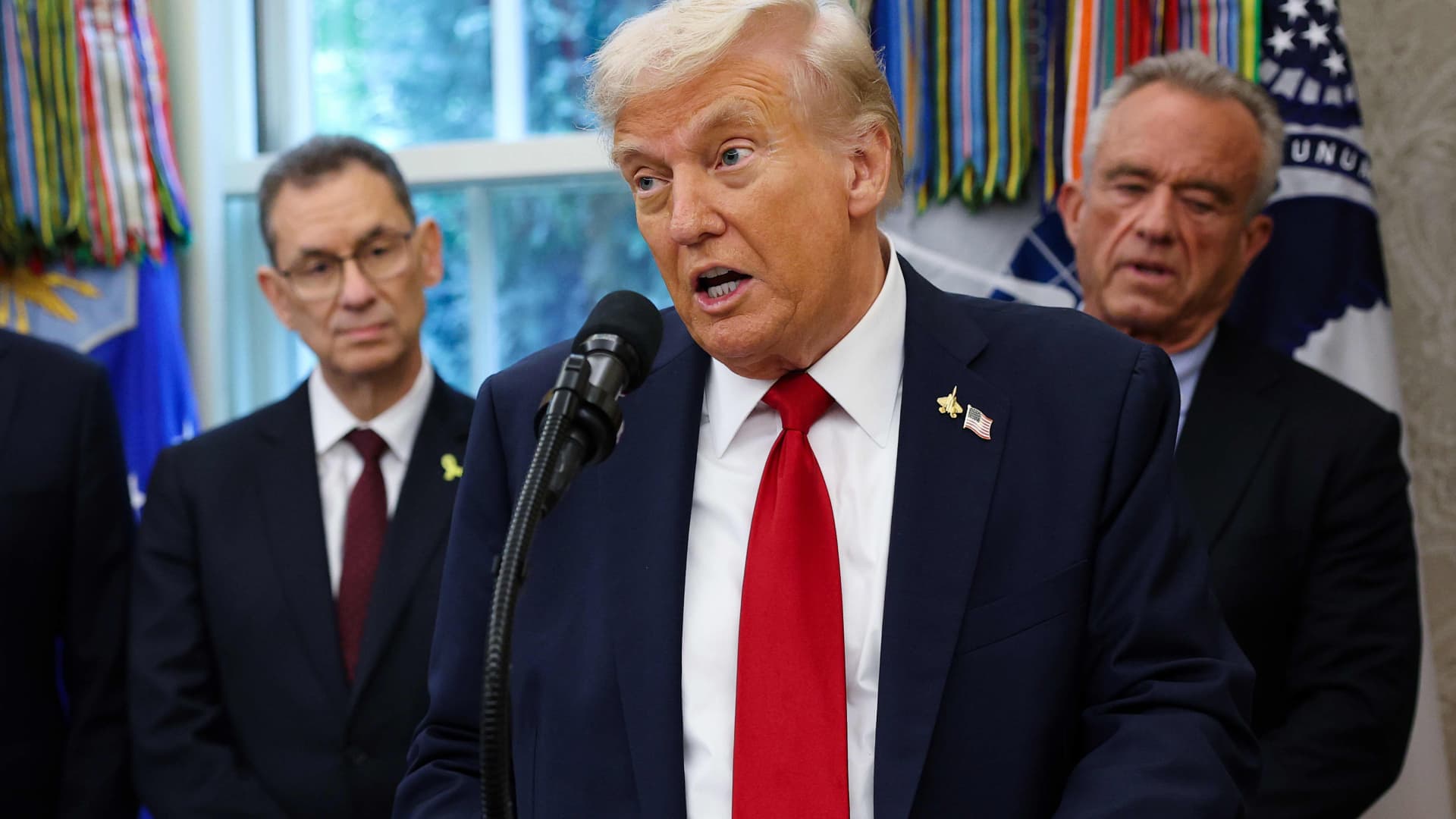

Albert Bourla, CEO of Pfizer, speaking at Squawk on the Street at the World Economic Forum in Davos, Switzerland, on January 20, 2026.

Oscar Molina | CNBC

Pfizer On Tuesday it reported fourth-quarter results that beat estimates even amid declining demand for its Covid products, while reaffirming its modest 2026 guidance that rattled investors in December.

The pharmaceutical giant is looking for longer-term investments in its portfolio, including the $10 billion acquisition of obesity biotech Metsera, to counter waning sales of Covid products and the decline of older drugs. Pfizer moved to show the promise of that investment on Tuesday, when it also reported mid-stage data showing that an anti-obesity shot from Metsera can be administered once a month and drive robust weight loss.

Additionally, Pfizer is on track to reduce costs by approximately $7.7 billion by the end of 2027 as part of two separate initiatives.

Here's what the company reported for the fourth quarter compared to what Wall Street expected, according to a survey of analysts by LSEG:

- Earnings per share: Adjusted 66 cents vs. expected 57 cents

- Revenue: $17.56 billion vs. $16.95 billion expected

Pfizer reported revenue of $17.56 billion for the fourth quarter, down about 1% from the same period a year earlier. This is largely due to lower demand for its Covid vaccine and Paxlovid, an antiviral pill for the virus.

The company posted a net loss of $1.65 billion, or 29 cents per share. That compares with net income of $410 million, or 7 cents per share, during the same period a year ago.

Excluding certain items, including restructuring charges and costs associated with intangible assets, the company posted earnings per share of 66 cents for the quarter.

Pfizer expects 2026 adjusted earnings to be between $2.80 and $3 per share, and revenue to total between $59.5 billion and $62.5 billion. Those sales would remain largely flat compared to 2025 revenue.

Pfizer previously said the lackluster revenue outlook is partly due to declining sales of its Covid vaccine and antiviral pill Paxlovid, which it expects to fall by around $1.5 billion year-over-year to $5 billion.

The company also noted another expected drop of approximately $1.5 billion year-over-year in sales as certain products lost their exclusivity in the market. Some blockbuster drugs, such as the company's Prevnar pneumonia vaccine, face increased competition from rivals.

In December, Pfizer Chief Financial Officer Dave Denton told investors that there is also “price and margin compression built in” to the company's 2026 guidance as it plans to offer “deeper discounts” on its Medicaid business as part of a landmark drug pricing agreement reached with President Donald Trump.

Under that deal, Pfizer agreed to sell its existing drugs to Medicaid patients at the lowest price offered in other developed countries and guarantee the same “most favored nation” price on its new drugs to Medicare, Medicaid and commercial payers. In exchange, the company will get a three-year tariff exemption.

Pfizer's Xeljanz and Xeljanz XR, treatments for rheumatoid arthritis and other inflammatory diseases, were selected in January for the third round of Medicare drug pricing negotiations. The new negotiated prices will come into effect in 2028.