Eli Lilly On Thursday, its daily obesity pill met the company's objectives in the first of several tests in the late stage, helping patients with type 2 diabetes to reduce their blood sugar and body weight and show safety comparable with popular injections in the market.

The results of the essay are among the most observed studies of the pharmaceutical industry of the year, since they bring the experimental pill of Eli Lilly, called Orforglipron, another step closer to becoming a new alternative and without needles in the rise weight loss and the diabetes market. This more convenient and easier manufacturing pill could give Eli Lilly a great advantage over Novo Nordisk and other rivals trying to enter the lucrative space.

The weight loss data of the pill, together with fees of side effects and treatment discontinuations, were in line with what some Wall Street analysts expected. But Orforglipron did not reach the estimates of some analysts for a key diabetes metric.

Eli Lilly's actions rose 11% in trade prior to commercialization.

The highest dose of the pill helped patients lose 7.9% of their weight, or around 16 pounds, on average after 40 weeks. Eli Lilly also said that patients did not see a plateau in their weight loss when the study ended, which suggests that they could lose further beyond that period.

Previous studies on the pill and existing injections have shown that diabetes patients lose less weight than those without condition, which hinders the comparison of data with those of medications specifically for obesity.

About 8% of patients who took the highest dose of the pill suspended treatment due to side effects. These side effects were mainly gastrointestinal, such as nausea and vomiting, and mild to moderate gravity. It is estimated that 14% of those who took the highest dose experienced vomiting, while 16% and 26% had nausea and diarrhea, respectively.

In a note earlier this month, TD Cowen analysts said they expected a 9%interruption rate. Other analysts said they anticipated that the side effects of the pill would be slightly worse than injections, since it is taken daily instead of weekly.

But the pill lost the estimates of some analysts for a key diabetes metric. It helped reduce A1C hemoglobin, a measure of blood sugar levels, by an average of 1.3% to 1.6% in different doses at 40 weeks, from an initial level of 8%. That compares with a 0.1% reduction in patients who took a placebo during the same period.

Some analysts expected a reduction of up to 1.8% to 2.1%, which is in line with the results in patients with diabetes that took the injection of Novo Nordisk Ozempic diabetes.

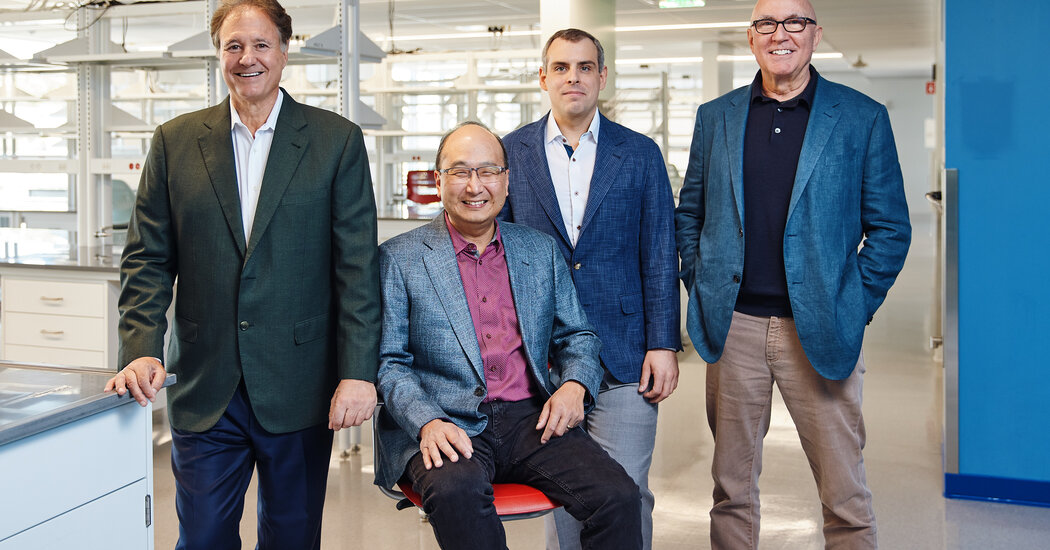

Even so, Eli Lilly is “pleased to see that our last incredine medicine meets our safety and tolerability expectations, glucose control and weight loss, and we expect additional data readings at the end of this year,” said the company's CEO, David Ricks, in a statement. Incretin medications imitate certain intestinal hormones to suppress a person's appetite and regulate blood sugar.

There are seven studies in the late stage on the pill, including five diabetes trials and two obesity studies. The company expects to request the regulatory approval of the pill for obesity by the end of the year and for diabetes in 2026.

If approved, Orforglipron could help more patients access treatment and relieve the supply deficit of popular injections in the market. The pill “could easily manufacture and launch at a scale for use by people around the world,” Ricks said in the statement.

The pill could also help Eli Lilly solidify its domain in the growing segment such as a board of other medication manufacturers to bring similar products to the market.

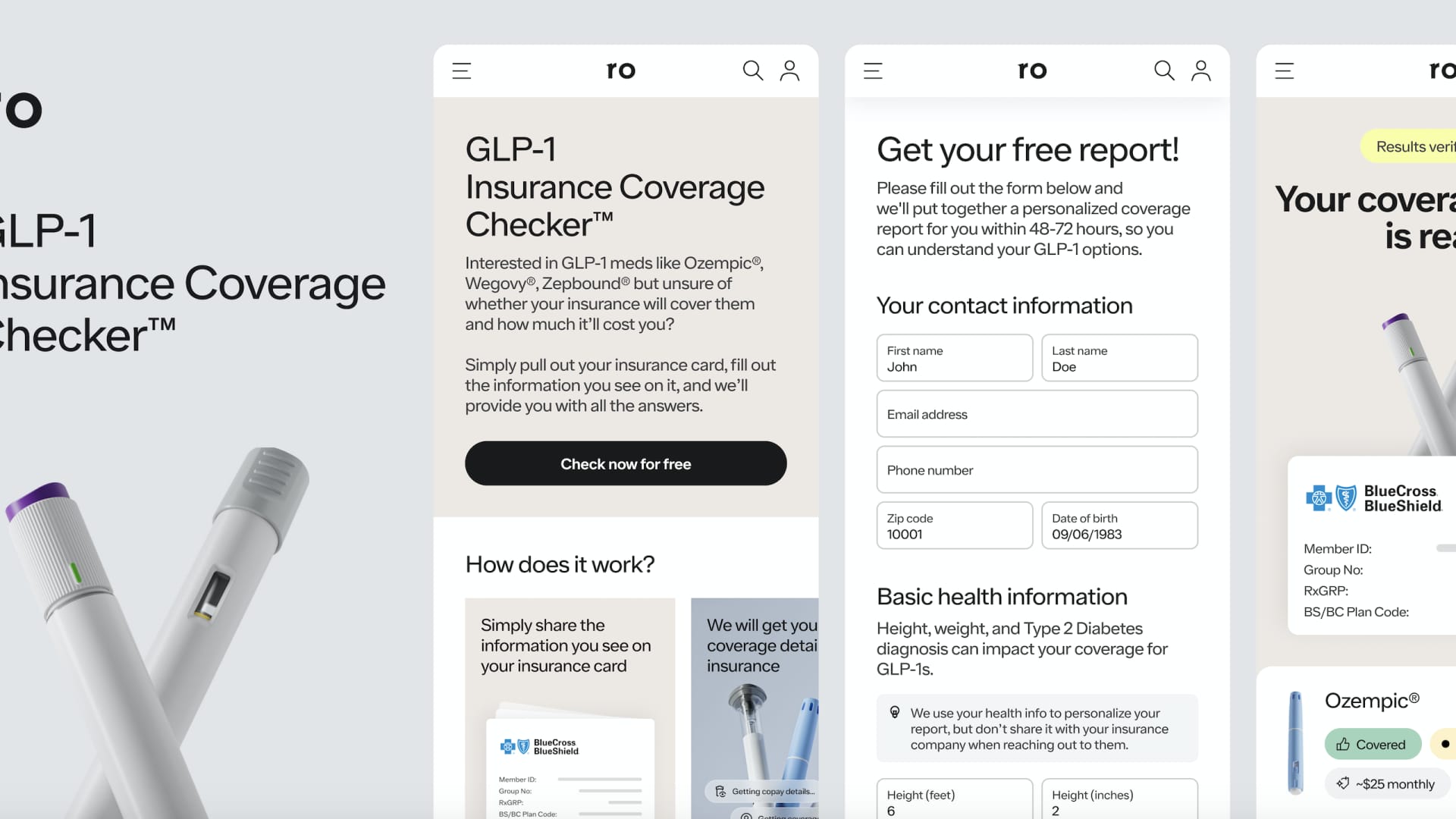

Offering the first oral version of a so-called GLP-1 could help Eli Lilly capture an even greater market proportion for that popular class loss and diabetes medications. Eli Lilly is currently about three years ahead of other drug manufacturers develop pills, including AstrazenecaRoche, Structure therapy and Viking therapyAnalysts told CNBC.

Some analysts hope that the LPG-1 market is more than $ 150 billion annually in the early 2030s. Oral LPG-1 could grow to assert $ 50 billion of that total, according to some estimates of analysts.

Eli Lilly's pill works similarly to Wagovy's diabetes pill, Ozempic and Novo Nordisk, which goes to an intestinal hormone called LPG-1 to suppress a person's appetite and regulate blood sugar.

But unlike those three medications, Eli Lilly's pill is not a peptide medication. That means that the body absorbs more easily and does not require dietary restrictions as Rybelsus does.