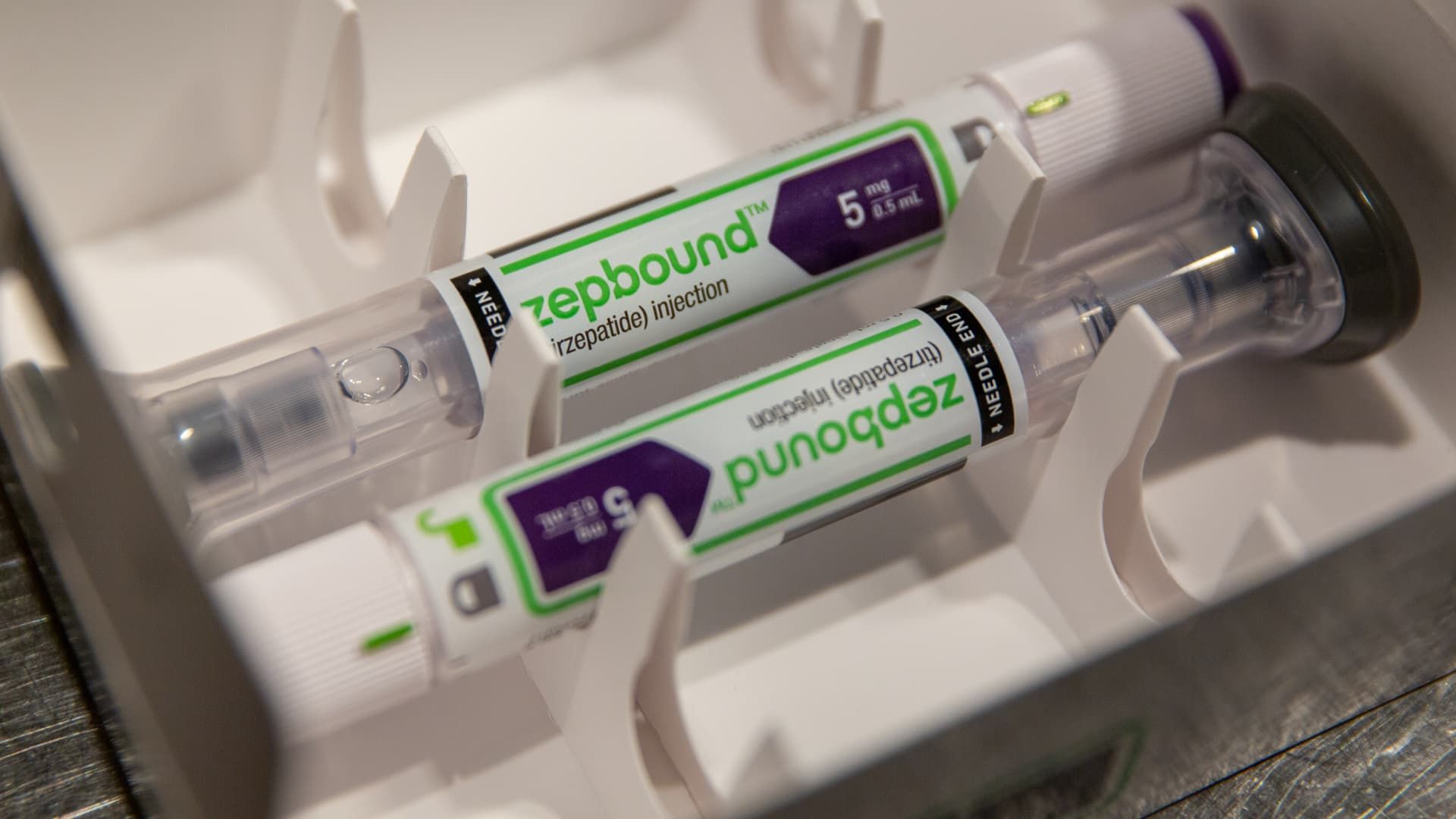

Many on Wall Street expect the loss of Novo Nordisk to have been Eli Lilly's gain, and this will be good news for the second quarter of the Zepbound manufacturer. Novo Nordisk's actions have created about 47% since the beginning of the year, as doubts arose about the perspectives of their GLP-1 drugs, Ozempic for diabetes and the couple of obesity. The company has said that its business has been affected by the competition for composite pharmacies, which are making versions of imitation of its semaglutida, the active ingredient in both brands. This led to Novo to reduce his annual forecast and expel his CEO. Lilly's business seems to be much better, according to analysts. They anticipate that the test will be in the results and quarterly perspectives. In addition, several analysts expect other catalysts, including next -generation medications, to help boost Lilly's actions. 'Potential materiality' so far this year, Lilly's shares have registered a decrease of approximately 3%, with a lower market yield. However, catalysts could come as soon as Thursday, analysts say. “We observe that the next call 2q of Lly is scheduled for 8:30 am et on August 7, unlike the standard time slot of the company for the company calls after the market is opened, which suggests a potential materiality through upper line test results together with the profits,” said Asad Haider of July 28. He said the report is “the most anticipated short -term event” in its pharmaceutical coverage. In addition to the financial perspectives, investors are eager to listen more about Orforgripron, the company's experimental GLP-1 pill. In June, at the Conference of the American Diabetes Association, Lilly revealed that the medicine helped patients with type 2 diabetes in a late stage to lose weight without serious side effects. Reading phase 3 data for patients with obesity should be released soon. Wegovy's “favored state” analysts are also eager to listen to the thoughts of Management on CVS Health policy to grant Wegovy the state favored on Lilly's Zepbound. The policy entered into force in July and means that CVS Health Caremark Pharmacy Benefits Manager will prioritize Wagovy in its list of covered medications. It has the potential to be a wind against Lilly. However, patients can look for exemptions and remain in the medication to lose weight or pay their pocket on their own or through Lilly Direct, the direct website to the company's consumer. In addition, there is the possibility that Lilly reaches an agreement and returns to the list of drugs covered by CVS Caremark, analysts said. According to Bernstein Courtney Breen analyst, the first weeks of the switch showed that patients who change Zepbound to Wogovy were eclipsed by the number of patients who began the medication with a new recipe. On average, analysts surveyed by LSEG expect Lilly to win $ 5.57 per share in the second quarter in revenue of $ 14.71 billion. If Lilly reaches that income estimate, a growth of 30% year after year will have achieved. This is what they are saying before the report. Lly YTD Mountain Eli Lilly Actions Year to date. Citigroup: Buy rating, $ 1,190 Target Citi Analyst Citi Geoff Meacham said Lilly is still one of her favorite actions, and placed a 90 -day catalyst clock on July 30. Its target price of $ 1,190 implies 55% up to the closing of Tuesday. “IQVIA LPG-1 scripts data give us continuous confidence in the capacity of the Lilly 2025 income guide ($ 58b- $ 61b). In particular, Zepbound scripts remain solid (+45% q/q) and general participation increased to 65.5%, it represents a gain of ~ 600bps in the market market. We believe that this is not what this is not Lillydirect Road now representing ~ 20% TWNWER TWLIPS triple TWLIPS. [total prescriptions] and highlight the increase in the potential for a consumer angle in sales of LPG-1 … conduct absorption in the future (2T25E $ 3.1b; +$ 99m vs. BBG cons). [Type 2 diabetes drug] Mounjaro scripts increased 16.3% Q/Q and now captures 42.2% participation (2q25e $ 4.5b; +$ 18m vs. cons); Although a slower growth than Zepbound, this is expected to give the most entrenched nature of the type 2 diabetes market … the first mental for investors will be Phase 3 of orforgripron to reach readings for obesity (Jul/AUG). The weight loss of 12-15% is the effectiveness bar and the continuation of a squeaky cleaning security profile that we saw in Ada … will be essential. “Morgan Stanley: Overweight, $ 1,135 at the beginning of July, Morgan Stanley Analyst Terence Flynn modified its target price, increasing to $ 1,135 from $ 1,133. The objective of 48% upspense of the update of the MAA views of $ 1,133. Mounjaro+Zepbound 2Q Beat will dictate how it handles how it handles the Income Guide 2025 $ 58- $ 61 billion (ms $ 62.3bn against cons Elimination to discuss previously in the course of the disease and expand the opportunity for the category, as well as providing lateral reading to biib/eisai's leqembi (where PH3 is also current Bernstein, $ 1,100 behenstenstenstensteStenstenstensteinsteins Bernstein, $ 1,100. And Jpmorgan has an objective price of $ 1,100 for Lilly shares, suggesting that it could increase almost 44% since the closing of Tuesday. Given the majority of street monitoring scripts in the United States, the advantage here arises from an additional unexpected price (reimbursement adjustments), sub -registration in IQVIA (a possibility) and an ex US performance (due to lower visibility). … Despite the potential of a rhythm of the upper line (we see potential for a modest pace of 1.2% above the consensus to 14.6b), we do not anticipate that Lly will rush to increase the orientation, given the last years, half challenge and uncertainty for the Q3 that remains in CVS Caremark (although the initial signs are strong). ” Continue, competition and expansion of the slowest market. (Based on strong growth trends), and we evaluate total sales in the QTR of $ 14.8bn ($ 370 mmmm. In the EPS line, we are slightly below the consensus ($ 5.49, -$ 0.06), since we hope that a continuous OPEX ramp supports a growing pipe of the late stage and [direct-to consumer] initiatives Looking towards the future, we expect some moderation in zepbundado growth as the CVS form change enters into force on July 1, but we hope that the product still grows TRX in 3Q and accelerates in the 4Q. And for the year, our estimates are close to the upper end of the company 2025 of the company both in Topline ($ 60.8 billion, +$ 1.3 billion vs. cons) and in the lower line ($ 22.09 EPS, +$ 0.07 vs. cons) and would not surprise us time of time of time of time dynamics). “Goldman Sachs: Buy, $ 883 The target price of $ 883 of Haider is approximately 15% above where Lilly's shares closed on Tuesday.” … we expect another rate of income, driven by a [foreign exchange] Tail wind and a strong trx growth for Zepbound/Mounjaro, where our consensus estimates have followed a higher monitoring in printing. … In the 2T profit call, we also notice an important discussion of investors about the magnitude of the potential pressure on the 2015 fiscal year income guide of the company where we hope that management can adjust the range of $ 58- $ 61 billion for the year by increasing the low level (based on 1h trends, the estimates of GS/Consensus are $ 60bn/$ 60bn/$ 60.6bn by 2025). These trends are now well understood with the highest investor approach in trying to triangular the impact on sales of 3T25 for Zepbound/Mounjaro of the CVS form form in favor of Novo that entered into force on July 1 “.