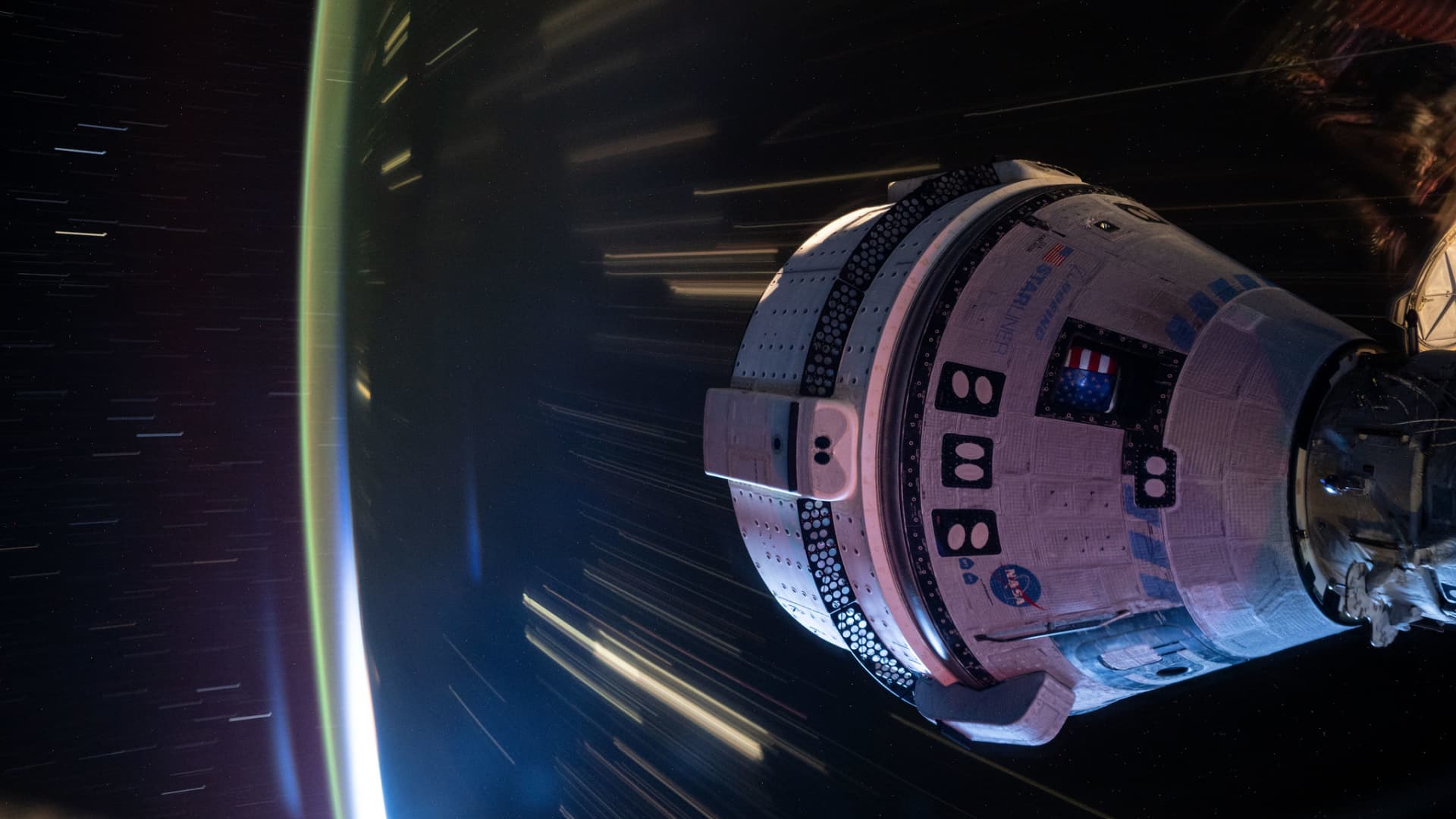

Sen. Elizabeth Warren, D-Mass., speaks during the Senate Armed Services Committee hearing on security in Afghanistan and the Central and South Asian regions, in the Dirksen Building on Tuesday, Oct. 26, 2021.

Tom Williams | CQ-Roll Call, Inc. | fake images

Sen. Elizabeth Warren is accusing Federal Reserve Chair Jerome Powell of following the financial industry's orders in considering changes to a broad set of regulations aimed at increasing the capital buffer that big U.S. banks are required to maintain.

In a June 17 letter first obtained by CNBC, Warren asked Powell for a response to reports that “you are advocating halving” the capital increase required under the proposals, known as the Basel endgame. III.

“I am disappointed by press reports that you are personally intervening – after numerous meetings with CEOs of large banks – to delay and relax the Basel III capital rules,” said Warren, D-Massachusetts.

Last year, three US banking regulators, including the Federal Reserve, unveiled proposed rules, a long-awaited regime change around bank capital and risky activities such as trading and lending. The regulations incorporate new international standards created in response to the 2008 global financial crisis.

“These rules are critical and long overdue, particularly after the bankruptcies of Silicon Valley and Signature Bank, and as risks from the weak commercial real estate market and other economic threats spread throughout the banking system,” Warren said.

Bank CEOs and their lobbyists have said the increases are unnecessarily aggressive and would force the industry to reduce lending.

In March, Powell told lawmakers he expected “broad and material changes” to the proposal in the wake of the industry's campaign against the rules. JPMorgan Chase Chief Executive Jamie Dimon coordinated efforts to weaken the rules, urging CEOs to appeal directly to Powell, the Wall Street Journal reported last month.

“It now appears that you are directly doing the bidding of the banking industry, rewarding it for its extensive personal lobbying of you,” Warren said in her letter. “Taking orders from the industry that caused the 2008 economic crisis would sacrifice the financial security of working and middle-class families to line the pockets of wealthy investors and CEOs.”

He further criticized Powell, saying that “regulatory rollbacks” under the Fed chair allowed the 2023 regional banking crisis to occur and “enriched Jamie Dimon and his Wall Street cronies.”

Warren urged Powell to allow a Federal Reserve Board vote on the original, stricter Basel proposal later this month. The window to finalize and approve the rules before the US elections in November is approaching, and analysts have said the proposal could be delayed or scrapped if Donald Trump is re-elected president.

“Instead of following Mr. Dimon's orders, they should do their job and allow the Board to meet to vote on a 16% capital increase by June 30, as global regulators determined was necessary to avoid another crisis. financially,” Warren said.

The Federal Reserve did not immediately respond to a request for comment on Warren's letter.