The Eli Lilly and Novo Nordisk logos.

Mike Blake | Little Tom | Reuters

It's the story of two drugmakers in the red-hot obesity drug market.

Both Nordisk and Eli Lilly are grappling with lower prices in the US, but their outlook for 2026 is wildly divergent: While Novo braces for a sales slump, Lilly sees revenue rising again thanks to its blockbuster drugs.

The split in guidance, despite similar headwinds, underscores the strength of Lilly's position in the obesity and diabetes drug market, supported by its most effective injections and its early foray into direct-to-consumer sales, among other factors. While Novo Nordisk did indeed make the drugs mainstream, Lilly has since taken a clear lead in market share, and forecasts show it will likely only widen its lead this year.

“The difference in sales momentum and market share trend was visible throughout 2025, but the dichotomy between the two companies' outlooks was accentuated within this 24-hour period in which Novo underperformed consensus and Lilly underperformed consensus expectations,” Leerink Partners analyst David Risinger told CNBC on Wednesday.

“That really solidified an investor's idea that Lilly will be the dominant player in obesity in the future,” he added.

This year, all eyes will be on how Lilly's upcoming obesity pill, or forglipron, fares against Novo's oral drug Wegovy, which has had an explosive launch in the United States this year.

In an interview on CNBC's “Squawk Box” Wednesday, Lilly CEO David Ricks said between 20 million and 25 million patients are currently taking both companies' drugs. But he said the total addressable patient market in the obesity space is “gigantic.”

Divergent perspectives

On Wednesday, Lilly forecast 2026 sales of between $80 billion and $83 billion, beating the $77.62 billion analysts had expected, according to LSEG.

The midpoint of that outlook translates to 25% sales growth this year.

In contrast, Novo warned Tuesday that it expects sales and profits to fall between 5% and 13% this year, as prices fall in the United States and exclusivity on its blockbuster obesity and diabetes drugs expires in China, Brazil and Canada.

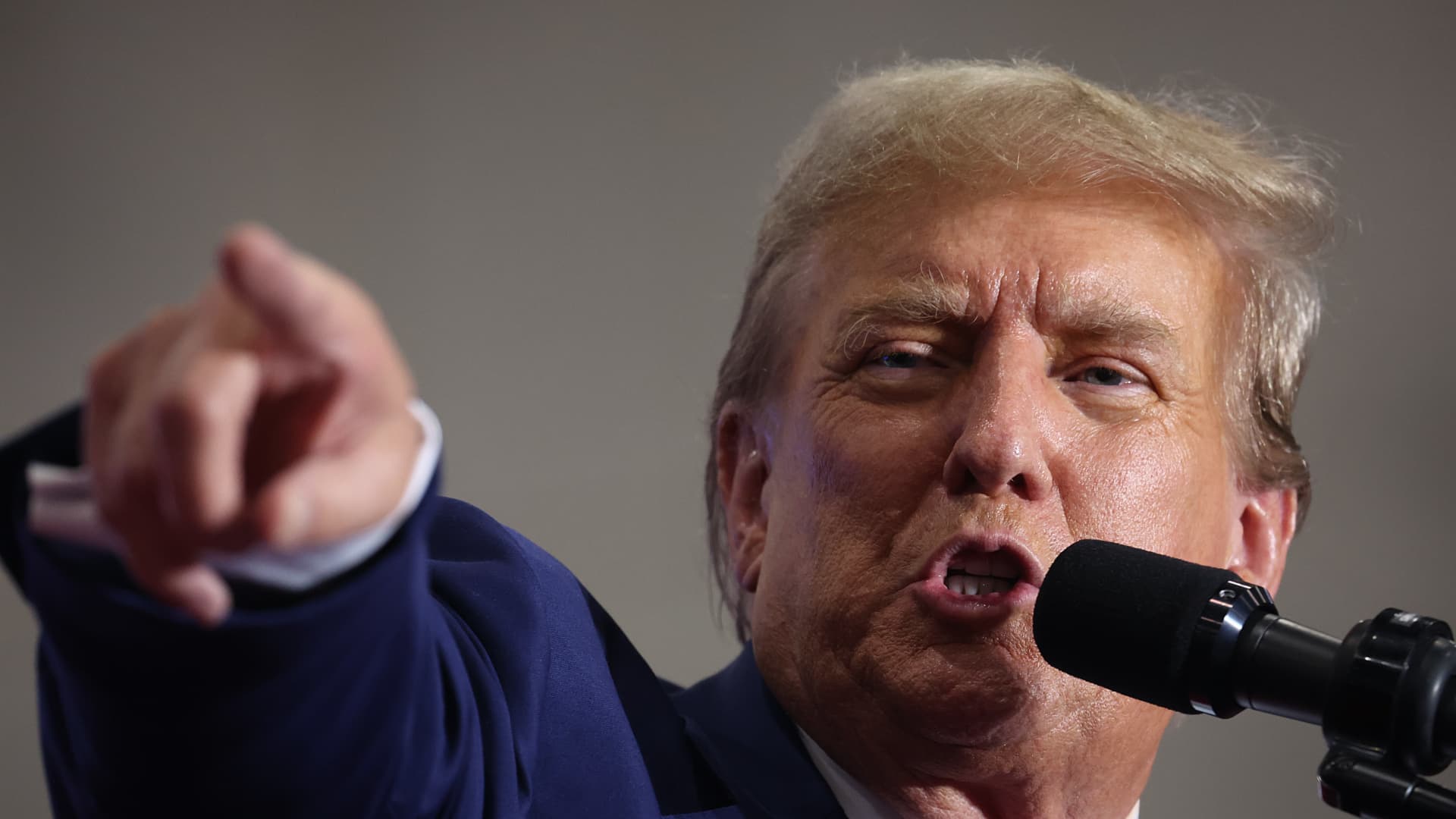

Mike Doustdar, left, CEO of Novo Nordisk, and David Ricks, CEO of Eli Lilly, listen as President Donald Trump speaks in the Oval Office during an event on weight loss drugs on Nov. 6, 2025.

Andrew Caballero-Reynolds | afp | fake images

Lilly also noted a “global price decline in the 15 to 15 years.” [percentages] This year.” This comes after historic “most favored nation” agreements both companies signed with President Donald Trump in November to reduce the costs of obesity and diabetes drugs, along with their recent efforts to further reduce direct-to-consumer prices for their treatments.

The deals with Trump are expected to reduce sales for both companies, but eventually increase prescription volumes for their drugs. Still, Lilly is optimistic about other factors that will help offset that price pressure.

This includes continued global demand for its obesity drug Zepbound and its diabetes counterpart Mounjaro and the expected launch of its obesity pill GLP-1 in the second quarter, pending approval in the United States. Lilly also noted that government Medicare coverage of obesity treatments will begin for the first time at least in July, one of the winning features of the drug pricing deals with Trump.

Lilly's Ricks told CNBC that the coverage will open access to 40 million new Medicare beneficiaries, “and that could be quite expansive in volume.”

Overall, Risinger called Lilly's guidance “very encouraging” and said “the price-to-volume trade-off is working well” for the company.

It said tirzepatide, the active ingredient in Zepbound and Mounjaro, is “superior” in its effectiveness and tolerability compared to semaglutide, the ingredient in De Novo's obesity and diabetes drugs. This was demonstrated in a comparative clinical trial conducted by Lilly in 2024, and prescribing trends show that the company's medications are preferred among prescribers.

“I think that's what's driving Lilly's market share gain” relative to Novo, Risinger said.

Another factor that distinguishes Lilly and Novo is the exclusivity of the patent. While Novo said patent expirations in some international markets pose a challenge, Lilly's Ricks said tirzepatide should be protected until “the second half of the 2030s” in major markets.

Risinger noted that Lilly is still working to boost global acceptance of tirzepatide, which gained U.S. approval for obesity in 2023.

All eyes on the pills

A pharmacist displays a box of Wegovy pills at a pharmacy in Provo, Utah, on January 15, 2026.

George Frey | Bloomberg | fake images

Novo Nordisk is the first to market a GLP-1 pill for obesity and reached 50,000 weekly prescriptions in just under three weeks of its launch. But investors are watching to see how that changes once Lilly's pill reaches patients later this year.

In an interview with CNBC's “Mad Money,” Novo CEO Mike Doustdar said he is confident in the company's ability to compete with Lilly.

“We clearly have the most effective weight loss pill out there and I am very optimistic and optimistic about when they will come with their pill and we will have to fight this,” Doustdar said.

It refers to clinical trial data suggesting that Novo's Wegovy pill promotes comparable weight loss to its injectable counterpart, which is around 15%. Meanwhile, Lilly's pill appears to be a little less effective than that, according to data from separate studies.

Risinger said Novo's pill launch has benefited from the fact that the company is leveraging the Wegovy brand, which is recognizable to many patients, and immediately launched direct-to-consumer advertising for the product in early January.

But he said Lilly could capitalize on the convenience of its pill.

Orforglipron is a small molecule drug that is more easily absorbed by the body and does not require dietary restrictions like the Novo Nordisk pill, which is a peptide medication. Patients are not supposed to drink more than four ounces of water with the Wegovy pill and should wait 30 minutes before eating or drinking anything else each day.

Novo maintains those requirements will not hinder acceptance, but Risinger said they could help Lilly's pill eventually generate greater sales globally.