US President Donald Trump arrives to make an announcement in the Roosevelt Room of the White House in Washington, DC, US, on Friday, December 19, 2025.

Will Oliver | Bloomberg | fake images

Drug prices. Patent cliffs looming. Negotiation. The first year of Trump 2.0.

These were among the topics that dominated conversations last week as drugmakers of all sizes met with investors to map out their plans for 2026 and beyond at the JPMorgan Healthcare Annual Conference in San Francisco.

After geopolitical uncertainty hit trading during the first half of 2025, investors and drugmakers were optimistic that 2026 could mark a turning point for the sector. Investors are starting to see signs of recovery in US biotech so far this year, after years of volatility, and are betting that lower interest rates and renewed appetite for deals will reopen the IPO window.

The conference lacked the flashy, expensive acquisitions that normally take center stage there. But Big Pharma made clear they are on the hunt for potential acquisitions and collaborations as they seek to offset an estimated $300 billion in potential revenue losses as patents on blockbuster drugs expire toward the end of the decade.

Some concerns about President Donald Trump's health care policy agenda have eased after more than a dozen major drugmakers ended 2025 with historic drug pricing deals and three-year tariff waivers.

Asked if he still stood by his prediction from last year that Trump would be positive for the sector, Pfizer CEO Albert Bourla told reporters last week: “Yes,” although “I got really scared” along the way.

Still, investors are trying to understand how drug pricing agreements will affect companies and analyze the implications of policy changes such as softer vaccine recommendations in the United States.

Here's what we're hearing from pharmaceutical executives about the year ahead.

Drug prices

Some executives said recent drug pricing agreements, part of Trump's “most favored nation” policy, reduce uncertainty and will likely have a modest impact on their businesses.

The deals involve lowering prices on certain products for Medicaid patients by tying them to lower prices overseas and agreeing to sell some drugs at a discount on direct-to-consumer platforms, including the administration's upcoming TrumpRx site.

“I don't want to give the impression that there is no impact [the most-favored-nation deal,] because there is,” sanafi CEO Paul Hudson told reporters at a media event Wednesday morning. “The question for us is: Can we manage that and deliver an attractive long-term plan? We think, so far, we can do that.”

Sanofi and several other companies with pricing deals could outline how they expect the deals to affect their businesses when they release their 2026 outlook in the coming weeks.

Sanofi CEO Paul Hudson speaks during an event held by US President Donald Trump to make an announcement on lowering drug costs, in the Roosevelt Room of the White House in Washington, DC, US, on December 19, 2025.

Evelyn Hockstein | Reuters

AstraZeneca expects the initial effects of its drug pricing agreement to be limited and manageable, as it so far applies to a specific Medicaid population and represents “a low-single-digit percentage” of the company's global sales, Chief Financial Officer Aradhana Sarin said during a Jan. 13 presentation.

Meanwhile, Bourla told reporters on Jan. 12 that the agreements will help companies pressure European countries to increase what they will pay for drugs, similar to how the United Kingdom agreed in December to raise drug prices as part of a trade deal with the United States.

He said companies could stop supplying drugs to some countries that refuse to pay more.

“Do you reduce [U.S.] prices at the level of France or stop supplying France? “Stop supplying France,” Bourla said. “Then they will run out of new drugs… because the system will force us to not be able to accept the lower prices.”

Patent losses, settlements

Pharmaceutical companies were confident that they could offset losses from the upcoming patent expiration of popular drugs and focused on trading as a key tool to generate new revenue. Cheaper generic versions of brand-name drugs typically enter the market after their patents expire, leading to significant price drops and a loss of market share over time due to increased competition.

During a presentation on January 12, merck CEO Rob Davis said his company hopes to “grow through” the upcoming loss of exclusivity of its top-selling Keytruda cancer immunotherapy.

Merck raised its outlook for new products, saying those items It will contribute projected sales of $70 billion by the mid-2030s. That's nearly double what Wall Street expects Keytruda to post in 2028 before its patent expires. Keytruda generated $29.48 billion in sales in 2024, which accounted for nearly half of Merck's total revenue for that year.

Davis indicated that Merck may not be done with negotiation, especially for later-stage or already approved products.

“If we look at it from a dollar perspective, we've been looking at a range of up to $15 billion,” he said. “We have been very clear that we are willing to go further, but we will only do so following exactly the same logic and discipline.”

Bristol-Myers Squibb has the greatest exposure to the next cycle of loss of exclusivity, with blockbuster drugs such as blood thinner Eliquis facing competition from generics, according to a note from JPMorgan analysts in late December. Eliquis raked in $13.3 billion in sales in 2024, accounting for more than a quarter of the company's revenue for the year.

But in an interview on Jan. 13, Bristol Myers Squibb CEO Chris Boerner said the company has the potential to offer up to 10 new products by the end of the decade.

“We feel very good about the substrate we have in the late stage of development, and the mid-stage of the project is also progressing very well,” he told CNBC.

Boerner highlighted 11 late-stage data readouts in 2026 on six potential new products. Boerner said the company is “casting a wide net” to develop its business.

He added that Bristol Myers Squibb hopes to leverage the core therapeutic areas it knows well, examine different phases of development and focus on “the best, most innovative science we can find” to address difficult-to-treat diseases.

This year, Nordisk It also faces expiring patents on semaglutide (the active ingredient in its blockbuster diabetes drug Ozempic and its obesity counterpart Wegovy) in certain countries, including Canada and China.

Novo Nordisk CEO Mike Doustdar said 2026 “will be the year of price pressure” due to generic competition in some international markets and its drug pricing agreement in the United States. He added that Novo Nordisk intends to offset price cuts with volume growth and will be actively involved in business development to see what “can complement our own portfolio.”

Those comments come after Novo Nordisk lost a heated bidding war with Pfizer last year for anti-obesity biotech Metsera.

Vaccine rhetoric

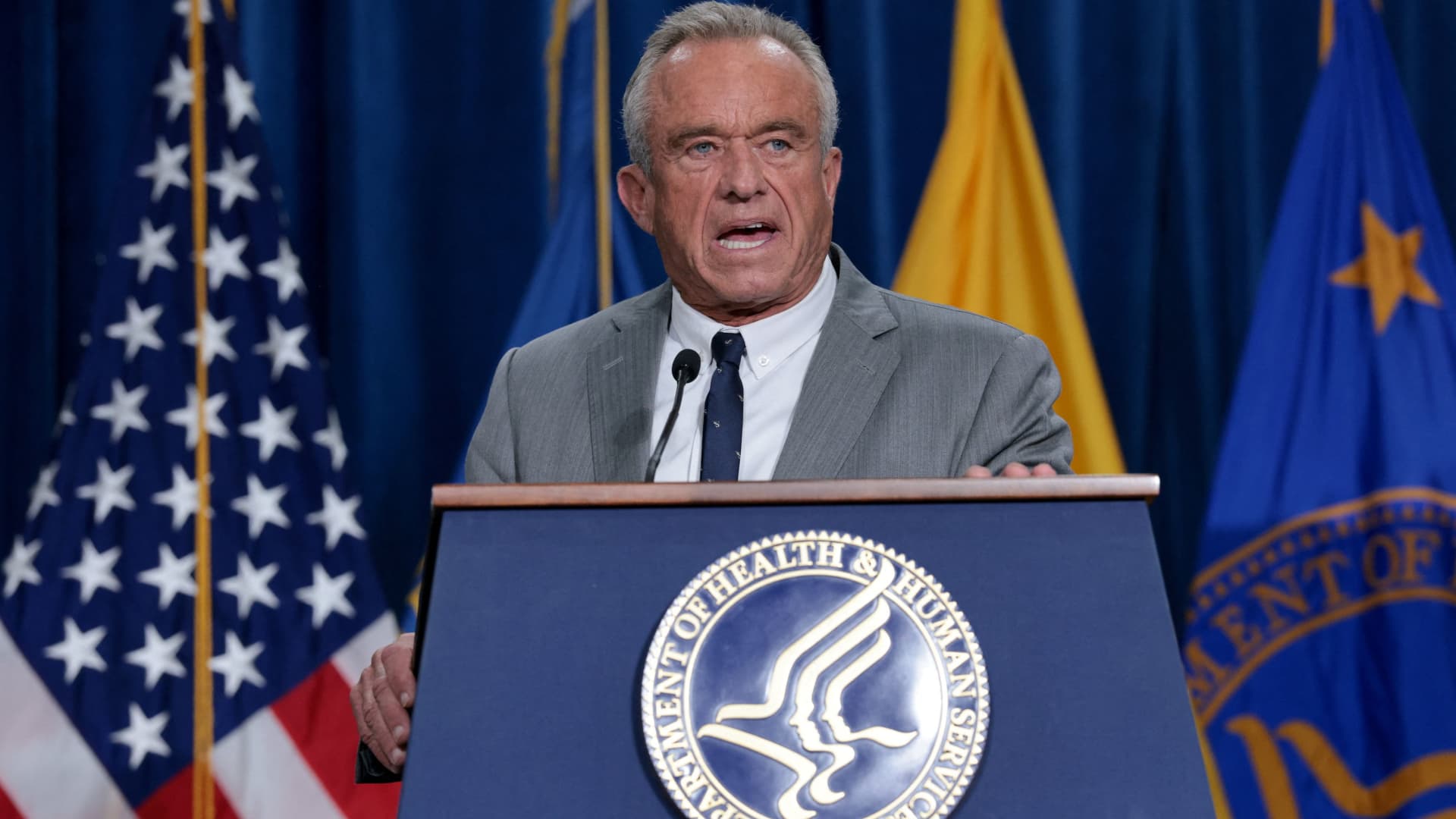

U.S. Secretary of Health and Human Services (HHS) Robert F. Kennedy Jr. speaks and announces new nutrition policies during a press conference at the Department of Health and Human Services in Washington, DC, U.S., on January 8, 2026.

Jonathan Ernst | Reuters

Some executives reiterated their concerns about the administration's changes to U.S. immunization policy under Health and Human Services Secretary Robert F. Kennedy Jr. — a prominent vaccine skeptic — and his appointees. That includes the Centers for Disease Control and Prevention's recent move to reduce the number of vaccines routinely recommended for children.

“I'm very upset. I'm very disappointed,” Pfizer's Bourla said, adding that “what's happening has no scientific merit and only serves an agenda, which is political.”

He added: “I think we do see that there are reductions in vaccination rates for children and that will increase disease, and I'm sure of that.” But Bourla said he doesn't think recent changes to the childhood vaccine schedule will affect Pfizer's results.

He said the pressure the administration is putting on immunizations “is an anomaly that will correct itself.”

Meanwhile, Sanofi's Hudson said the Trump administration's scrutiny of vaccines is aligned with what the company expected ahead of the 2024 election.

“I've had conversations with Kennedy, we just try to stick to the facts of the evidence,” Hudson said. “There's not much we can do.”

“I just hope that in the end the tests are enough for all these things,” he added.