The US labor market finished 2023 strong, generating more jobs than experts expected and fueling hopes that the economy can stabilize at a level of strong, sustainable growth rather than falling into a recession.

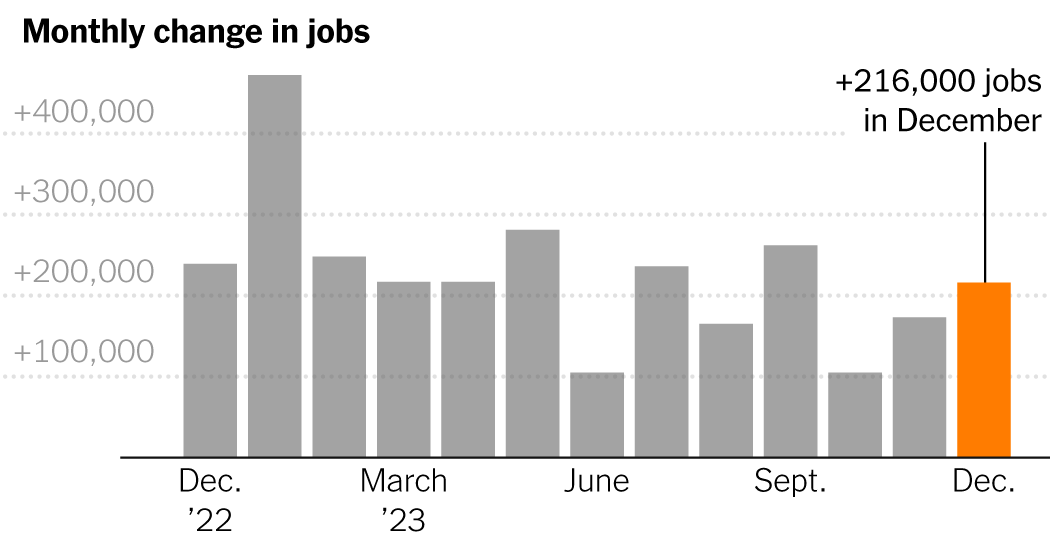

Employers added 216,000 jobs in December on a seasonally adjusted basis, the Labor Department reported Friday. The unemployment rate remained unchanged at 3.7 percent.

Although hiring has slowed in recent months, layoffs remain near historic lows. The durability of both the hiring and the pay increases is even more notable in light of the Federal Reserve’s aggressive series of interest rate increases in recent years. But a number of analysts warn that the situation is not clear yet and say the effects of those higher rates will take time to filter through business activity.

“The real test for the labor market begins now, and so far it is passing,” said Daniel Altman, chief economist at Instawork, a digital platform that connects employers with job seekers.

Financial commentary over the past year has been dominated by conflicting narratives about the economy. Most economists warned that the Federal Reserve raising borrowing costs at a historically rapid pace would send the economy into a recession. Looking ahead to 2023, more than 90 percent of CEOs surveyed by the Conference Board said they expected a recession. And many prominent analysts thought that price increases could only be eased if workers experienced significant job losses.

But the resilience of the broader economy and consumer spending has so far defied those prospects: In June 2022, inflation was about 9 percent. Since then, inflation has fallen to 3 percent, while the unemployment rate has remained virtually unchanged.

In total, the U.S. economy added approximately 2.7 million jobs over the past year. This is a smaller increase than in 2021 or 2022. However, the 2023 increase was larger than that in the late 2010s and represented the fifth-strongest year of job growth since 2000.

Still, the report included indications that the landing could still present obstacles.

Services such as health care, social assistance work, and state and local governments led job gains in December, but previously popular sectors such as transportation and warehousing lost jobs or gained only modest gains.

The overall workforce — the ranks of those currently working or looking for work — shrank by nearly 700,000 workers, according to December data. It was unpleasant news after steady workforce growth for much of 2023.

Additionally, the October and November figures were revised downward by 71,000. That left the average monthly employment gain in the final quarter of 2023 at about 165,000, up from about 221,000 in the third quarter and 201,000 in the second quarter.

Omair Sharif, founder of data analytics firm Inflation Insights, said in a note to subscribers that December’s figure represented “a healthy gain,” but added that “hiring has clearly cooled.”

As we approach an election year, the employment outlook also has a political dimension.

President Biden, whose handling of the economy has earned low marks in voter polls, announced the December numbers. “Strong job creation continued even as inflation fell,” he said in a statement, although he noted that prices remain a concern for many in the country.

The closely watched University of Michigan Consumer Sentiment Index was lower in December than it has been 83 percent of the time since 1978, a period that has included shocks and depressions that, in the paper, they seem worse than the present. However, the index rose for much of last year and several factors may have contributed to more optimistic perceptions.

After nearly two years during which inflation outpaced wage gains, that balance has shifted in recent months. Workers’ average hourly earnings increased 0.4 percent in December from the previous month and 4.1 percent from December 2022.

The housing market, frozen by higher interest rates, is a source of frustration for aspiring first-time homebuyers. But for those who own their homes – about two-thirds of American households – the average rate on all outstanding mortgage debt is just 3.7 percent, protecting them from higher housing costs.

Although many families have struggled since 2021 and have fallen back into poverty as the federal aid network associated with the pandemic response faded, the share of household disposable income going toward debt repayment is below its pre-pandemic level, a sign of strong overall consumer health.

Annie Wharton, a 56-year-old art consultant in Los Angeles, benefits from the financial stability that many middle-class and wealthier Americans have been able to manage despite the headwinds of the 2020s.

Art is a business that “has always had challenges,” Wharton said. “But I’m happy to say this has been a good year.”

His office obtained a loan from the Commerce Department under the Paycheck Protection Program, a key component of the government’s pandemic relief effort, which allowed him to keep his small staff fully employed at all times.

Things have slowed down “with an uncertain economic outlook,” he added, saying that “people seem more cautious than normal” and “everyone is thinking twice before buying.” But she remains optimistic.

Once again, the greatest uncertainties may come from outside.

In 2022, just as disruptions to global supply chains were easing, the Russian invasion of Ukraine caused oil and a wide range of food and energy commodities to soar, sometimes doubling or more in price, driving a higher inflation.

Last year there was largely a lull in new disruptions. But conflagrations in the Middle East have expanded since the fall, threatening key international trade routes. Maersk, the international shipping giant, has announced that for the foreseeable future it will keep container ships away from the Red Sea, where drone and missile attacks on merchant ships have intensified in recent weeks.

As a result, the cost of shipping goods from Asia to northern Europe has risen about 170 percent since December, according to Bloomberg analysts who follow global trade. Oil and gas prices, which have declined substantially since the early stages of the war in Ukraine, have been largely unaffected by the latest turmoil, but American consumers could feel longer-term disruptions in the form of higher prices. of energy and goods.

Kathy Bostjancic, chief economist at insurance giant Nationwide, projects that the economy will experience at least a moderate recession this year, with unemployment rising to 5 percent.

But analysts on the optimistic side of the domestic economic debate largely stick to their point of view.

Joseph Brusuelas, chief economist at RSM, a consulting firm, expects inflation to continue to decline, “which will strengthen domestic household balance sheets and boost consumption in the coming year.”

Art Papas, CEO of Bullhorn, a software provider for recruiting and staffing agencies, says “there’s a lot of pent-up demand” among his clients (medium and large businesses) as they anxiously wait for the green light to make more hires. and investment.

“It feels like we’re in this strange state of balance,” he said, “that I’ve never seen before.”

Santul Nerkar contributed with reports.