Johnson & Johnson's logo is shown in a monitor.

Soup images | LIGHTROCKET | Getty images

Two Democratic legislators pressed on Tuesday five of the country's largest pharmaceutical companies about their low tax bills and if they support the extension of mass tax cuts for the industry in the draft reconciliation bill of the Republican Party.

Senator Elizabeth Warren, D-Mass., And Rep. Jan Schakowsky, D-Bill., Accuse Pfizer, Merck, Johnson and Johnson, Abbot and Amgen to pay little or no federal tax with profits obtained in 2024 and years before, despite generating tens of billions of dollars annually from their drugs.

In separate letters to each company on Tuesday, legislators claim that all pharmaceutical companies avoided paying US tax bills by transferring their profits to subsidiaries on the high seas in jurisdictions with much lower tax rates, such as Ireland and Bermuda. This practice was enabled by a provision in the 2017 tax and job cuts law of President Donald Trump, which aimed to stop the evasion of corporate taxes, but instead created new incentives for the US multinational companies to move profits and operations abroad.

In the letters, Warren and Schakowsky said that the practice illustrates “only one of the ways in which our Tax Code has been biased to benefit rich pharmaceutical corporations, which allows them to benefit Americans, charging them the highest prices in the world, without paying their fair part of taxes.”

They pressed drug manufacturers about whether the thousands of dollars they have spent pressing the Congress were allocated to the efforts to maintain that fiscal lagoon in the “Big Beaut Beat Law” of Trump, which the Chamber led by the Republicans approved at the end of May. J & J, for example, spent more than $ 150,000 by pressing international trimester of 2024, according to the letter to the company, which cites the data compiled by OpenCrets.

If promulgated as currently written, the package of taxes and billonary expenses would make many provisions in Trump Tax Law of 2017 permanent. The current iteration also contains historical Expenditure cuts to programs for low -income Americans, including Medicaid health coverage.

The bill is now in the Senate, where Republicans could choose to leave or review many of the provisions promoted by the Republicans of the House of Representatives who sought to reduce the expenditure in conjunction with the tax cuts. But any democratic impulse to eliminate fiscal escape on the high seas would be a uphill battle, since Republicans have the majority in the upper chamber.

Even so, the Democrats have tried to develop the public opposition to parts of the legislation while the Republican party tries to balance the interests of the parties in competition to approve it. Both parties have been addressed to pharmaceutical companies for years.

“It would be a slap for Congress to expand tax lagoons for large pharmaceutical companies that obtain billions of earnings by overloading Americans,” Warren said in a statement to CNBC. “These companies must be responsible for prioritizing their profits over people.

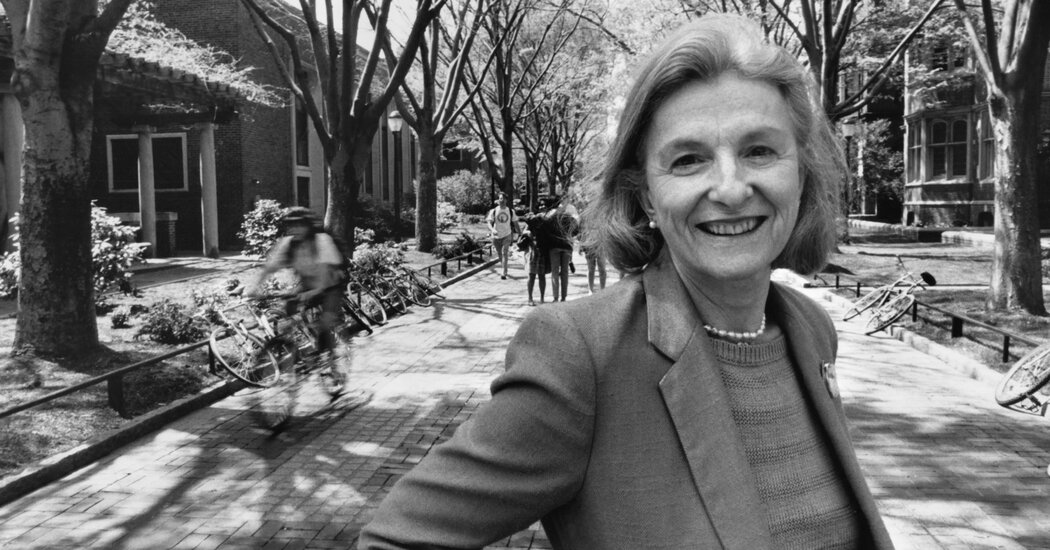

Senator Elizabeth Warren, D-Mass., Makes a press conference at the United States Capitol to express the opposition to the budget resolution of the Senate Republicans on April 3, 2025.

Tom Williams | Call Call Call, Inc. | Getty images

The letters to the drug manufacturers cited a March analysis by the Foreign Relations Council, a group of independent and non -partisan experts, which suggests that the reform of the fiscal escape on the high seas would collect at least $ 100 billion in 10 years.

The letters also include questions about the role of each company in the lobbying for an extension of the fiscal exemptions and their estimated federal fiscal responsibilities. Legislators asked each drug manufacturer to respond before July 1.

In a statement, a J & J spokesman said the company expects to “clarify” its “important fiscal contributions from the United States and cooperatively responding to Senator Warren and the letter from the representative Schakowsky.”

Pfizer, Merck, J & J, Abbvie and Amgen spokesmen did not immediately respond to requests for comments on the letters.

It is not the first time that legislators have analyzed pharmaceutical companies for their fiscal practices.

A March report accused Pfizer of achieving what Democratic Senator Ron Wyden, a Democrat of Ore, called “the greatest tax reduction scheme” in the history of the pharmaceutical industry. The report accused the company of using a tactic called “Excursion in La Ronda” to avoid paying any US Income Tax for $ 20 billion in national drug sales in 2019.

An investigation by the Democratic personnel of the Senate Finance Committee concluded that Pfizer used the tax escape to channel the profits through subsidiaries in the high seas in tax havens such as Ireland and Puerto Rico, despite selling to US patients. But the company said it paid $ 12.8 billion in US taxes for four years, and says that the documents to support have been presented to the stock exchange and values commission.

Tuesday's letters occur when the Trump administration considers imposing tariffs on pharmaceutical products in the US. In an attempt to restart manufacturing. Trump has complained that Ireland has successfully convinced medication manufacturers to open the manufacturing operations there by offering low tax rates.