The UK's economic recovery has faltered just two days after Rishi Sunak called a general election, as official figures released on Friday showed retail spending plunged more than expected last month.

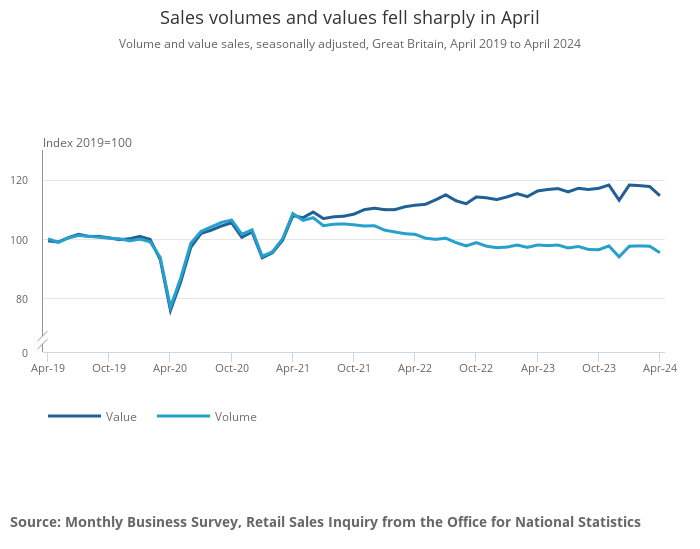

Data released by the Office for National Statistics (ONS) showed retail sales across the UK plunged 2.3 per cent in April, following a 0.2 per cent fall in March.

Economists had expected a softer decline of 0.6 percent for the month.

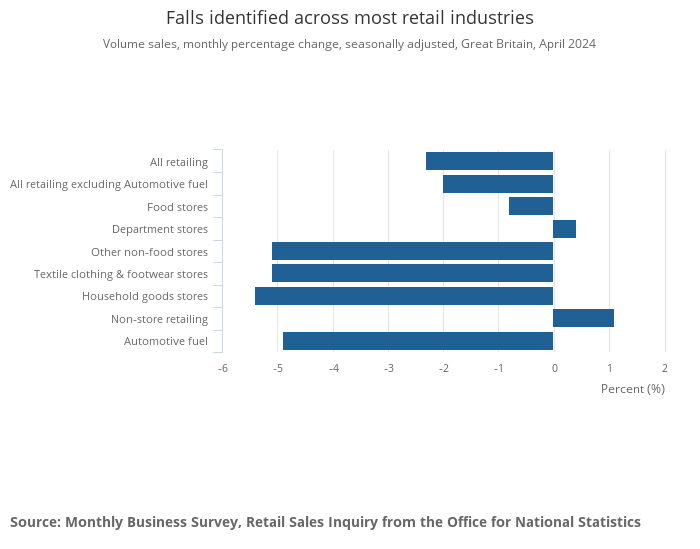

In non-food stores, which the ONS says include clothing and home goods stores, sales volumes fell 4.1 per cent in April. This was the joint steepest drop since January 2021.

Annual retail sales volumes will make for more discouraging reading for the Prime Minister as they were 2.7 per cent lower than in April 2023 and 3.8 per cent below their pre-coronavirus pandemic levels. .

Retailers of clothing, sports equipment, games and toy stores and furniture stores were particularly hard hit by shoppers staying away from the High Street.

Department stores and online retailers were among the few industries that saw sales improve last month.

The ONS said torrential rain and storms that hit Britain last month had contributed to the low footfall reported by retailers.

Sunak will be hoping for an improvement in the coming figures as the economy will be a key battleground in the run-up to the July 4 election.

Along with his chancellor, Jeremy Hunt, Sunak has claimed in recent days that the economy is on the right track after recent figures showed falling inflation and stronger-than-expected economic growth of 0.6 per cent in early of year.

However, these latest retail figures will dampen the mood in Conservative headquarters, as shoppers hit by years of high inflation and rising prices still appear reluctant to spend.

Oliver Vernon-Harcourt, head of retail at Deloitte, said: “April retail sales were more disappointing than expected, once again hit by wet weather, deterring high street shoppers and impacting sales. of seasonal items.

“While consumer confidence continues to rise, many remain concerned and are not yet loosening their pockets, especially on non-essential items and goods such as clothing and footwear.

“Consumers are focused on value, and products like private label foods remain resilient.

“Overall, this is a clear sign that, despite easing inflation, retailers' path to recovery will require them to continue investing in product ranges aimed at consumers of all budgets.”

Charlie Huggins, head of Wealth Club's quality equity portfolio, said the figures show the UK consumer is “not out of the woods” yet, as prices remain much higher than a few years ago.

He said: “Retail sales volumes were much worse than expected in April. Wet, dull weather appears to be the main culprit behind shoppers sheltering in place rather than venturing out to the High Street.

However, I'm not sure you can completely point to the weather gods. Although online sales held up better than those in stores, they still fell 1.2%. And there were declines in almost every category, including food and fuel.

While we must be careful not to over-interpret these climate-affected figures, they do indicate that the UK consumer is not out of the woods. Inflation may have moderated, but prices for most goods and services are still much higher than they were a couple of years ago. “This continues to instill a sense of caution in consumer behavior.”

With the impending general election likely to increase uncertainty, retailers could be in for a tough few months.”

TUC general secretary Paul Nowak said the disappointing figures showed the pressure on household budgets was “far from over”.

He said: “We need people to be able to spend in their local economies to drive growth and businesses. Only in this way can we achieve a sustainable recovery.

“But the current drop in retail sales shows that families are still struggling with the cost of living crisis, and millions of people are having to make cuts.

“The enormous pressure on household budgets is far from over. A toxic combination of rising prices – and 14 years of stagnant wages – has destroyed incomes.