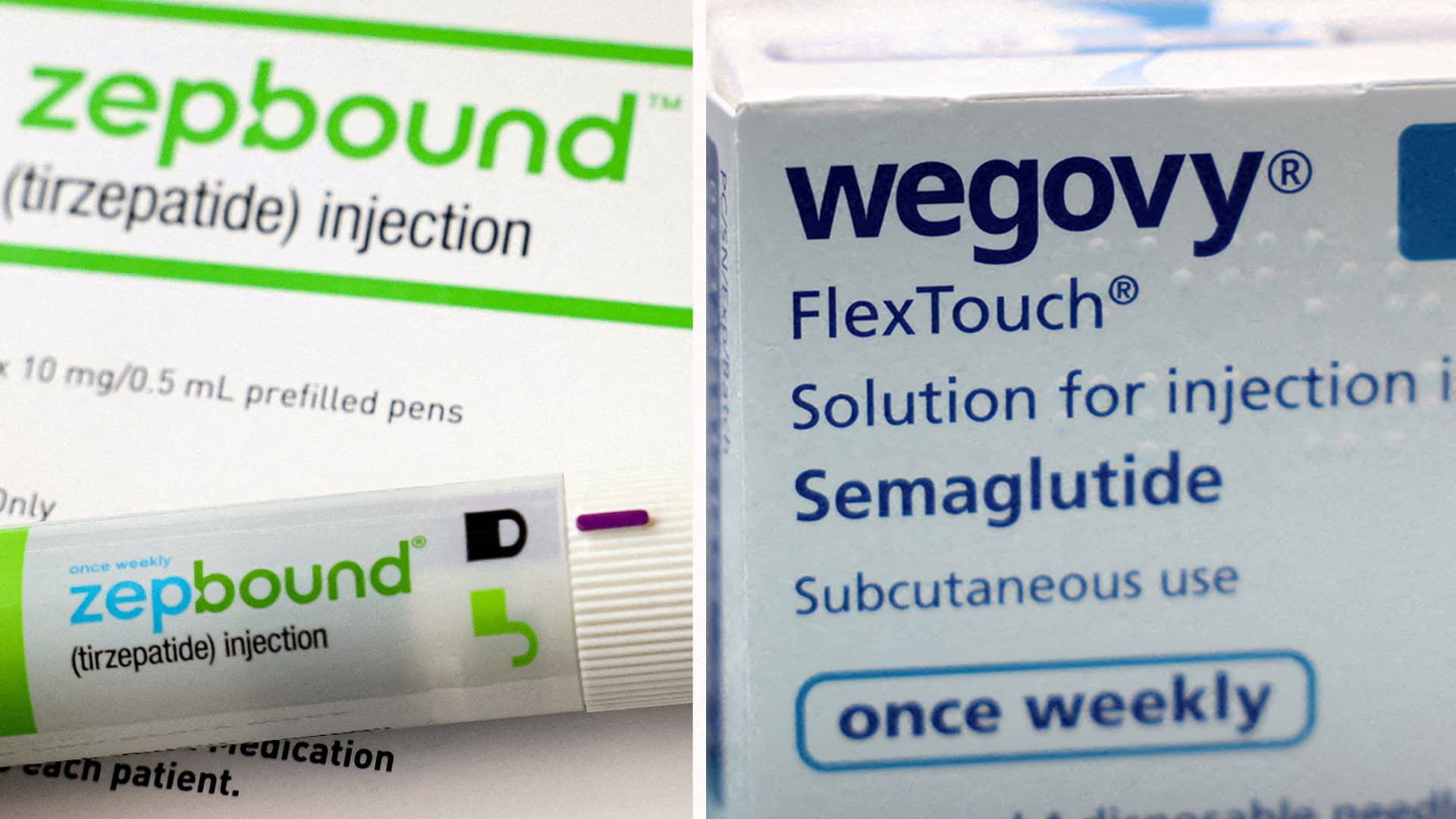

A merged image shows an injectable pen of Zepbound, Eli Lilly's weight-loss drug, and boxes of Wegovy, made by Novo Nordisk.

Reuters

Orders for blockbuster weight-loss drugs in the U.S. more than doubled in 2024, even with limited insurance coverage and high out-of-pocket costs for the treatments, according to data released Thursday by the savings company. GoodRx medications.

The figures offer further evidence of the insatiable demand for a class of drugs called GLP-1 and GIP agonists, which mimic gut hormones to suppress appetite and regulate blood sugar. That includes NordiskThe weight loss drug Wegovy and Eli LillyZepbound obesity treatment, which has high list prices of about $1,000 per month before insurance or savings cards.

Wegovy and Zepbound's prescription fills have increased by more than 100% and 300%, respectively, since the beginning of 2024. Zepbound's jump reflects its first year on the market, as it was approved in the US in November 2023. Wegovy obtained US approval in 2021.

“It's just a pretty astronomical increase in sales, and because of that, a lot of eyes are on them as far as affordability and accessibility,” GoodRx research director Tori Marsh said in an interview.

The data comes from GoodRx's new Weight Loss Medication Tracker, which examines filling trends and spending patterns in the U.S. for popular weight loss medications.

The high coverage rates come even though only 9% of people with commercial insurance have unrestricted coverage from Zepbound and 14% have unrestricted coverage from Wegovy, according to GoodRx. This refers to insurance coverage without additional obstacles that patients must overcome, such as prior authorization or higher BMI requirements.

Much higher rates of patients (about 60% to 70%) are under insurance plans with more restrictive drug coverage. But Marsh said out-of-pocket costs can add up, even if a patient has insurance coverage for a weight loss treatment.

The average insured person taking Zepbound can expect to pay more than $2,500 a year in copays for the drug, he said. GoodRx found that people spent an average of $231 out of pocket on a monthly Zepbound prescription from January 2023 to October of this year.

“Insurance is no longer the stopgap it used to be,” Marsh said.

Meanwhile, nearly 1 in 5 people with commercial insurance do not have coverage for at least one brand-name GLP-1 and GIP agonist prescribed for weight loss.

GoodRx found that Americans have spent more than $200 million paying full retail prices for weight-loss medications instead of taking advantage of savings options, such as GoodRx coupons or assistance programs offered by Eli Lilly or Novo Nordisk . GoodRx said it calculated the overpayment figure based on the average price people could have paid for a drug with a GoodRx discount.

GoodRx said uninsured people can save an average of $250 monthly, or $3,000 annually, by using their coupons for weight-loss medications.

The GoodRx data is consistent with other research indicating spotty insurance for weight-loss drugs in the U.S. For example, a survey released in October found that less than one-fifth of the country's large employers include coverage for those treatments in their health insurance plans.

The federal Medicare plan also does not cover weight loss treatments unless they are approved and prescribed for another health condition. Research has shown that covering medications could significantly increase costs for employers and state and federal governments.

But the Biden administration proposed a rule in November that would allow Medicare and Medicaid to cover weight-loss drugs for patients with obesity. If given the green light by the incoming Trump administration, the rule would significantly expand access to treatments.