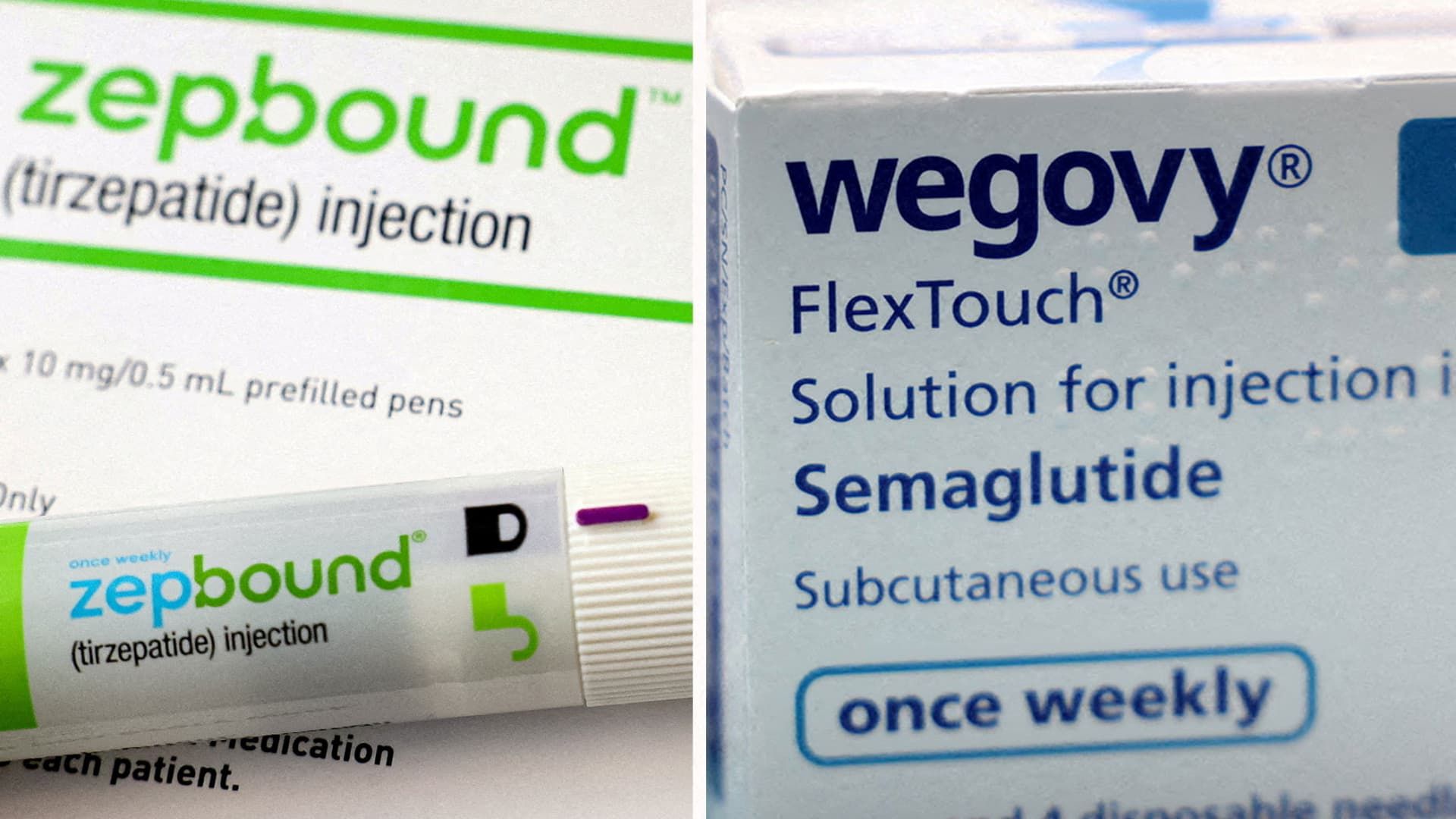

A combined image shows a Zepbound injection pen, the Wogovy Eli Lilly weight loss drug and Wogovy boxes, made by Novo Nordisk.

Hollie Adams | Reuters

A version of this article appeared for the first time in the Healthy Bulletin returns from CNBC, which brings the latest medical care news directly to its entrance tray. Subscribe here To receive future editions.

For once, the Trump administration can be giving some drug addicts a reason to celebrate.

The Trump administration plans to experiment with the expensive drug deck to lose weight low Medicare and Medicaid, Washington Post reported Friday. This plan could expand access to millions of Americans with obesity that currently cannot be allowed Novo NordiskSgovy and Eli LillyGLP-1 Zepbound's drugs that cost around $ 1,000 per month before insurance.

In a statement to CNBC on the Plan, the Department of Health and Human Services said that all drug coverage experience a “cost-benefit review.” Medicare and Medicaid service centers “It does not comment on potential models or coverage,” the department added.

The informed plan, if it will finally enter into force, would be a great victory for Eli Lilly, Novo Nordisk and many Americans.

The irregular insurance coverage of obesity medications remains the largest barrier for access to patients, and is a broader absorption of the absorption and growth of income for the two pharmaceutical giants. Many health plans, including Medicare, cover the LPG-1 for the treatment of diabetes, but not obesity. Medicaid coverage of obesity medications is limited and varies according to the State, according to the Health Policies Research Organization.

But it is important to remember that this plan is not exactly new.

In November, the Biden Administration proposed that Medicare and Medicaid cover obesity treatments, which would have extended access to approximately 3.4 million beneficiaries of Medicare and approximately 4 million medical receptors. The proposal was controversial at that time, since taxpayers would cost up to $ 35 billion during the next decade, according to an analysis of the Congress.

The Trump administration withdrew that proposal in April, but said it could reconsider the coverage of those drugs in the future.

Let's get into how the new reported iteration of the plan is seen.

According to the Pilot Plan reported by the Trump Administration, the state programs of Medicaid and the plans of the Medicare part d could voluntarily choose to cover Ozempic, Wegovy, Mounjaro and Zepbound for patients for “weight control.” That is in accordance with several centers for Medicare and Medicaid services documents obtained by the position.

The plan is expected to begin in April 2026 for Medicaid and January 2027 for Medicare's plans, the post reported.

It is not clear how the plan will develop, said Jared Holz, Mizuho's medical care strategist, in a client note on Friday. Holz said that the government will establish some coverage parameters related to factors such as age, body weight, body mass index and other comorbidities, or chronic coexisting health conditions.

He also said that the price of drugs will be an “important consideration.” Holz said that the Government pays less than the prices of the current list of medicines. But have that Coverage would expand access and could help boost higher sales volumes, he said.

Another factor to consider is how much is willing to the Government to take energetic measures against the so-called compound pharmacies, which are allowed in rare cases to sell cheaper and not approved versions of LPG-1. The pharmaceutical industry opposes those imitation LPG-1, since their safety and efficiency are not examined by regulators and, in some cases, are sold illegally at scale.

Holz said that the complaints of the industry to the Government about the LPG-1 composed so far “have not found a generalized closure.”

But in general, Holz said that the disposition of the Trump administration informed to consider covering obesity drugs is “a light positive in terms of feeling of the industry.”

It is definitely a breath of fresh air for Eli Lilly, Novo Nordisk and other drug manufacturers, including Amgen, Roche, Astrazeneca and Pfizer – That they hope to bring their own drugs of obesity to the market.

The last six months have been everything but soft for the broader industry: the Trump administration has increased calls to drug manufacturers to reduce the prices of drugs in the United States, reviewed federal health agencies and could impose radical tariffs on pharmaceutical products imported to the country in any day.

We will continue to see if this plan is implemented, so they are attentive to our coverage!

Do not hesitate to send any advice, suggestion, stories ideas and data to Annika in [email protected].

The latest in medical attention: the profit season saw the Medicare Advantage players change their place

UnitedHealth Group Inc. Signaling on the floor of the New York Stock Exchange on April 21, 2025.

Michael Nagle | Bloomberg | Getty images

After informing your second consecutive failures, failure and orientation cut, Unitedhealth Group He completed his executive sweep replacing the CFO John Rex. Executives in the earning call admitted a bad execution in Medicare Advantage and pledged to return to profitability and recover the investor trust.

Almost two years ago was CVS health Under pressure, after the profits in the company's health insurance division of the company were torpedoated by the low quality grades of the Medicare Advantage star.

This week, CVS won and raised his perspective on the strength of his MA program. CEO David Joyner, now a year after work, told me that he feels good with the change in Aetna and his Medicare business. In addition to that, the company saw market share profits in its stores, thanks in part to win the Rite Aid customers.

Human, in a similar way, he has seen progress in his change, but CFO Celeste Armelet told me that all insurers are dealing with price plans for next year amid high medical costs. A high -cost driver at this time, Mellet told CNBC, are oncological drugs, since some expensive therapies are now being used in combination.

The next moment of truth for Medicare Advantage players will come in the next six weeks, when they will learn the fate of their stars grades for the 2026 plans.

Read more from Bertha Coombs of CNBC here.

The latest in Medical Care Technology: Dr. Marc Harrison moves to a strategic advice role in general Catalyst

The Medical Care Executive for a long time, Dr. Marc Harrison, resigned as CEO of the Catalyst general health guarantee transformation company, or Hatco, and has moved to a role of strategic advisor, CNBC confirmed.

The risk capital firm brought Harrison and announced the training of Hatco in 2023. In a statement at that time, General Catalyst said the company would work in close collaboration with the health system partners and that it would eventually acquire and operate its own health system.

Months later, Hatco announced his plans to buy Summa Health, an integrated non -profit health system in the northeast of Ohio. Under his new structure, Summa would become a profit organization, and General Catalyst said he would introduce new solutions enabled for technology that aim to make attention more accessible and affordable.

Buying a health system is an unprecedented movement in the company's industry, and the agreement was not well received by some members of the Ohio community. Hundreds signed a petition urging Summa to remain a non -profit organization and stop negotiations with Hatco.

Ohio Dave Yost Attorney Generally approved the agreement in June, although he described a series of “enforceable commitments” as part of the agreement. Hatco will have to notify the Attorney General of Transactions that could trigger antitrust concerns for 10 years after the agreement closes, for example.

Harrison went to the Medicine School in the late 1980s and has spent most of his career within health systems, more recently as CEO of Intermountain Healthcare. General Catalyst told CNBC that Harrison will continue to provide the firm's CEO, Hemant Taneja, with clinical ideas and will remain connected to his ecosystem in his new role.

“It became clearer for both Marc and us that Marc's role would be better achieved as Hemant Taneja strategic advisor while we give life to that ambition and vision,” said a Catalyst general spokesman.

Daryl Tol, the head of the Catalyst General Health Guarantee Ecosystem, was promoted to President of Hatco, said the spokesman. The daily work of the company with Summa Health Leadership is headed.

General Catalyst also appointed Kate Walsh, former Secretary of Health and Human Services of Massachusetts, for the Hatco Board. In addition, she will serve as president of the Board in Summa Health once the transaction is closed.

“We are grateful for the leadership and collaboration of Marc as co -founder and CEO to help us take us to this point in the evolution of Hatco, and we hope to take advantage of his invaluable perspective as we continue to progress,” said the spokesman.

Read more of CNBC's coverage on the acquisition of Summa Health of Hatco here.

Do not hesitate to send any advice, suggestion, stories ideas and data to Ashley at [email protected].