3D illustration of a human liver organ.

magic mine | iStock | fake images

Do you think a friend or colleague should receive this newsletter? Share this link with them to register.

Good day! Millions of Americans with a common and life-threatening form of liver disease will soon have access to the first treatment for the condition.

In a historic decision Thursday, the Food and Drug Administration approved Madrigal Pharmacy' drug “Rezdiffra”, which is used together with diet and exercise. The company expects the drug to be available next month with a hefty price tag of $47,400 a year before insurance and other reimbursements.

So why is this approval so important?

First of all, people suffering from this disease urgently need treatment. Rezdiffra is specifically approved to treat patients with nonalcoholic steatohepatitis, or NASH, who also have moderate to advanced liver scarring.

Some specialists have begun calling the condition metabolic dysfunction-associated steatohepatitis, or MASH, to avoid potentially stigmatizing language.

MASH is a severe form of liver disease characterized by excessive fat accumulation and inflammation. It can cause scarring of the liver and, in more severe cases, liver failure or cancer. The condition is often associated with other health problems, such as high blood pressure, type 2 diabetes and obesity.

About 6 to 8 million people in the U.S. have MASH with moderate to advanced liver scarring, according to one estimate cited by the FDA.

The agency's approval is also important because it means Madrigal has succeeded in an area where several other drugmakers have failed – or are still trying to succeed.

That gives Madrigal an advantage in a market that could be huge: The MASH industry could be worth nearly $26 billion by 2032 in the United States, France, Germany, Italy, Spain, the United Kingdom and Japan, according to an estimate from data analytics firm GlobalData. .

Madrigal's drug is setting the standard for efficacy and safety for MASH treatment, while opening the door to medications still in development.

There's one important detail in the approval that could bode well for the entire MASH space: The FDA is not requiring patients to have a liver biopsy to determine their eligibility for Madrigal's drug.

It refers to a procedure in which a doctor removes a small piece of liver tissue from a patient so it can be examined under a microscope for signs of damage or disease.

“The absence of a liver biopsy requirement on Rezdiffra's label should boost biotech stocks” of companies developing MASH treatments and “potentially accelerate and expand patient access,” William Blair analyst Andy Hsieh wrote. in a note on Friday.

In this photo illustration the Madrigal Pharmaceuticals logo seen displayed on a smartphone screen.

Rafael Enrique | SOPA Images | Light rocket | fake images

There are a handful of biotech companies with promising experimental MASH treatments:

But the question for all of those companies is to what extent a successful class of drugs called GLP-1 will dominate the MASH market.

GLP-1s work by mimicking a hormone produced in the intestine to suppress a person's appetite and regulate blood sugar.

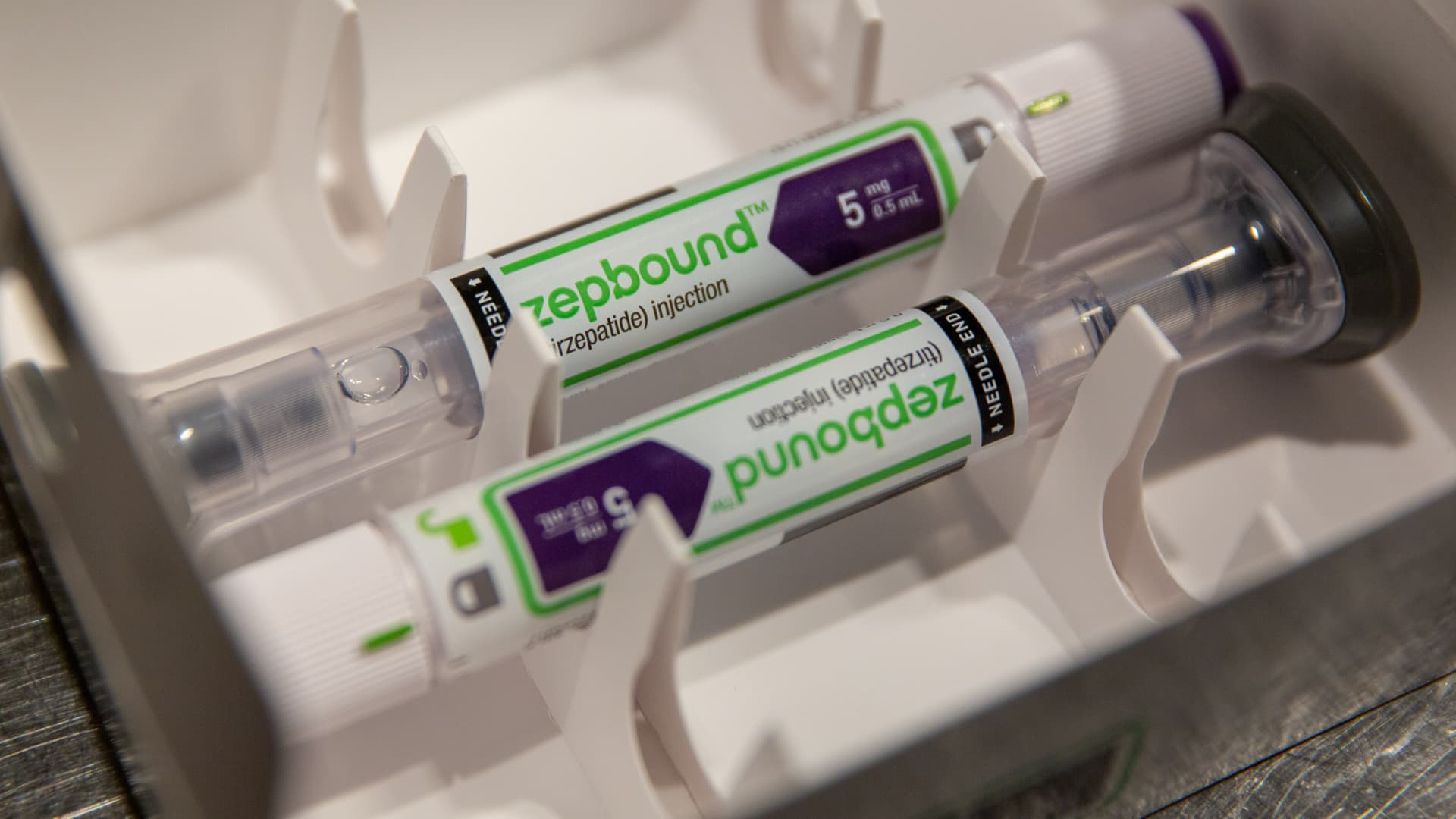

include NordiskWeight loss drug Wegovy and diabetes treatment Ozempic. Eli LillyThe respective diabetes and weight loss injections, Zepbound and Mounjaro, are also part of this class, but target an additional hormone called GIP.

- Nordisk is studying semaglutide, also known as Wegovy and Ozempic, in a late-stage trial for the treatment of MASH.

- Eli Lilly published positive mid-stage data on tirzepatide, also known as Zepbound and Mounjaro, in the treatment of MASH, and expects to present full data from that trial later this year.

- Pharmaceutical Zeeland and Boehringer Ingelheim published positive mid-stage data for an experimental drug called survodutide in patients with MASH. The companies are also studying the treatment in late-stage trials as a treatment for obesity. The treatment activates GLP-1 and another hormone called glucagon.

- merck is studying a drug called efinopegdutide in mid-stage trials. The treatment activates GLP-1 and another hormone called glucagon.

Mizuho healthcare equity strategist Jared Holz wrote in an email to investors on Friday that adoption of GLP-1 is a factor that will be “key to the broader NASH thesis.”

He said this is because “we have no doubt that the use of weight loss therapies will greatly reduce liver fat and we would expect many doctors (at least primary care ones) to opt for GLP first, before to refer patients to specialists.

Wegovy, Ozempic, Zepbound and Mounjaro are already expensive, around $1,000 a month, or about $13,000 a year, before insurance and other reimbursements. But that's still far less than the nearly $50,000 annual price tag for Madrigal's drug.

We probably have a better idea of what the MASH drug landscape will look like over the next year, and how big the threat from GLP-1 will be, so stay tuned for our coverage!

Feel free to send any tips, suggestions, story ideas, and facts to Annika at [email protected].

The latest in health technology

Conclusions from the HIMSS conference

HIMSS attendees in Orlando, Florida 2024.

Courtesy of HIMSS

Perhaps not surprisingly, generative AI dominated my conversations at the HIMSS conference in Orlando, Florida, last week.

As I ran across the show floor to meet with executives from companies like microsoft, Googleepic systems, GE Health Care, Sales force And what's more, the topic was literally hard to avoid. I walked past a random sample of about 40 vendors at the conference, for example, and about 75% of them had the word “AI” prominently displayed on their booths.

The popularity of AI in HIMSS was expected. As I mentioned in last week's newsletter, it also stole the show at last year's conference. But this year, the conversation about the role of AI in healthcare had matured. Instead of discussing far-reaching, long-term applications of the technology, most of my conversations revolved around how it is being tested and used in practice.

The most popular use case by far was environmental clinical documentation, which came up again and again. Environmental clinical documentation tools allow physicians to consensually record their patient visits, and those conversations are automatically transformed into clinical notes and summaries using AI.

Companies such as Nuance Communications, Abridge, and Microsoft's Suki have developed these capabilities, which they say will help reduce doctors' administrative workloads and prioritize meaningful connections with patients.

Administrative tasks are a major problem for physicians across the U.S. healthcare system, as they are one of the leading drivers of burnout, according to a survey released by Athenahealth in February. As a result, health systems are very interested in tools such as clinical environmental documentation that could help reduce this administrative burden.

Organizations such as California-based Stanford Health Care and UCI Health announced at HIMSS that they are implementing environmental clinical documentation tools across their companies. Since automating documentation does not directly impact diagnoses or patient care, I expect we will see many similar announcements across the country this year. It's an easier and less risky way for health systems to implement generative AI at scale.

Many of the companies I spoke to are diving into more diagnostic and patient-facing AI applications, but I think it will be a while before we see doctors and nurses widely using the technology to support their treatment decisions.

Please feel free to send any tips, suggestions, story ideas, or information to Ashley at [email protected].