Eli Lilly investors have received some very good news in recent months, with one notable exception regarding the stock's performance. Eli Lilly shares entered Wednesday's session down nearly 9% from the close on Oct. 30, the day the drugmaker's messy third-quarter earnings report sent the stock down 6%. . Zoom out even further to include that impact on earnings, and over the past six months, the only name in the Club to do worse than Eli Lilly is Constellation Brands, falling nearly 15% and 16%, respectively. Stocks, even those that have outperformed the S&P 500 in each of the last five years, as Eli Lilly has, go through tough times from time to time. What makes Lilly's meager performance of late stand out is that during this period, the company's position in the fierce and lucrative anti-obesity drug race has become more formidable. In late November, challenger Amgen reported disappointing results in the mid-stage trial of its experimental obesity treatment known as MariTide. Then on Dec. 20, Wegovy maker Novo Nordisk, Lilly's main rival in weight-loss drugs, saw its stock crushed due to weaker-than-expected data for its next-generation obesity treatment called CagriSema. Sandwiched between those peer updates were results from Eli Lilly's own trial on Dec. 4, which showed its obesity drug Zepbound beat Wegovy in the first head-to-head study comparing the two. LLY 1Y mountain Eli Lilly shares over the last 12 months. The threat of competition in the fast-growing obesity market, which some on Wall Street expect to be worth $100 billion annually by the end of the decade, has loomed over Lilly even during its recent run of success. . While the stock has gained about 3% since the session before Amgen's launch, why haven't these positive developments translated into more upside? The answer, analysts say, is concern about what might lie in Eli Lilly's upcoming fourth-quarter earnings report, due out in early February. “In our view, recent moves in LLY stock and conversations with investors suggest there are questions about Q4 results and 2025 guidance,” Morgan Stanley analysts wrote in a note to clients this week. Analysts cited the poor performance of Amgen and Novo Nordisk shares following their respective test updates and contrasted it with the way Eli Lilly has traded. If not for the uncertainty around results and forecasts, Morgan Stanley argued that Lilly shares “would have significantly outperformed.” For their part, JPMorgan analysts described the dynamics of the fourth quarter as “an excess in history” for Lilly. Both research firms lowered their combined U.S. quarterly revenue estimates for Lilly's biggest product, tirzepatide, which is sold under the name Zepbound for obesity and Mounjaro for type 2 diabetes. Morgan Stanley forecast sales of 5,300 million in the United States, up from $6 billion previously, due to recent trends in prescription data. JPMorgan's model projects combined revenue of $5 billion in the United States. “There is already some expectation that Tirzepatide's fourth-quarter sales could be below consensus,” Morgan Stanley wrote. The most important takeaway, however, is that Morgan Stanley and JPMorgan are not wavering in their long-term optimism on Eli Lilly, reiterating their equivalent buy ratings on the stock. And neither do we. We also have a 1-equivalent buy rating on Lilly stock. However, the reality is that until the company reports numbers before the Feb. 6 deadline and provides its official outlook for 2025, the stock could struggle to mount a sustained rally. Investors are likely to overlook a fourth-quarter failure if the outlook for 2025 is encouraging. The supply of Zepbound and Mounjaro appears to be a major factor in determining Eli Lilly's financial success this year. The influential JPMorgan Healthcare Conference, starting next week in San Francisco, offers a chance to improve sentiment before earnings arrive. CEO David Ricks is scheduled to participate in a “fireside chat” at 5:15 p.m. ET on Tuesday. At the conference a year ago, Ricks' comments focused more on the overall opportunity than short-term financial updates, but investors still loved what he had to say as the stock jumped to what was then It was an all-time high in the next session. . The CEO also has a lot of good things to talk about this time around, even if the recent stock chart suggests otherwise. (Jim Cramer's Charitable Trust is long LLY. See here for a full list of stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable fund's portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTMENT CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS OR IS CREATED BY VIRTUE OF THE RECEIPT OF ANY INFORMATION PROVIDED IN RELATION TO THE INVESTMENT CLUB. NO SPECIFIC RESULTS OR BENEFITS ARE GUARANTEED.

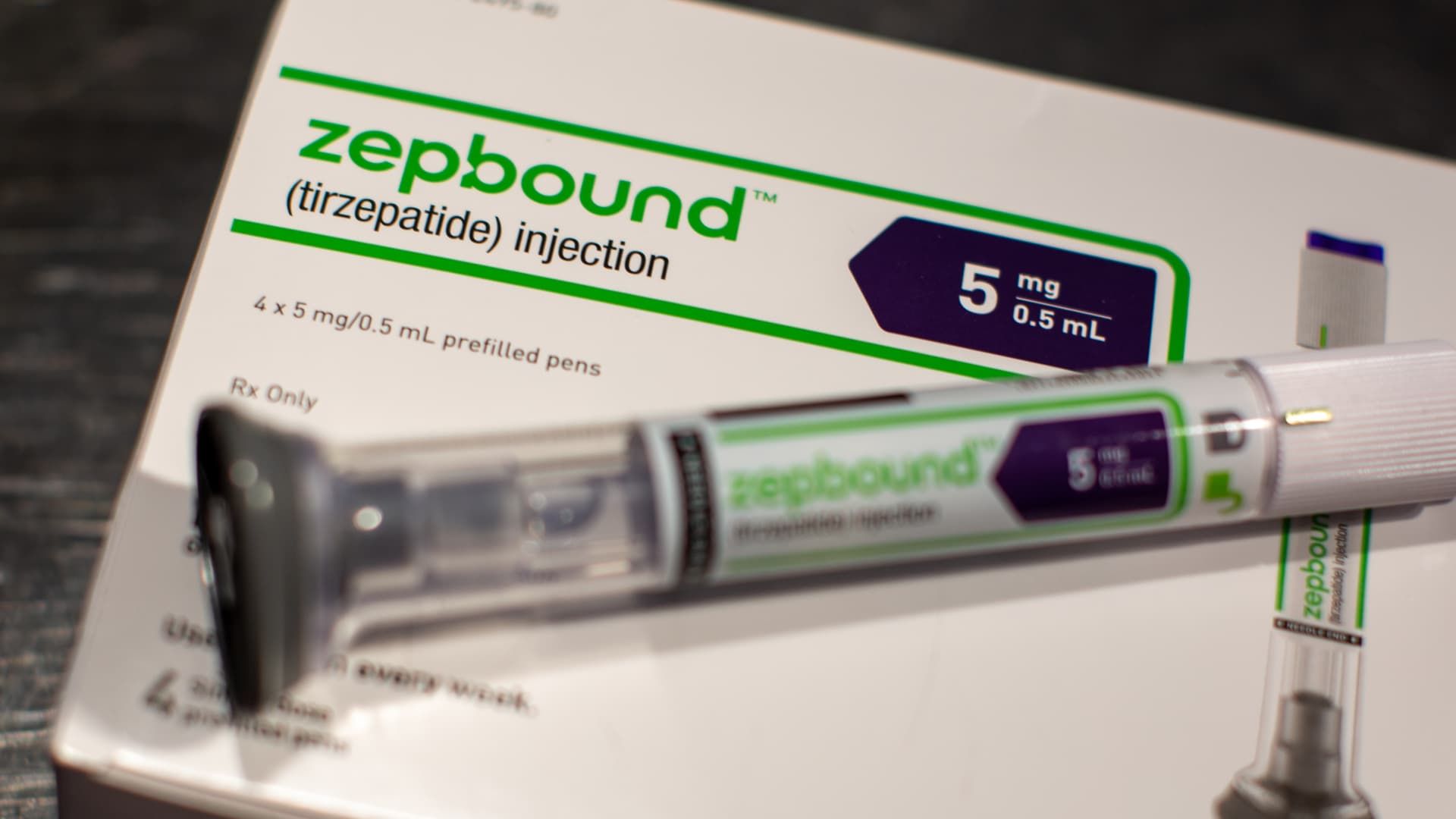

A Zepbound injection pen from Eli Lilly & Co., March 28, 2024.

Bloomberg | Bloomberg | fake images

Eli Lilly Investors have received some very good news in recent months, with the notable exception of stock performance.