Pots of Activia yogurt, manufactured by Danone SA, are on display.

Bloomberg | fake images

The CEO of the French consumer goods giant danone downplayed the threat of anti-obesity drugs to its food business, arguing that consumers were likely to turn to healthy products as part of their new weight-loss regimen.

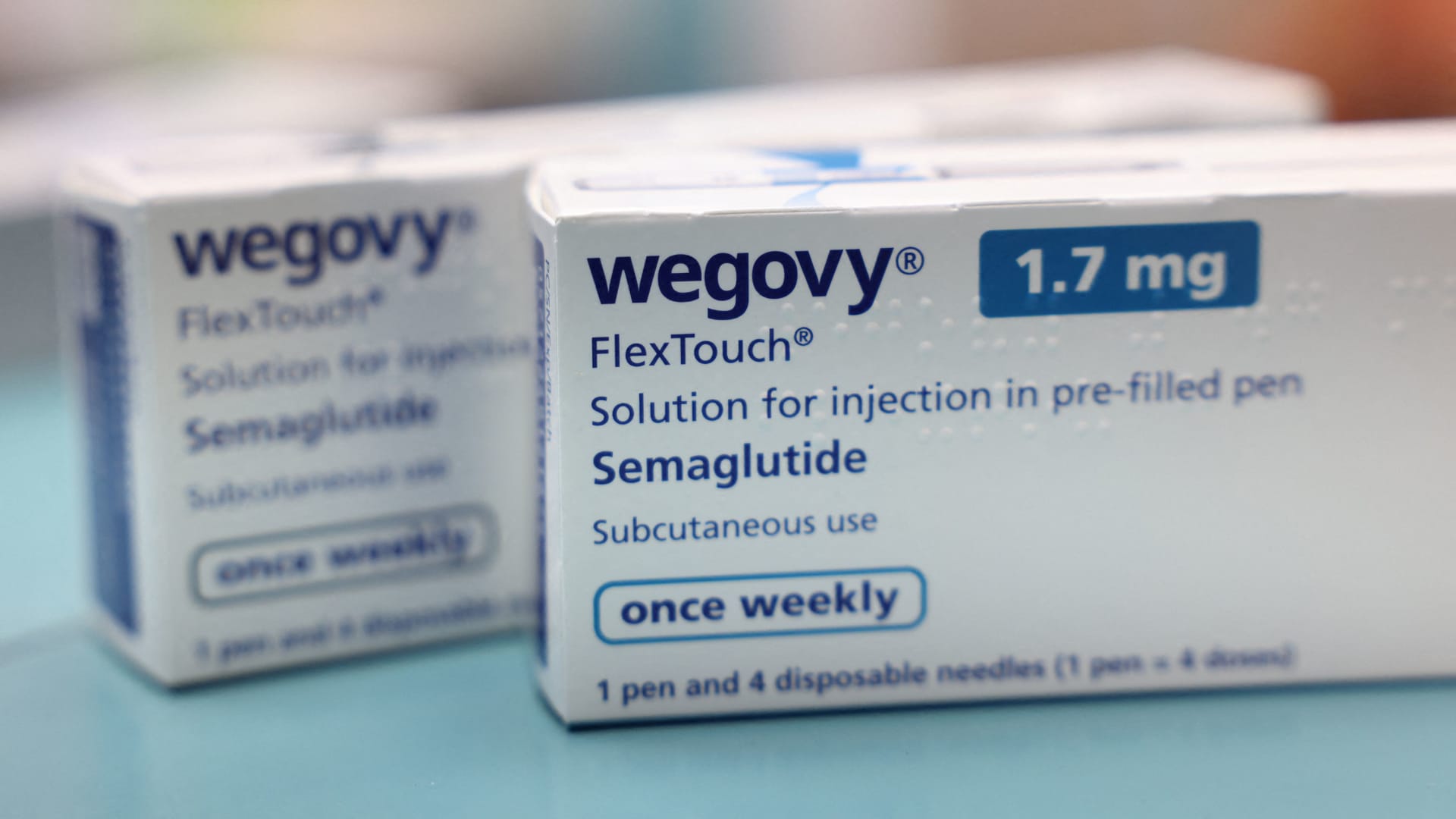

Antoine de Saint-Affrique said the growing demand for drugs such as Wegovy and Mounjaro would only increase consumers' appetite for more nutritional products.

“We consider ourselves extremely complementary to GLP-1,” de Saint-Affrique told CNBC's Charlotte Reed on Wednesday.

GLP-1, or glucagon-like peptide 1 agonists, are the underlying class of drugs in weight loss injections, such as Wegovy and Mounjaro. They work by mimicking the hormones that regulate appetite in the body and effectively reducing hunger levels.

The rapid rise of these types of drugs has raised concerns among food manufacturers, who fear a drop in sales as consumers' appetites decline. The general director of the manufacturer Wegovy Nordisk said in February it was receiving calls from “scared” food bosses asking how the new pharmaceutical class could affect their businesses.

However, de Saint-Affrique said Danone products, including Activia yogurts and Alpro plant-based milks, would be an important component of consumers' new diets.

“We provide proteins and proteins that cannot be found naturally,” he said. “You need to have those proteins and if you're on the regimen, you're going to miss them. We can and do contribute to your gut health,” she said.

“We are actually at the heart of what is needed when using something like LPG-1,” de Saint-Affrique added.

Analysts at financial services research firm Kepler Cheuvreux said in a research note last month that concerns about the impact of LPG-1 on the consumer goods market may be overblown, particularly in the food space. nutritional.

“GLP-1 users may consume fewer calories, but we see no material impact on overall food demand, while we see opportunities for protein product and dietary supplement manufacturers,” wrote Jon Cox, head of European consumer securities. , in a note sent by email.

“While consumers may avoid unhealthy ultra-processed foods (UPF), we believe European companies generally have healthier portfolios compared to some rivals,” he added.

Kepler Cheuvreux named Danone and Swiss food maker Nestlé as potential beneficiaries in the new consumer goods landscape. Last month, Jefferies also named Danone a buy amid a broader slowdown in the food sector as consumers cut spending in the face of high inflation.