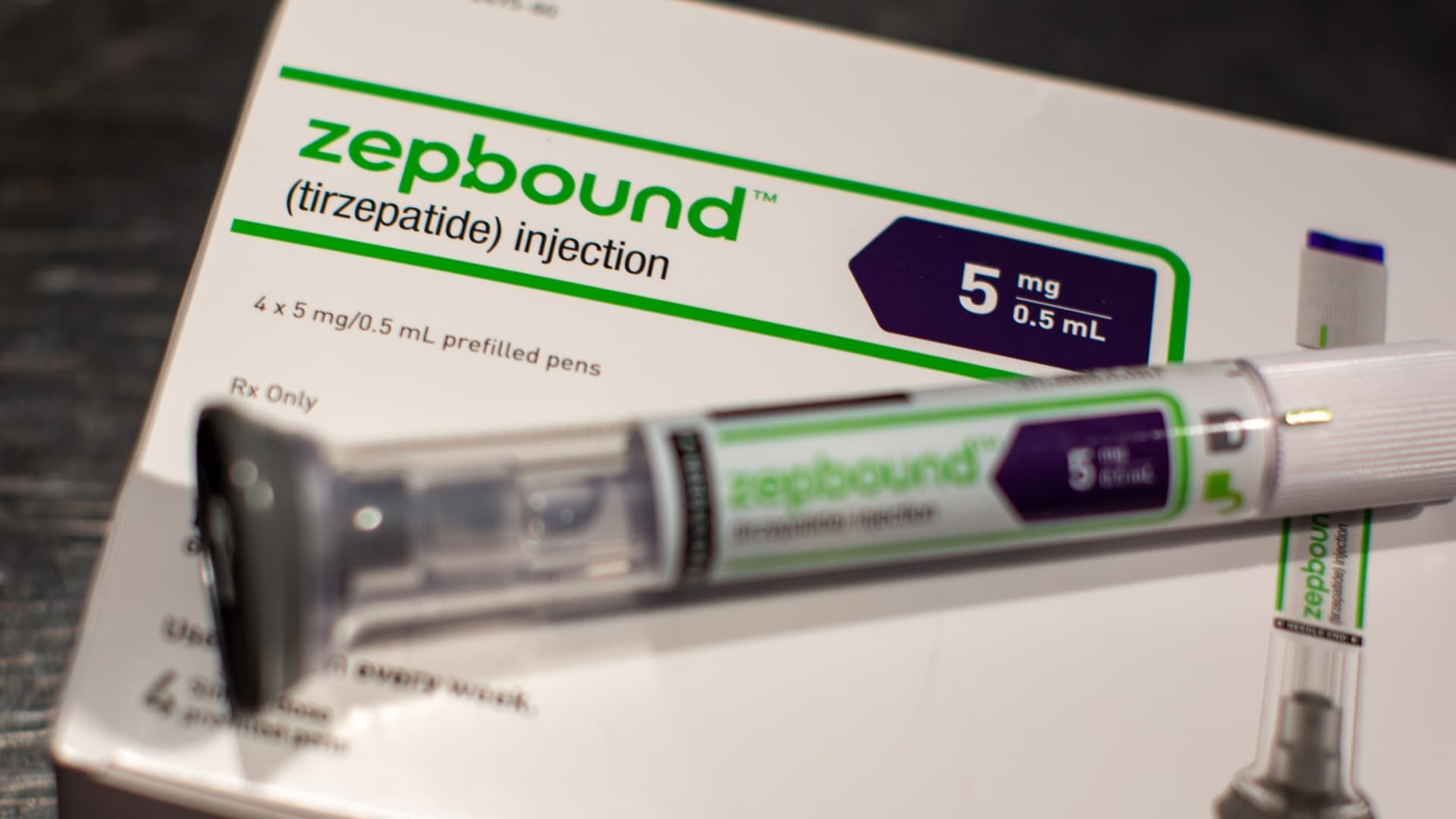

A Zepbound injection pen from Eli Lilly & Co., March 28, 2024.

Bloomberg | Bloomberg | Getty Images

Do you think a friend or colleague should receive this newsletter? This link with them to register.

Good afternoon! New Nordisk and Eli Lilly Until now, they have dominated the booming market for a class of weight-loss and diabetes drugs.

But Eli Lilly may be starting to gain the upper hand over its Danish competitor in the two-horse race to capitalize on growing demand for those treatments, also known as GLP-1.

This became clear last week after both companies reported their respective second-quarter earnings.

“Lilly is taking the lead in the metabolic duopoly,” BMO Capital Markets analyst Evan Seigerman said in a research note Thursday.

On Aug. 7, Novo Nordisk cut its full-year profit forecast after reporting that quarterly sales of its weight-loss injection Wegovy fell well short of Wall Street expectations. The disappointing result was due to higher-than-expected price concessions to pharmaceutical benefit managers, which negotiate drug discounts with manufacturers on behalf of insurers, executives said on a conference call last week.

Revenue from Ozempic, its blockbuster diabetes drug, also missed estimates for the period. The company's shares plummeted.

Still, Novo Nordisk slightly raised its full-year sales growth forecast.

Eli Lilly's quarterly report, released a day later, was a completely different story. The Indianapolis-based company's weight-loss injection Zepbound and diabetes treatment Mounjaro both beat expectations for the second quarter.

Eli Lilly raised its 2024 revenue outlook by $3 billion and boosted its full-year earnings guidance thanks to strong performance from Zepbound and Mounjaro and “greater clarity” on the company’s production expansions for those drugs.

Unlike Novo Nordisk, Eli Lilly benefited from higher U.S. prices for Mounjaro during the quarter as use of savings card programs for the drug declined. Executives said they expect “stable pricing” for Mounjaro and Zepbound during the final two quarters of 2024.

Eli Lilly shares closed up more than 9% on Thursday.

Boxes of Ozempic and Wegovy manufactured by Novo Nordisk are seen in a pharmacy in London, Britain, March 8, 2024.

Hollie Adams | Reuters

Several analysts were particularly pleased with Eli Lilly's positive production updates. Demand for weight-loss and diabetes drugs is outstripping supply in the U.S., so companies that can get more of a product to patients quickly may gain an advantage in this sector.

All doses of Mounjaro and Zepbound are now listed as available in the Food and Drug Administration’s drug shortage database. Meanwhile, some doses of Wegovy are in limited supply as Novo Nordisk invests billions in its own manufacturing expansion efforts.

In a research note Thursday, Bank of America analysts raised their combined revenue forecast for Mounjaro and Zepbound to $19.7 billion in 2024, $31 billion in 2025 and $38.5 billion in 2026 because they “have become more comfortable with the supply dynamics.”

Analysts said there could still be intermittent supply shortages for Mounjaro and Zepbound in the near term “as access improves and physicians become more comfortable with supply availability,” but they applauded Eli Lilly’s progress in strengthening its manufacturing and supply network.

For example, Eli Lilly CEO David Ricks said on an earnings call Thursday that the company has built six manufacturing plants, some of which are already up and running, and has hired thousands of workers to ramp up production. The company acquired another plant earlier this year.

Eli Lilly expects production of the incretin drug (another term for weight loss and diabetes treatments) in the second half of 2024 to be 50% higher than during the same period last year, it added.

Ricks said Eli Lilly's ability to scale up manufacturing of Zepbound and Mounjaro gives the company confidence it can compete with newcomers to the weight-loss and diabetes drug market that may not have the same capacity.

“I don't know if it's a barrier, but it's certainly work to be done: scaling up manufacturing,” Ricks said.

“We're talking about manufacturing things on a billion-scale, which takes time, is technically difficult and requires a lot of capital,” he continued. “So of course competitors will have to appear. But there's a long road ahead for all these companies.” [other drugmakers] that the two leading companies have already largely come a long way.”

Feel free to send tips, advice, story ideas and information to Annika at [email protected].

The latest in healthcare technology

Stryker to acquire artificial intelligence startup Care.ai

Medical technology company Stryker announced Monday that it has agreed to acquire Care.ai, in another deal related to artificial intelligence in the healthcare sector.

Care.ai uses tools like AI-powered sensors to help doctors monitor patients and workflows in hospitals, skilled nursing facilities, and assisted living facilities. The company raised $27 million from Crescent Cove Advisors in 2022.

Stryker offers medical and surgical equipment and a range of orthopedic and neurotechnology products. The company said technology like Care.ai's is of “increasing importance” as healthcare organizations grapple with challenges such as nursing shortages, burnout, administrative burden and workplace safety concerns, according to a statement released Monday.

Terms of the deal were not disclosed and Stryker said the acquisition is subject to customary closing conditions.

Stryker shares were roughly flat on Tuesday.

“Care.ai will help Stryker significantly accelerate our digital and IT vision in healthcare to provide customers with intelligent, connected, real-time decision-making tools that improve the lives of caregivers and their patients,” Andy Pierce, group president of MedSurg and Neurotechnology at Stryker, said in the release.

The technology offered by Care.ai will “integrate seamlessly” with Stryker's platforms and devices, the company added.

“Our commitment to simplifying and improving the lives of healthcare professionals and patients remains unwavering,” said Chakri Toleti, founder and CEO of Care.ai, in a LinkedIn post on Monday. “Together, we are transforming healthcare, ensuring that we always prioritize the well-being of those who need care and those who are dedicated to caring for others.”

Stryker declined to comment. Care.ai did not immediately respond to CNBC's request for comment.

Read the full announcement here.

Feel free to send tips, advice, story ideas and information to Ashley at [email protected].