If what goes up must come down, then the urgent question many in Europe are asking is when will interest rates start to fall? For months, rates have been set at the highest in the European Central Bank's history.

Investors have been betting that the central bank will cut rates very soon, possibly in April. Traders calculate that rates must fall because inflation has slowed noticeably (it has been below 3 percent since October) and the region's economy is weak. By the end of the year, the central bank will have cut rates by more than 1 percentage point, or between five and six quarter-point cuts, trading in financial markets implied.

However, authorities are trying to push market sentiment in the other direction and delay expectations of rate cuts. Many members of the central bank's Governing Council fear declaring victory on inflation too soon, lest it settle above the bank's target of 2 percent.

On Thursday, the European Central Bank maintained this outlook. It kept interest rates steady, leaving the deposit rate at 4 percent, where it has been since September.

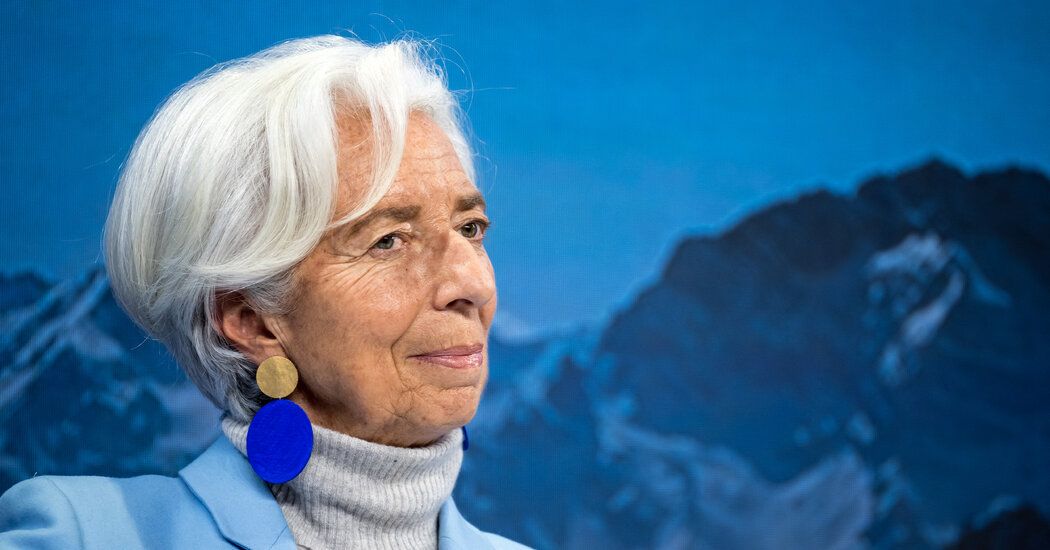

Rates are at levels that, “maintained for a sufficiently long period, will make a substantial contribution” to returning inflation to 2 percent in a “timely” manner, Christine Lagarde, the bank's president, said Thursday.

The region needs to be “further advanced” in the disinflation process before the bank can be confident that inflation will remain on target, he added.

Not now, but probably in the summer.

Recently there has been a change in the central bank. In December, Lagarde said rate cuts had not been discussed and stressed the need to keep an eye on inflation. But the new year brought a slight change in tone. And last week, Lagarde said in an interview with Bloomberg News that rates were likely to fall in the summer.

Asked about this again at a news conference in Frankfurt on Thursday, Lagarde said the 26-member Governing Council still agreed that it was “premature to discuss rate cuts.” Policymakers would make their decisions based on incoming economic data, not following a timetable, he said, apparently in an effort to keep bets on rate cuts at bay.

Still, he said, “I usually stand by my comments.”

It's a comment that traders have seized on and are now firmly expecting a rate cut at the bank's June meeting, while bets for April have increased.

Central banks have to choose their words carefully to guide markets because what investors think matters. If traders begin to anticipate lower interest rates, they can move markets in that direction and ease financial conditions sooner than the central bank would like. That could potentially undermine efforts to slow the economy and slow inflation. This started happening in earnest late last year, after the Federal Reserve signaled it would cut rates this year, sending markets moving in the United States and internationally.

Delay expectations

Policymakers have tried to delay expectations of rate cuts until at least the summer, arguing they won't have the data they need, particularly on wage growth, until their June meeting.

“The ECB will err on the side of caution,” said Oliver Rakau, chief German economist at Oxford Economics, because they are worried about getting inflation wrong again, having previously underestimated its strength.

Meanwhile, those who say inflation will continue to slow depend on the economy not suffering further major shocks. Attacks on commercial ships in the Red Sea have caused shipping prices to soar, and analysts warn it could lead to a resurgence in inflation if the disruption continues for long and those cost increases are passed on to consumers.

Better sooner than later?

On the other hand, data shows that inflation has been declining faster than the central bank predicted. Headline inflation rose in December as some government support measures ended, but could fall below 2 percent in the fall, according to economists at Berenberg bank.

The region's economy is also weak and is not overheating. Germany, the bloc's largest economy, is sluggish, after data showed it contracted 0.3 percent last year. Separate data released this week showed that demand for loans by businesses and households across the eurozone continued to decline.

But this situation can be viewed somewhat positively, according to Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management. “It could have been much, much worse,” he said. For example, the recession in Germany could have been much deeper, he added. “Inflation was a disaster,” he said. “It's not under control, but it's going in the right direction.”

He expects the central bank to begin lowering rates in June and cut rates by a full percentage point altogether by the end of the year. Other economists, including those at Goldman Sachs and Deutsche Bank, predict rate cuts will begin in April.

While there is debate over when and how quickly rates will fall, most economists agree that ultra-low rates are a thing of the past.

“The very low rates we had seen before the pandemic are unlikely to return,” said Rakau of Oxford Economics, because there is a much greater need to borrow money to invest, particularly in renewable energy and new technologies.