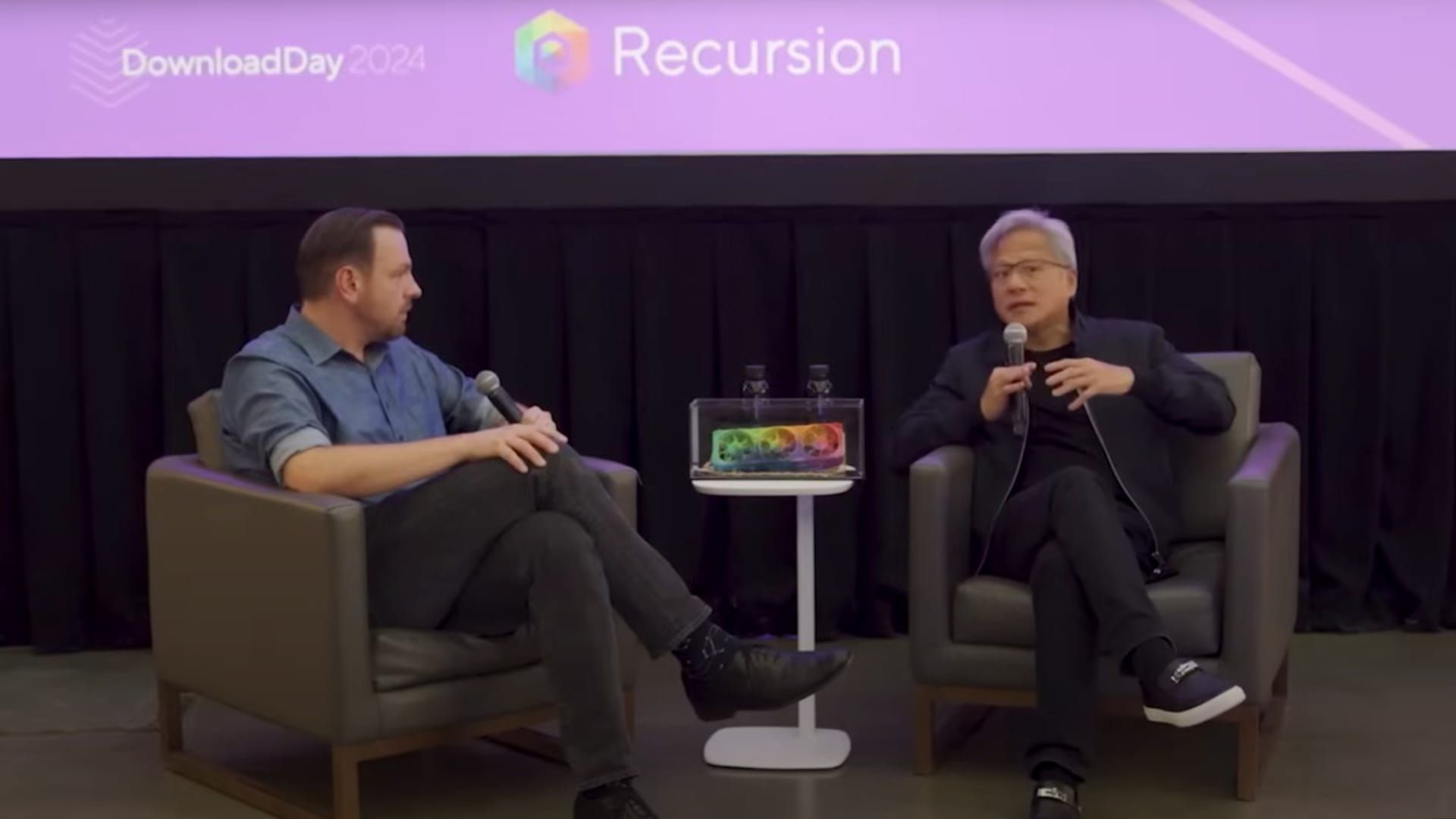

As investors look to the future to imagine which industries are ripe to be reshaped and energized by artificial intelligence, drug discovery is quickly becoming an obvious choice. Every new drug that hits the market is the product of billions of dollars in investment, often taking at least a decade to get there. The path to commercialization tends to be fraught with costly trial and error as drug candidates are vetted and selected. Only then can a compound be put through a rigorous, years-long process of clinical trials, where massive amounts of data are produced, processed and submitted for review — all with no guarantee of success. Now, many in the field are hoping AI can help speed up this timeline by making the pieces of the puzzle more efficient and effective. Analysts who have been following companies at the forefront of using generative AI for drug discovery say it’s still very early days. But investor excitement and interest are increasing as more AI-assisted drugs move down companies’ production lines. Some tech investors looking to find companies that stand to benefit from AI advances are taking a closer look at the health care sector. KeyBanc Capital Markets analyst Scott Schoenhaus said Recursion Pharmceuticals will have clinical readouts in the second half of this year, while AbCellera and Schrodinger have data expected in the first half of next year. Together, these events will help determine the group’s stock valuations, according to Schoenhaus. To date, AI trading has favored the most direct beneficiaries like Nvidia, maker of the processors the systems run on. But for those investors with an appetite for risk and a belief that AI will lead to more successful and profitable drug research and development, here’s a look at several leading companies in the space. Each has its own technologies, and business models vary. Recursion Pharmaceuticals Recursion CEO Chris Gibson made a splash at its analyst meeting on June 24 by appearing onstage with Nvidia CEO Jensen Huang. Not only does the semiconductor company help power Recursion’s computing power, it’s an investor, recently holding a 3.4% stake, according to FactSet. Cathie Wood’s ARK Investment Management is the largest institutional investor with a 10.7% stake. But these backings haven’t pulled Recursion stock out of a slump. The stock is down 26% so far this year. Recursion told analysts it expects to share seven clinical readouts over the next 18 months, including analyses of four Phase 2 data sets. The news briefly cheered investors, but the stock plunged two days later when the company announced a secondary stock sale to raise cash. RXRX 1Y mountain Recursion stock over the past year. In a research note, Leerink Partners analyst Mani Foroohar said that past clinical development delays have raised questions about the company, making it a “show me” story. “We struggle to find meaningful near-term catalysts that can serve to refute these concerns and validate Recursion’s advantage in speed and likelihood of success in drug development,” Foroohar wrote. In other words, the stakes are high for the clinical data Recursion will present because they will help prove that its tools will save companies time and money. Recursion’s first chance to prove itself comes in September, with expected data from a Phase 2 trial for REC-994, a treatment for cerebral cavernous malformation (CCM), a condition that can lead to bleeding in the brain or spinal cord. KeyBanc’s Schoenhaus said there are about 360,000 symptomatic patients with MCC in the U.S. and the European Union, and the treatment has received orphan drug designation in both. Needham analyst Gil Blum said the primary goal of the study is to assess safety, but it’s also an opportunity to measure its clinical benefit. Coupled with the other results that will follow over the next 18 months, Recursion can begin validating its platform. Once its technology is proven, further benefits can emerge from its partners, which now include Bayer. The pharmaceutical company will be a beta user of Recursion’s Large Language Model-Orchestrated Workflow Engine (LOWE) and the pair are also partnering on oncology research. Blum also noted that Recursion has the fastest supercomputer in biopharma, Biohive-2. The data it collects is creating a flywheel that may lead to the creation of other models. “If you think this is an important space and you think AI is going to be important in biology in the next five years, I don’t think you have any other bet that makes sense,” Blum said in an interview. “Not in the public domain; in the private, maybe.” AbCellera AbCellera’s strength is the massive amount of data it has on immune cells and antibodies, which it can scan to identify drug candidates. The database was shown to have helped its partner Eli Lilly find a monoclonal antibody, bamlanivimab, to treat Covid-19. AbCellera has prioritized collaborative relationships, and its partners include Prelude Therapeutics and Incyte, which focus on oncology, and Biogen, which is working on discovering antibodies that can deliver treatments across the blood-brain barrier. ABCL 1Y mountain AbCellera stock over the past year. AbCellera’s internal research is in very early stages. A program in metabolic and endocrine diseases could lead to a first-in-class treatment, according to KeyBanc’s Schoenhaus. He expects an investigational new drug application to be filed early next year. Filings are expected for a treatment for atopic dermatitis, which would have a $17 billion market opportunity by 2032, and for inflammatory bowel disease next year, Schoenhaus said. While the company’s market value has more than halved this year, analysts generally rate it the equivalent of a buy. According to FactSet, the average price target is $14.63. That’s well above where AbCellera closed on Wednesday, just a few cents above a 52-week low of $2.69. “With a validated engine, a strong balance sheet, a maturation strategy focused on high-value strategic partnerships, and most importantly in our view, a greater willingness to take internal assets to higher-value inflection points before partnering, we like the long-term setup of this name, particularly as we gain more visibility into internal and partner programs,” Piper Sandler analyst Allison Bratzel wrote in a research note in late May. Relay Therapeutics Relay Therapeutics has focused on how proteins interact with other compounds, applying this strategy to targeted oncology and genetic diseases. The company has said its Dynamo platform has been able to reduce the time it takes to find drug candidates. For example, it said it took 18 months to target RLY-4008 for the treatment of bile duct cancer compared with an average industry timeline of three to five years. “I would almost say Relay has shown us proof of concept at this point,” Goldman Sachs analyst Salveen Richter said in an interview. “They’ve really been able to take motion-based drug design and apply it to enhance existing targets or to go after targets.” Still, the work being done on its lead drug candidate, RLY-2608, is being closely watched as it will provide a commercial opportunity for Relay. An update on a phase 1b trial for RLY-2608, which treats a form of breast cancer, is expected in the fourth quarter of this year. Relay has also indicated that RLY-2608 could have benefits outside of this type of breast cancer as well. In May, Barclays analyst Peter Lawson upgraded Relay shares to overweight, saying he believed the update on the RLY-2608 trial would show superior efficacy and safety. Lawson put a 70% chance of positive data coming out of the trial, expecting this to push the stock higher. But for now, the stock is down 43% so far this year, with some recent insider selling weighing on sentiment. RLAY 1Y Relay Therapeutics stock has risen over the past year. Wall Street, however, is united in its view of Relay, with all analysts covering it rating the stock a buy. Schrodinger Schrodinger’s computational platform takes a physics-focused approach to help find better drug targets. The company licenses this software to other biopharmaceutical companies. More recently, it has begun working on developing its own pipeline of products and has collaborations with other companies, including Japan’s Takeda Pharmaceutical. Late this year or early next year, Schrodinger should be able to share Phase 1 data on SGR-1505, an experimental MALT1 inhibitor to treat non-Hodgkin B-cell lymphoma. Data on its other drug candidate, SGR-2921, will follow. A Phase 1 dose-escalation trial for a third drug, SGR-3515, should begin in the current quarter. Like the other companies in the sector, the stock has suffered this year, falling 42%. Schrödinger's SDGR 1Y stock has soared over the past year. Last Tuesday, Leerink's Foroohar initiated coverage of the stock with an Outperform rating and a $29 price target, implying a 44% upside from Wednesday's close. “Despite short-term volatility in software revenue, [quarter to quarter] “With large customers transitioning from on-premise licensing to hosted licensing (partly an accounting/time impact), SDGR’s physics-based modeling software remains the most proven in its niche,” Foroohar wrote. He expects Schrödinger to benefit from an improved biotech funding environment that will likely occur next year. If that materializes — and new customer growth returns to a 12-percent pace — Foroohar expects a roughly $9 increase to his price target. The stock could also outperform his target if the company’s collaborations or internal research yield positive results, he said. Some detractors have been concerned that Schrödinger will be hurt as the technology-enabled drug discovery industry becomes more crowded and big pharma companies like Amgen pursue their own internal efforts, but Foroohar said that’s “unlikely.”