This story is part of CNBC's quarterly Cities of Success series, which explores cities that have transformed themselves into business centers with an entrepreneurial spirit that has attracted capital, companies and employees.

The Denver-Boulder region is quickly emerging as a major hub for the life sciences industry, attracting companies developing cutting-edge medical technologies and treatments.

Research in biological sciences aims to understand living beings, from cells to our planet, to improve health, nutrition and the environment. Funding growth is being driven by a combination of factors: an increase in venture capital and government funding, a collaborative research environment, and a booming market for laboratory space.

BioMed Realty CEO Tim Schoen gives CNBC a tour inside a construction site that will be converted into a state-of-the-art lab space.

CNBC

San Diego-based BioMed Realty, a major real estate player (acquired by Blackstone in 2016 for $8 billion), made headlines in 2022 with a record $625 million purchase of Flatiron Park, a massive complex in Boulder, Colorado. The 1 million square feet spread across 23 buildings are being converted into laboratories and technology space to meet the region's growing demand.

“This was the next logical step…investing in Boulder and scaling,” said Tim Schoen, president and CEO of BioMed Realty. “Boulder has all the elements you want in an innovation ecosystem: research universities, scientists, venture capital and then ourselves, who provide the mission-critical infrastructure.”

In addition to Boulder, the company operates in five other major technology and life sciences markets, including San Diego, San Francisco, Seattle, the Boston area and Cambridge in Massachusetts, and Cambridge, United Kingdom.

Enveda Biosciences, a biotechnology company, occupies lab space in Boulder.

CNBC

According to commercial real estate group CBRE, 14 companies were seeking a cumulative 506,000 square feet of lab space across the Denver-Boulder market in 2023, which includes the neighboring city of Aurora. Additionally, 370,000 square feet of lab space has been completed and move-in ready in the Denver-Boulder market. with another 560,000 square feet under construction or renovation.

“I would describe Boulder as unique and explosive. Unique from the standpoint of its location in the foothills of the Rocky Mountains,” Schoen said, “and then explosive in terms of how the ecosystem has really grown and expanded over the last decade “.

Funding on the rise

Investors are taking notice.

“Investors in Colorado and all coasts are seeing opportunity here,” said Elyse Blazevich, president and CEO of the Colorado Bioscience Association. “Our ecosystem has raised more than $1 billion for the past seven consecutive years, and seed funding in Colorado in 2023 grew faster than other life sciences markets nationwide.”

Founded in 2003, the Bioscience Association supports the growth of the life sciences, focusing on access to capital, education, networking and more.

According to Blazevich, funding for pre-seed companies and series A and B rounds increased from 2022 to 2023. The largest increase was seen in series A and B funding, which grew by $53 million, or 28%, year after year. Pre-seed funding, the earliest stage of venture capital, grew by $18 million, an increase of 163%, during that period.

A recent report from CBRE found that Denver-Boulder is the top U.S. life sciences real estate market, driven by record investments from venture capitalists and the National Institutes of Health.

The report also found that the pool of skilled life sciences workers is growing much faster in the region than the national average, growing 35% over the past five years, compared to 16% growth for the United States in general.

Business success

The recent increase in venture capital flowing into Denver-Boulder builds on the area's proven track record of success over the past several decades.

In 1998, entrepreneur Kevin Koch co-founded the biotechnology company Array BioPharma in Boulder. The company was acquired by Pfizer for $10.64 billion in 2019, and Koch is now co-founder and CEO of a clinical-stage startup. Cutting-edge therapeutics.

Edgewise develops therapies for rare muscle disorders and generated net proceeds of $186.1 million in its initial public offering in March 2021.

But the company started small.

“We were in an incubator within the University of Colorado. And we brought in talented people from the University of Colorado,” Koch told CNBC. “We received interns who eventually became employees.”

A scientist working at Edgewise Therapeutics in Boulder, Colorado, focused on developing therapies for rare muscle disorders.

CNBC

Today, Edgewise has a much larger space in Boulder: 28,000 square feet in total, with half of its 93 employees working out of the city office. The company plans to expand its presence and hire more workers in the coming years.

Koch said the Boulder region's history of DNA and RNA research in the 1980s was key to unlocking protein-based drugs to fight disease, which helped attract capital to the life sciences center.

“[That research] “It anchored investment in the Boulder area,” he said. “Now, those companies that marketed those products reinvested in Boulder.”

With the help of leading venture firms, Edgewise Therapeutics has raised more than $500 million – $550 million in cash through 2027.

“We decided that Boulder really was the right place. And I think that was the case. We've been able to attract a lot of fantastic talent,” Koch said.

Research power

Denver-Boulder's innovation ecosystem is generating ideas rapidly.

Aurora, Denver's largest suburb, is the epicenter of life sciences research: a 256-acre complex home to the University of Colorado Anschutz Medical Campus, which receives $700 million in annual grants.

Dan LaBarbera is a professor of pharmaceutical sciences and founding director of the Center for Drug Discovery on the medical campus.

“Our goal here at the Center for Drug Discovery is to serve as a bridge to move innovation from academia to industry and then to the clinic,” LaBarbera told CNBC.

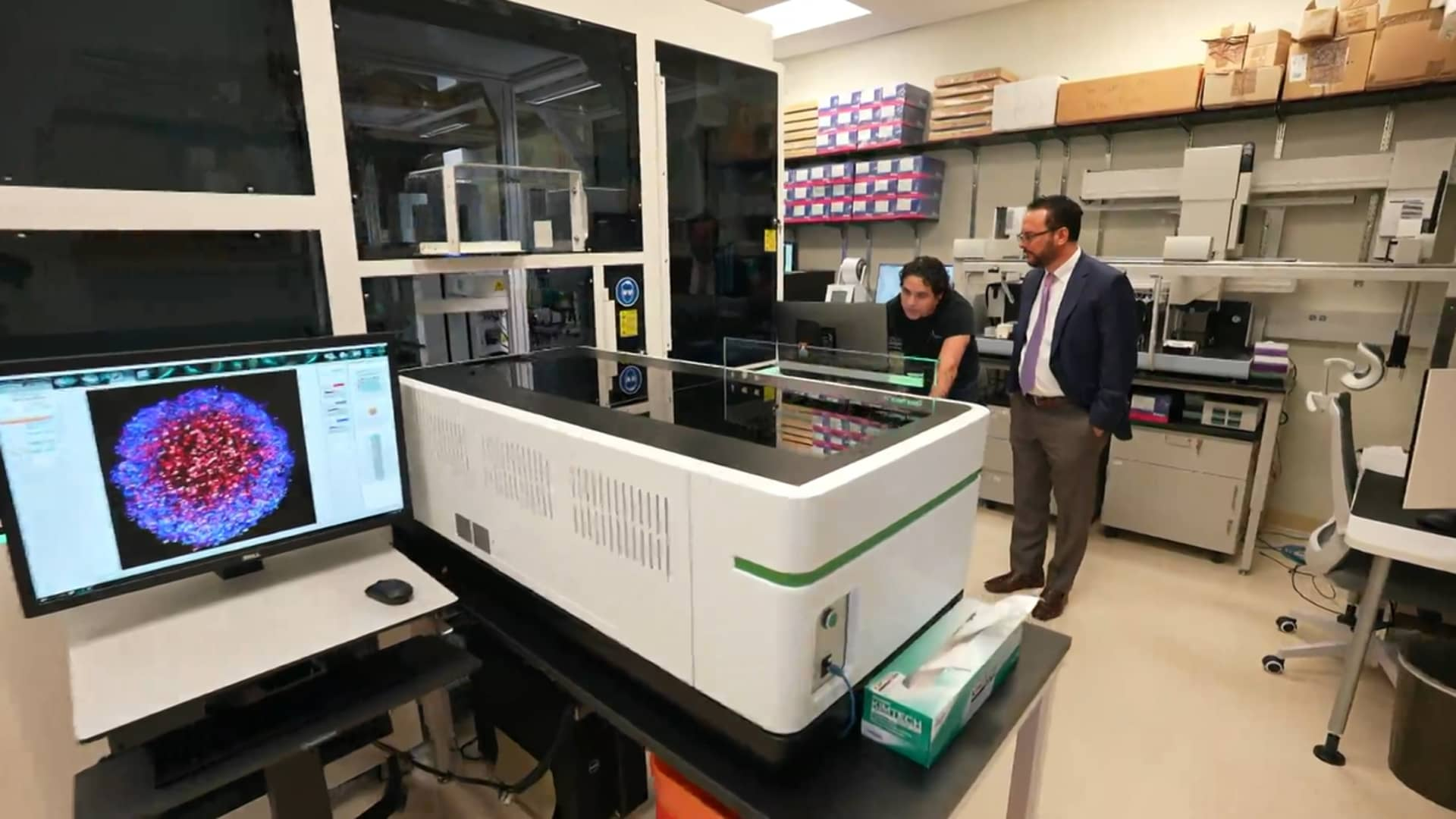

A look inside the Center for Drug Discovery on the CU Anschutz Medical Campus, led by Dr. Dan LaBarbera (right), with the goal of accelerating the process from drug discovery to delivery to patients.

CNBC

Founded in 2021, the center develops drugs for a wide range of diseases, from cancer to Alzheimer's, using cutting-edge technology including robots and 3D bioprinters.

“I think people in general are familiar with 3D printers, because of their ability to print plastics or even metals,” LaBarbera said. “We are using very similar technologies to print complex tissues that mimic aspects of human diseases.”

Historically, it took 10 to 15 years for a drug to go from the discovery phase to approval by the US Food and Drug Administration.

“Now we can accelerate that with this technology so that the process takes approximately six to eight years,” LaBarbera said.

The center helps shorten the time from drug discovery to treatment, helping emerging and existing companies get innovative medicines to patients faster.

“Our goal is not to compete with the pharmaceutical industry,” LaBarbera said. “Actually, our goal is to work with them to develop really innovative potential drug therapies.”