Do you think a friend or colleague should receive this newsletter? Share this link with them to register.

Wegovy injectable weight loss drug at New City Halstead Pharmacy in Chicago on April 24, 2024.

Scott Olson | fake images

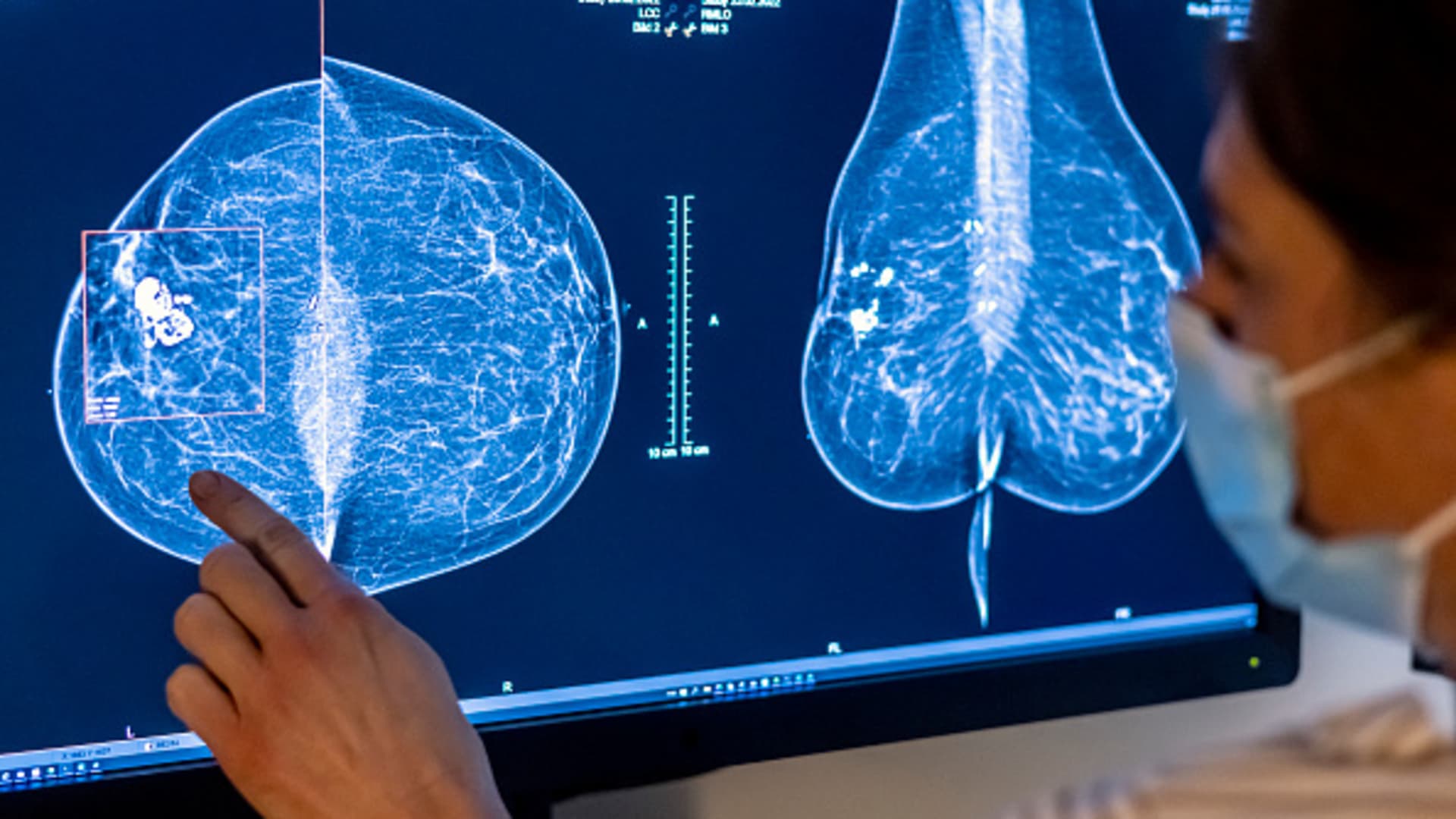

Good day! A survey found that more and more American employers are covering a class of fad drugs called GLP-1 for weight loss.

About a third of employer health plans in the U.S. said they cover GLP-1 drugs like Nordisk's Ozempic and Wegovy for both diabetes and weight loss, up from 26% last year.

GLP-1 weight loss drugs also grew as a share of overall employer annual medical claims spending, accounting for nearly 9% in 2024, compared to about 7% the previous year.

This is according to the survey published Thursday by a nonprofit organization, the International Foundation for Employee Benefit Plans, which includes more than 33,000 member companies or public institutions. The survey was conducted in May across nearly 300 U.S. employer health plans.

The increased coverage is a victory for patients, who often struggle to afford the high $1,000 monthly prices of these drugs without insurance or other reimbursements. It is also good news for the manufacturers of these treatments, Novo Nordisk and Eli Lillywho are working to increase insurance coverage for medications and overall patient access.

Notably, most employee health plans and other insurers do not cover weight-loss medications, including LPGs like Novo Nordisk's Wegovy and Eli Lilly's Zepbound. The federal Medicare program also does not pay for weight loss treatments unless they are approved and prescribed for another health condition.

GLP-1s for diabetes, such as Eli Lilly's Ozempic and Mounjaro, are typically covered by plans.

Both weight loss and diabetes medications have skyrocketed in popularity in the U.S., while attracting growing investor interest, for helping people achieve dramatic weight loss over time. . They work by mimicking one or more hormones produced in the intestine to suppress a person's appetite and regulate blood sugar.

About 57% of employer health plans said they only cover medications to control diabetes, up from 49% in 2023, according to the survey.

But a substantial proportion (about 19%) said they are considering covering them to lose weight.

“Data from this new survey shows that over the past six months, GLP-1 coverage has increased for both weight loss and diabetes,” Julie Stich, vice president of content at the International Health Foundation, said in a statement. Employee Benefit Plans.

Stich said new regulatory approvals and clinical trials, along with growing demand for GLP-1 drugs in the U.S., have contributed to broader coverage.

For example, Novo Nordisk's Wegovy is now approved in the US to dramatically reduce the risk of serious heart complications.

Insurance industry experts previously told CNBC that approval will not automatically translate into widespread insurance coverage of the weight-loss drug. At a minimum, some plans will take note of the new use of Wegovy and begin evaluating whether they will cover the treatment the next time they update their formularies, those experts said.

Novo Nordisk and Eli Lilly are also conducting a series of studies on their GLP-1 drugs in different patients. That includes those with chronic kidney disease, sleep apnea, and certain fatty liver disease.

But there's no doubt that medications can put a strain on any health plan's budget.

According to the survey, about 85% of employers that cover GLP-1 rely “heavily” on certain requirements aimed at controlling costs.

That includes certain eligibility rules, such as requiring employees to have a certain BMI, or body mass index, to receive coverage. It also includes “step therapy,” which requires members to try other medications or lower-cost means of losing weight before using a GLP-1.

Meanwhile, other insurance plans are dropping coverage of weight-loss drugs. Blue Cross Blue Shield of Michigan, the state's largest insurance company, said it will begin eliminating coverage for different weight-loss drugs next year.

There's also a bigger problem, even as insurance coverage improves among employers: Novo Nordisk and Eli Lilly have been struggling to get enough supply of their treatments to meet demand. That's another part of the GLP-1 story that we will continue to monitor.

Feel free to send any tips, suggestions, story ideas, and facts to Annika at [email protected].

The latest in health technology

About 25% of Healthcare Venture Capitalists' Money Goes to Companies Using AI, Report Says

Hands, tablet and doctor with body hologram, overlay and DNA research for medical innovation in the app. Doctor, nurse and mobile touch screen for writing in anatomy study or 3d holographic ux in clinic

Jacob Wackerhausen | Stock | fake images

Healthcare companies that are exploring new uses for artificial intelligence are gaining traction among venture capital investors.

One in every four dollars of healthcare investment goes to companies using AI, and business activity in AI for healthcare has grown twice as fast as AI transactions in the tech industry as a whole, according to a recent report from Silicon Valley. Bank, which is now a division of First Citizens Bank.

The report says venture capitalists invested $7.2 billion in healthcare AI last year, and the figure is on track to reach $11.1 billion this year.

Administrative applications of AI in healthcare are attracting around 60% of funding, according to the report. Administrative tasks, such as paperwork, are a major burden on the healthcare sector and are contributing to physician burnout and staff shortages.

More than 90% of doctors report feeling burned out on a regular basis, and 64% of these doctors said overwhelming administrative workloads are a major reason for this, according to a February survey from Athenahealth. Doctors spend an average of 15 hours per week outside of their normal schedule on administrative tasks, according to the survey.

In other words, administrative work is a big problem for the healthcare sector. Venture capitalists are especially interested in it as it typically faces less regulatory oversight than clinical decision support tools or patient-facing solutions, according to the SVB report.

Although AI companies in the healthcare sector are expected to raise more funding this year than last year, SVB said access to quality data and enough computing power to train models could be barriers to adoption.

This is particularly true for AI-based patient diagnostic tools, which account for 52% of total investment in clinical solutions, according to the report. As of now, there is a “significant gap” in access to the computing power and data needed to train a model that can accurately diagnose a patient.

“Companies that can access data, partner with doctors and hospitals to leverage patient data, and partner with large technology companies are better prepared to deploy AI at scale,” the report says.

Please feel free to send any tips, suggestions, story ideas, or information to Ashley at [email protected].