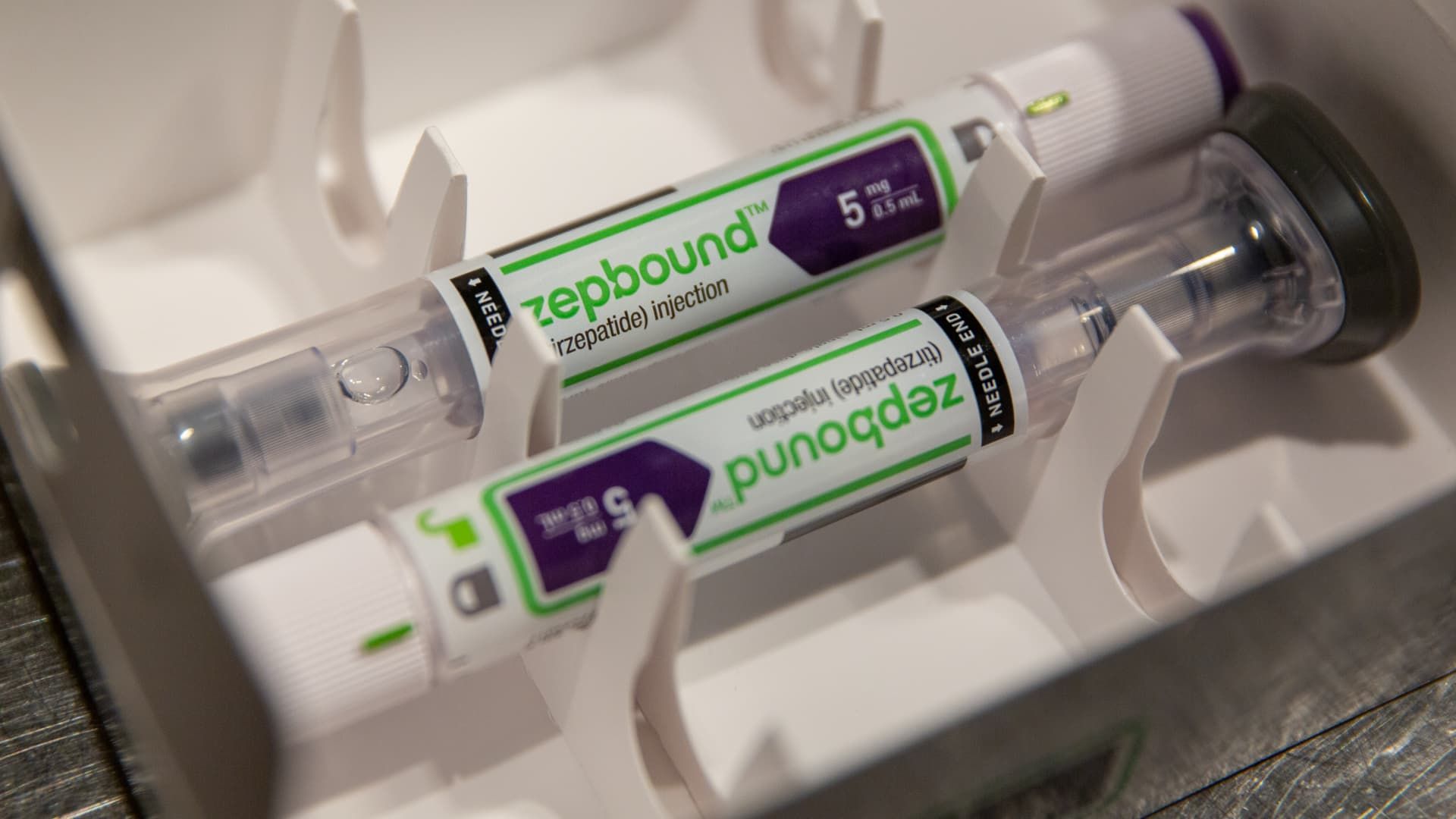

Investors want to know if Eli Lilly is experiencing the same pricing pressures on its blockbuster weight-loss drug Zepbound that Novo Nordisk experienced with its competing drug Wegovy in the second quarter. Novo Nordisk surprised investors on Wednesday when its latest results missed Wall Street expectations. The stock is reeling, down 8%, after the company cut its operating profit growth forecast for 2024. Eli Lilly will report its second-quarter results before the market opens on Thursday. Analysts polled by LSEG expect the drugmaker to earn $2.60 per share on revenue of $9.92 billion. Demand for Lilly’s GLP-1 drugs Mounjaro and Zepbound, also known as tirzepatide, is helping drive expected revenue growth of nearly 19% from the second quarter of 2023. But Novo’s results prompted some selling in Lilly stock on Wednesday, with the stock down 3%. While Eli Lilly stock is still up 32% so far this year, concerns about rising competition in the category have led to a nearly 16% drop in Lilly shares over the past month. The outlook for the obesity drugs will largely determine where the stock heads from here, analysts say. LLY YTD mountain Eli Lilly shares year to date Why the stock is under pressure Novo Nordisk has been working hard to ramp up manufacturing capacity for its popular GLP-1 drugs and expand access to Medicaid patients. Management said both efforts will help its long-term growth but have hurt short-term performance. Eli Lilly is making similar attempts with Zepbound, but its launch is at an earlier stage than Wegovy. Second-quarter sales of Ozempic, Novo’s diabetes treatment, rose 4% from the first quarter, while Wegovy revenue grew 24% quarter over quarter. However, Wells Fargo analyst Mohit Bansal noted that the number of prescriptions written for Ozempic in the second quarter rose 17%, while Wegovy prescriptions grew 58%, according to IQVIA, over the same time period. In part, Wegovy’s net price is declining because of efforts to expand access to Medicare patients in 20 states. While patients enrolled in the federal health insurance program are generally not covered for weight-loss drugs, the Food and Drug Administration approved the use of Wegovy as a way to prevent heart attacks and strokes in people with cardiovascular disease who are overweight or obese. This decision opened the door to expanded coverage. “Its [Novo Nordisk management’s] “The goal is to secure supply to serve as many patients as possible, noting that price typically declines with increasing volume,” Bansal wrote in a research note Wednesday. Barclays analyst Emily Field told clients in a research note that she would buy Novo Nordisk shares on weakness. “Was this the perfect quarter we were hoping for? “Not necessarily,” he said. “But ultimately, obesity is going to be a volume-driven market and the overwhelming message we got from the company this morning is that volume is on track.” Are prices approaching parity? It’s also important to remember that Wegovy is priced at a premium to Zepbound. “It remains to be seen whether additional discounts from Wegovy’s higher price could be driving down overall prices, or whether it’s simply trending toward price parity versus Zepbound,” Bansal said, adding that demand for the drugs, which mimic incretin hormones to suppress appetite and control blood sugar, remains strong. Bansal expects Lilly’s diabetes treatment Mounjaro to have seen a 14% increase in volume from the first quarter to the second quarter, while Zepbound’s volume was up 59% over the same period. But how prices will play out won’t be known until results are released Thursday. Bansal said he expects both drugs to beat estimates even if pricing weakened a bit during the quarter. “Ultimately, the overall demand environment for incretins remains very strong as NVO raised fiscal 2024 revenue guidance by 2% at the midpoint after a 1% increase last quarter,” he said. Lilly could also adjust its revenue guidance, especially in light of the manufacturing gains it has made, which have helped remove tirzepatide from the FDA’s shortage list. Portfolio preview David Song, an investment partner at Tema ETFs, said investors will also be focused on any updates Lilly provides for the drugs it has in development. Song said Lilly is “well positioned” with orforglipron, an oral GLP-1 drug it is developing. However, there are other pipeline updates that will be keenly anticipated in the second half of the year, including data from Amgen on MariTide and Novo on CagriSema. JPMorgan analyst Chris Schott expects health outcomes data for tirzepatide to be a key catalyst for Lilly stock in the coming months. “While there have been a number of initial pipeline updates from competitors in the obesity space, we do not believe these agents are differentiated or likely to take significant market share and our view that LLY and Novo will continue to dominate the incretin market remains unchanged,” Schott said. Schott expects Mounjaro and Zepbound to reach $16.5 billion in sales by the end of this year and then rise to $27 billion by 2025. By 2026, sales should reach $36.5 billion.