Seoul – In South Korea, the 25% rate of the Trump administration on imported cars has sent to local Hyundai and Kia car manufacturers to fight to protect one of the country's most valuable exports. But General Motors, which last year sent 418,782 units From its factories here to American consumers, or 88.5% of their total sales, they can face a much greater situation.

Unlike Hyundai and Kia, which control more than 90% of the domestic market here, the Detroit -based car manufacturer produces budgetary SUVs such as the Chevrolet Trax or the Chevrolet Trailblazer almost exclusively for the US market. The Trax has been the most exported car in South Korea since 2023.

This business model has done GM, which operates three factories and uses some 11,000 workers in the country, exposed exclusively to Trump's automotive rates, resurfaceing long -standing concerns in the local automobile industry that the company can pack and leave.

Until the rates last month, cars sold between the United States and South Korea were not rinsed under a bilateral free trade agreement. That helped South Korea to become the third largest car exporter for the United States last year with the sum of $ 34.7 billion – o Around half of its total car exports. In contrast, South Korea bought only $ 2.1 billion in the United States cars

Earlier this month, GM executives estimated that tariffs would cost the company up to $ 5 billion this year, adding that the company would increase production in its US plants to compensate for the coup. With additional factories in Mexico and Canada, GM currently imports around half of the cars in the US.

“If American tariffs remain in place, GM will no longer have any reason to stay in South Korea,” said Lee Ho-Guen, a professor of automotive engineering at the University of Daeduk.

“Tariffs can add up to $ 10,000 at the price of the label in cars sent to the US.

Kim Woong-Heon, an official in the GM Korea union, said the union is addressing the current rumors of the company's possible output with a precautionary dose, but added that the broader concerns about the long-term commitment of the company remain.

“The cars we are manufacturing here are at the lowest end of the GM price range, so labor costs will immediately transfer production to the United States,” he said.

“But we have painful GM memories that close one of its factories in 2018, so we get nervous every time these rumors arise.”

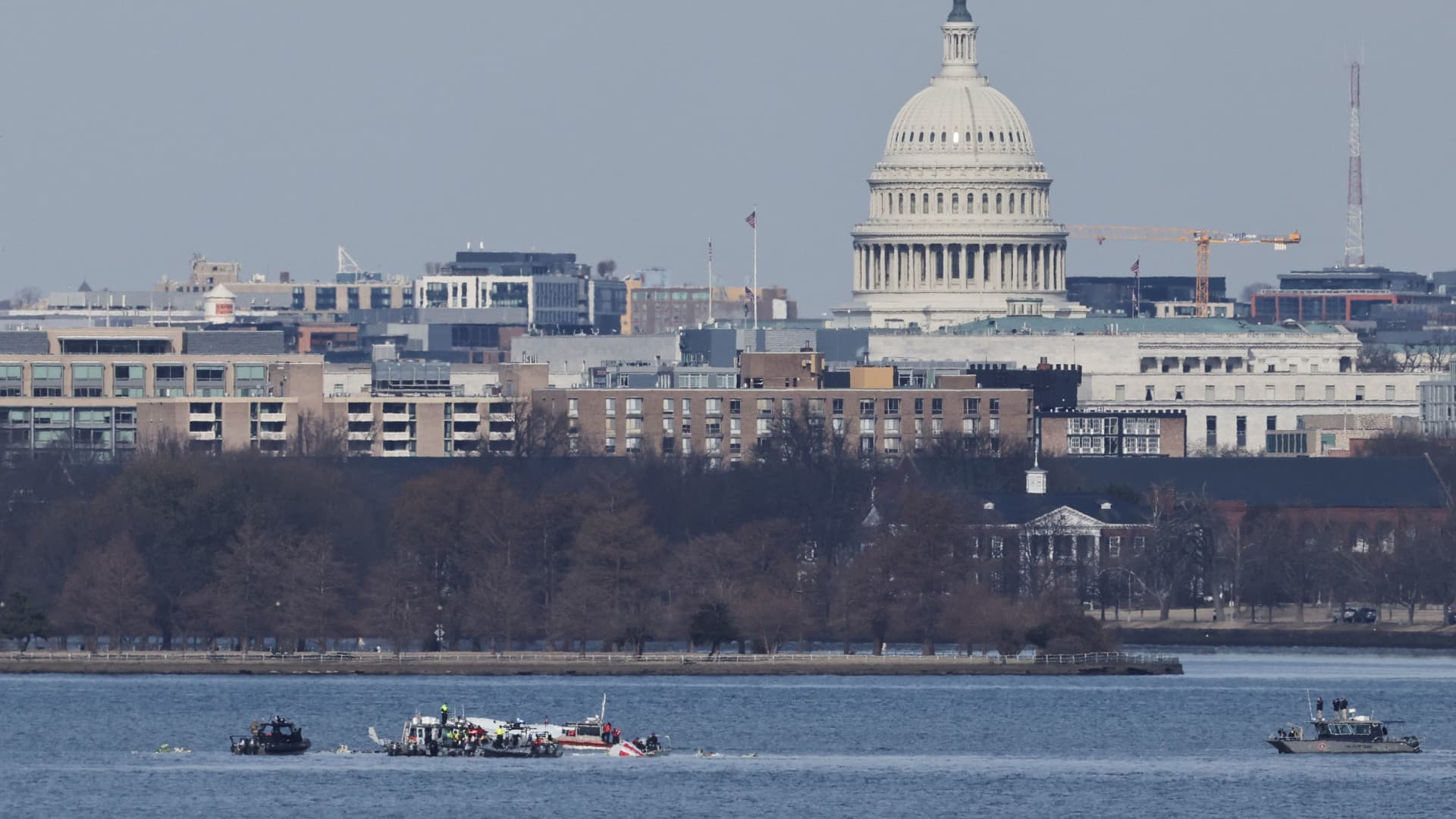

GM Chevrolet cars destined for export feel parked in the port of Incheon in South Korea.

(Seongon Cho / Bloomberg through Getty Images)

This is not the first time that GM's prospects in the country have been questioned. The company was first established in South Korea in 2002 by acquiring the banking Daewoo Motor Co. in an agreement backed by the Government that some at that time criticized as “GM that took Daewoo's cream for almost nothing.”

Fighting to compete with people like Hyundai, GM was briefly positioned as a production base for European and Asian markets to their bankruptcy in 2009.

Amid the global restructuring efforts they followed, the concerns that it would close their South Korean operations led the government to intervene once more. In the end, GM stayed after receiving $ 750 million in financing from the country's development bank with the condition that it would remain open for at least 10 more years.

But in 2018, the company closed its factory in the city of Gunsan, which had used around 1,800 workers, and left its research unit and development of its manufacturing base, a movement that many saw how the company strategically placing one foot through the door.

In February, shortly after President Trump announced 25% tariffs on foreign manufacturing carsPaul Jacobson, Financial Director of GM, hinted that the company could face equally difficult decisions:

“If they become permanent, then there are a lot of different things that you should think in terms of where you assign plants and move plants.”

In recent weeks, GM Korea executives have tried to calm rumors that the company's South Korean operations would be affected.

“We do not intend to respond to rumors about the departure of the company of Korea,” said Gustavo Colossi, Vice President of Sales of GM Korea, at a press conference last month. “We plan to move forward with our sales strategies in Korea and continue launching new models in the coming weeks and months, presenting new GM offers to the market.”

The union says that the two finished car plants of the company have been operating at full capacity, with 21,000 additional units recently assigned to the factory in Incheon, a city on the western coast of the country, a sign that the business will continue as usual for now.

But with the 10 -year guarantee of GM expire in 2027, Kim, a union official, said his demands for measures that show that the company's commitment beyond that has not been an answer.

These include the manufacture of electric and plug -in hybrid vehicles in South Korea factories, as well as making a greater range of their products available for sale in South Korea and other Asian markets.

“If the company intends to continue its operations here, it needs to make its business model more sustainable and not so dependent on imports to the United States,” Kim said.

“That will be our main demand in the salary and collective bargaining of this year.”

The immediate perspectives of GM in the country will depend on the ongoing rates conversations among US officials and South Korea who began last month with the aim of producing an agreement before July 8.

Although South Korea's Minister Ahn Duk-Geun has emphasized that cars are “the most important part of the United States and South Korea's commercial relationship”, few hope that Seoul may think about the type of agreement given to the United Kingdom, which last week assured a 10% rate In the first 100,000 vehicles sent to the USA every year.

Unlike South Korea, which registered a commercial surplus of $ 66 billion with the USA last year, the United Kingdom buys more from the US. Uu. Of what it sells. And many of the cars that sells to the US are luxury vehicles such as Rolls-Royce, which Trump has differentiated from the “monstrous car companies” that make “millions of cars.”

“At some point after the next two years, I think it is very likely that GM leaves and maintain only its research and development unit here, or at least significantly reduces its production,” said Lee, automotive professor.

In the port city of Southeast Changwon, home from the two GM finished car plants, local officials have been reluctant to give air to what they describe as premature fear.

But Woo Choon-AE, a 62-year-old real estate agent whose clients also include GM workers and their families, cannot avoid worrying.

She says that the company's departure would be devastating for the city, which, like many rural areas, has already been under tension of the population decrease.

GM uses 2,800 workers in the region, but represents thousands of jobs more in their suppliers. The Changwon factory, which manufactures the Trax, represented about 15% of the city's total exports last year.

“People work for GM because it offers stable employment until retirement age. If they close the factory here, all these workers will go to find work in other cities, which will be a critical blow to the real estate market,” he said.

“The houses are how people save money in South Korea. But if people's savings suddenly reduce in half, who will spend money on things like dinner?”