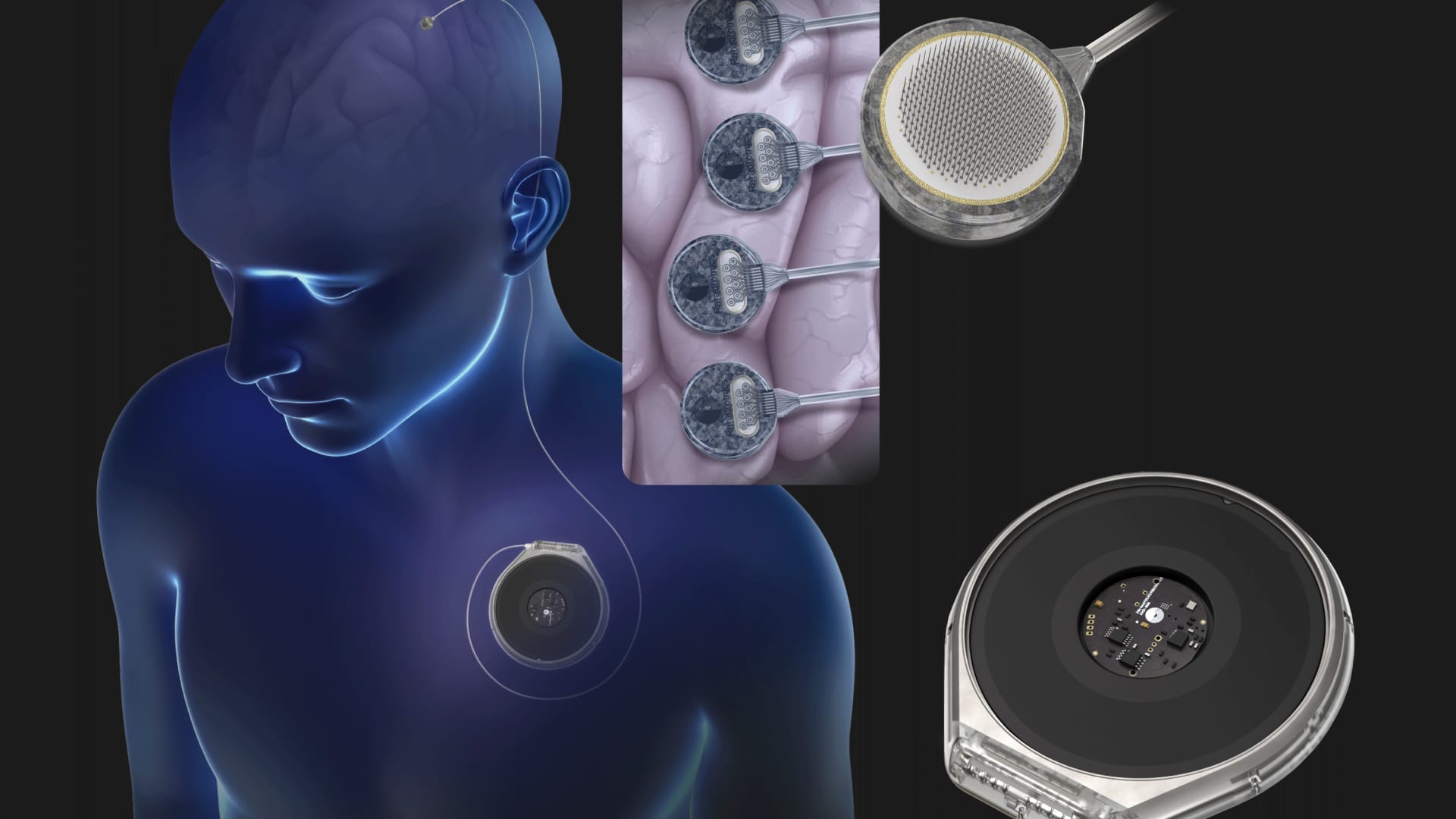

GE Healthcare reported a mixed second quarter on Wednesday morning, and shares initially dipped sharply. Shares then reversed higher as the post-earnings call began. Management made clear that it believes the weakness in China is temporary and sees plenty of other levers available to grow earnings. Revenue advanced less than 1% year over year to $4.84 billion, missing expectations of $4.87 billion, according to analyst estimates compiled by LSEG. Organic revenue growth was 1%. Adjusted earnings rose 8.7% to $1.00 per share, beating estimates by 2 cents. GE Healthcare Why we own it: GE Healthcare is the global leader in medical imaging, diagnostics and digital solutions in healthcare. Its separation from General Electric in 2023 allowed the now-independent company to invest more aggressively in R&D, leading to new product innovations, especially in artificial intelligence. The combination of new and higher-priced products along with the optimization of its business after the split creates an underappreciated margin expansion story. The launch of new therapies for Alzheimer’s disease is another long-term tailwind. Competitors: Philips and Siemens Most recent purchase: November 1, 2023 Initiated: May 17, 2023 Bottom Line It wasn’t the best performance from GE Healthcare, which has the Club name. China was a key source of weakness in the quarter and the main factor that forced management to revise down its full-year organic growth outlook. Sorry to say, we weren’t surprised. We trimmed our position in GEHC on Tuesday after rival Philips reported results and pointed to weakness in China. Economic stimulus from the Chinese government is expected to help boost business. But companies have been slow to get information on the package and have delayed orders. It’s still early, but the team is hopeful about the growth potential of an amyloid agent used in imaging Alzheimer’s patients now that the approval of Eli Lilly’s Kisunla treatment under the name Club has joined Eisai’s Leqembi and Biogen in the battle against the mind-robbing disease. In the meantime, GE Healthcare management continues to execute at a high level on what it can control and is finding more ways to improve efficiency and, in turn, profitability. That’s why GEHC was able to turn around from being down about 9% at the press time to positive when the conference call ended. Shares were up nearly 4% in afternoon trading. We reiterate our “expect a pullback” 2 rating and our $92 per share price target. GEHC YTD Mountain GE Healthcare YTD Quarterly Commentary Organic order growth rose 3%. Investors tend to focus on orders because they are indicative of customer demand. On the call, management said China was a 3 percentage point headwind to growth, meaning global revenue excluding the world’s second-largest economy was up 4% and orders were up 6%. Despite weakness in China, we delivered healthy earnings before interest and taxes (EBIT) margin expansion at a level above what Wall Street was looking for. That helped GEHC deliver a better-than-expected profit despite the revenue miss. On the call, the team noted that the expansion was driven by gross margin improvement thanks to better productivity and pricing dynamics. We believe the company’s ability to expand margins is one of the underappreciated aspects of GEHC’s investment thesis on Wall Street. Another measure of future demand is the order backlog, which exited the second quarter at $19 billion, down from $18.7 billion at the end of the first quarter. The company’s orders received to invoices ratio, which is a measure of orders received relative to sales, was 1.06, up from 1.03 in the first quarter and 1.04 in the second quarter of 2023. Anything above a ratio of 1 is a positive sign of future growth. It means more orders are coming in than revenue is being recorded. In GE Healthcare’s imaging segment, which houses products such as MRI and CT machines, revenue was down nearly 1% compared with the same period a year ago. (It was flat organically.) The imaging EBIT margin improved 40 basis points to 11%, through productivity and pricing improvements. Sequentially, the margin expanded 130 basis points due to higher volumes. Management said, “New product introductions are contributing to particular strength in product demand in the U.S.” Ultrasound segment revenue fell nearly 2%. It was down 1% organically. Ultrasound EBIT margin contracted 120 basis points to 21.6%, with management pointing to China as the main source of weakness. Patient Care Solutions (PCS) sales increased fractionally. (They grew 1% organically.) The segment covers a range of medical devices such as electrocardiogram machines and consumables used to take blood pressure readings, among others. EBIT margin for PCS contracted 90 basis points to 10.1%. The company blamed product mix. But productivity actions offset inflation. Pharmaceutical Diagnostics (PDx), used in radiology and nuclear medicine to deliver more accurate diagnoses, was particularly strong. Revenue from the segment grew 12.5%. (It grew 14% organically.) PDx EBIT margin improved 450 basis points to 31.2% thanks to improved sales volume, productivity and pricing. On the call, CFO Jay Saccaro said, “We are encouraged by positive developments in the molecular imaging market. We saw continued acceleration of Vizamyl doses delivered in the U.S. in the second quarter. These sales tripled.” Vizamyl is an amyloid imaging agent indicated for PET imaging of the brain that estimates plaque density in adult Alzheimer’s patients. Arduini added, “Vizamyl doses continued to grow in the second quarter in the U.S. With the recent FDA approval of donanemab, we anticipate even greater adoption of our amyloid diagnostic PET agent. This remains a small contributor to sales growth but gives us optimism about its sales potential in the years ahead.” Guidance GEHC updated its outlook for the remainder of the year, now forecasting organic revenue growth of 1% to 2%, down from the “approximately 4%” forecast provided previously, and below the 3.4% Wall Street was looking for. On the call, management blamed prolonged weakness in China, with CEO Peter Arduini saying the company “previously communicated that the region would experience negative sales growth in the first half as we faced a challenging comparison.” He continued: “At the time, we expected positive sales growth in the second half. Today, the extended timing of the implementation of the new [Chinese] The stimulus announced earlier this year is impacting the momentum of orders and sales. We expect sales in China to continue to decline compared to the previous year in the second half and anticipate that growth in China will be negative for the year. As a result, we are lowering our full-year organic total revenue growth forecast for the company.” The adjusted EBIT margin outlook was raised slightly to a range of 15.7% to 16% and above the 15.6% that Wall Street was looking for, even on the low end. The team cited further progress on “productivity and optimization initiatives.” Management reaffirmed its outlook for the company’s adjusted effective tax rate of 23% to 25%, earnings per share of $4.20 to $4.35 and free cash flow of approximately $1.8 billion. For the third quarter, the team expects organic revenue growth of about 1% and adjusted EBIT margin expansion “relatively similar” to the 57 basis point growth in the second quarter. Wall Street has been modeling about 50 basis points of expansion. The team added that they would “expect year-over-year organic revenue growth and adjusted EBIT margin in the fourth quarter to be the highest of the year.” (Jim Cramer's Charitable Trust is long GEHC, LLY. See here for a complete list of stocks.) As a subscriber to CNBC's Investment Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTMENT CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, ALONG WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, NOR IS CREATED, BY VIRTUE OF YOUR RECEPTION OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTMENT CLUB. NO SPECIFIC RESULTS OR PROFITS ARE GUARANTEED.

Pavlo Gonchar | Lightrocket | Getty Images

GE Healthcare On Wednesday morning, the company reported a mixed second quarter, and the stock initially fell sharply. The stock then reversed its upward trend as the post-earnings conference call began.