Shares of the American medical supply giant Medline jumped in its debut on the Nasdaq on Wednesday after the largest initial public offering of the year globally.

The stock opened at $35, compared to its IPO price of $29. Shares closed up more than 41% at $41 per share, bringing Medline's market capitalization to approximately $54 billion.

The private equity firm sold just over 216 million shares on Tuesday, raising $6.26 billion in an expanded offering that capped a strong year for new listings and reinforced optimism about the IPO market in 2026. Medline shares will trade under the symbol MDLN.

That IPO price gives Medline a market value of at least $37 billion, according to shares listed in its regulatory filings.

“Historically, we've done very little advertising, very little marketing, and this gives us a way to amplify our voice and really expand the receptivity of who we are,” Medline CEO Jim Boyle told CNBC's “Squawk Box” on Wednesday. “We're the biggest company you've ever heard of and we're everywhere. And that's a really cool thing.”

The US IPO market has remained stable despite market volatility in the spring, driven by President Donald Trump's sweeping tariffs and the longest US government shutdown in history in the fall. Just over 200 IPOs have been listed this year, including Medline, which is the largest US listing since rivian$13.7 billion deal in November 2021, according to data compiled by CNBC.

But Medline's IPO is also among the largest private equity-backed listings. Three private equity firms (Blackstone, Carlyle, and Hellman & Friedman) acquired a majority stake in the company in 2021 for a whopping $34 billion. At the time, the deal was the largest leveraged buyout since the financial crisis.

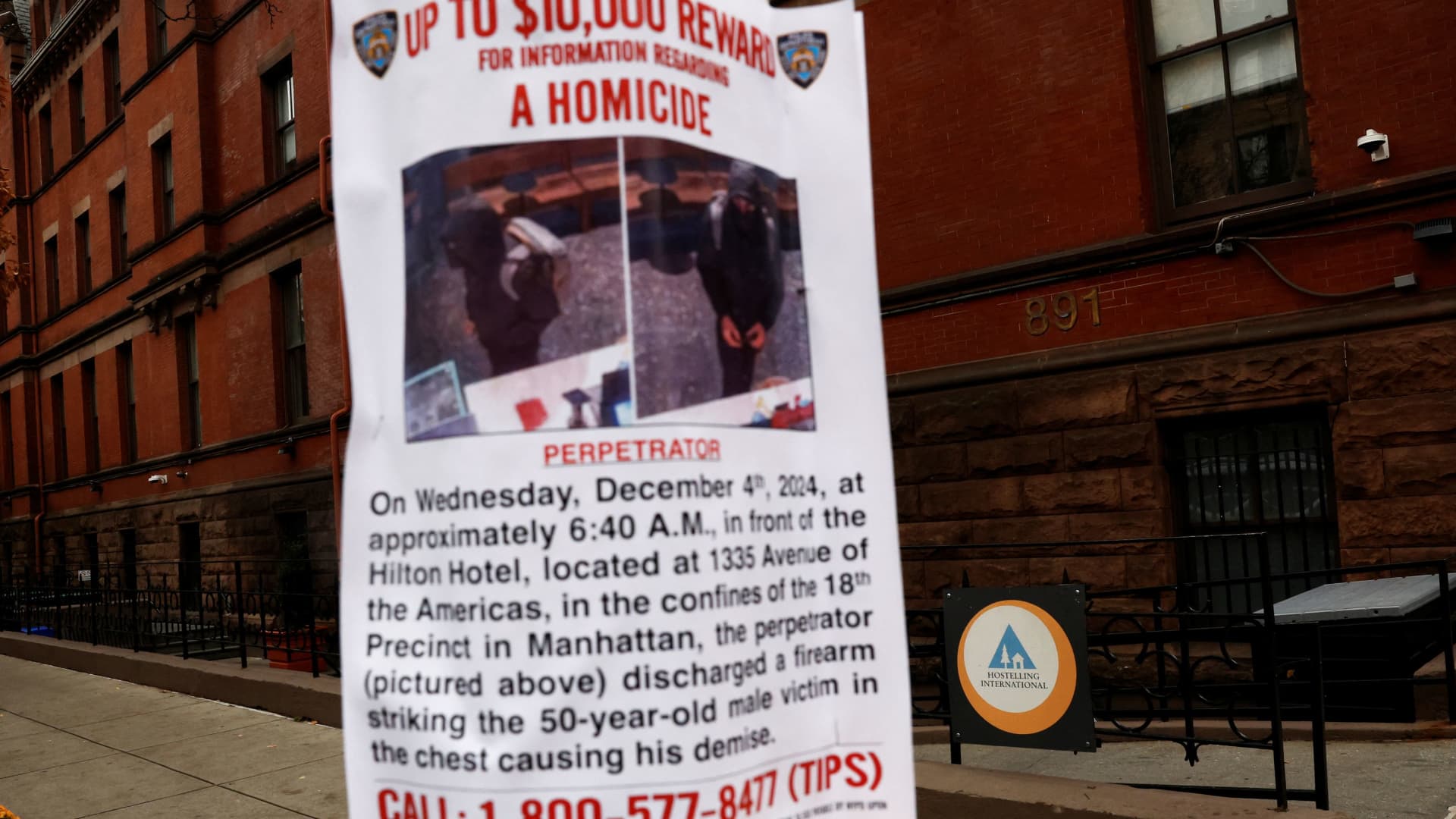

CEO Jim Boyle celebrates with others as medical supply giant Medline (MDLN) holds its IPO at the Nasdaq stock market site in Times Square in New York, December 17, 2025.

Shannon Stapleton | Reuters

Founded in 1966, Medline is headquartered in Northfield, Illinois. The company manufactures and distributes approximately 335,000 different medical and surgical supplies, from gloves, masks and scalpels to wheelchairs. Medline has customers in more than 100 countries and, as of the end of 2024, employed more than 43,000 workers worldwide.

Medline's total debt was around $16.8 billion as of the end of September 2025. The company made $25.5 billion in net sales in 2024.

Medline's previous plans to go public this year were postponed due to uncertainty around tariffs affecting products from Asia. Most of the company's products are sourced or manufactured in Asian countries, particularly China.

Medline expects a hit of between $150 million and $200 million from tariffs to pretax income in fiscal 2026.

The company competes with names like McKesson and Cardinal Health.

—CNBC's Gina Francolla contributed to this report.