Your support helps us tell the story

From reproductive rights to climate change to the great technology, The Independent is in the field when history is being developed. Whether it is investigating the Finance of the PAC PRO-TRUMP of Elon Musk or produces our last documentary, 'The Aa Word', which shines to a light on US women who fight for reproductive rights, we know how important it is to analyze the facts of the acts of the messaging.

In such a critical moment in the history of the United States, we need reporters in the field. His donation allows us to continue sending journalists to speak on both sides of history.

Americans trust Independiente throughout the political spectrum. And unlike many other quality media, we chose not to block Americans from our reports and analysis with payment walls. We believe that quality journalism should be available for everyone, paid by those who can pay it.

Your support makes all the difference.

Rachel Reeves has received great news about her hopes of fulfilling the main mission of work to revive economic growth in the United Kingdom.

In a blow to the Chancellor, the Bank of England has reduced its projections for growth due to the additional expenditure of the NHS announced in the budget of Mrs. Reeves last year and now it is expected that inflation will increase to a 3 , 7 percent, higher than previously estimated.

Mrs. Reeves, whose future as the chancellor is being questioned about her history in the first seven months of the Labor Government, was warned that the new “potent” “growth forecast must be a call of attention” with calls to make more To help companies fighting with the consequences of their budget.

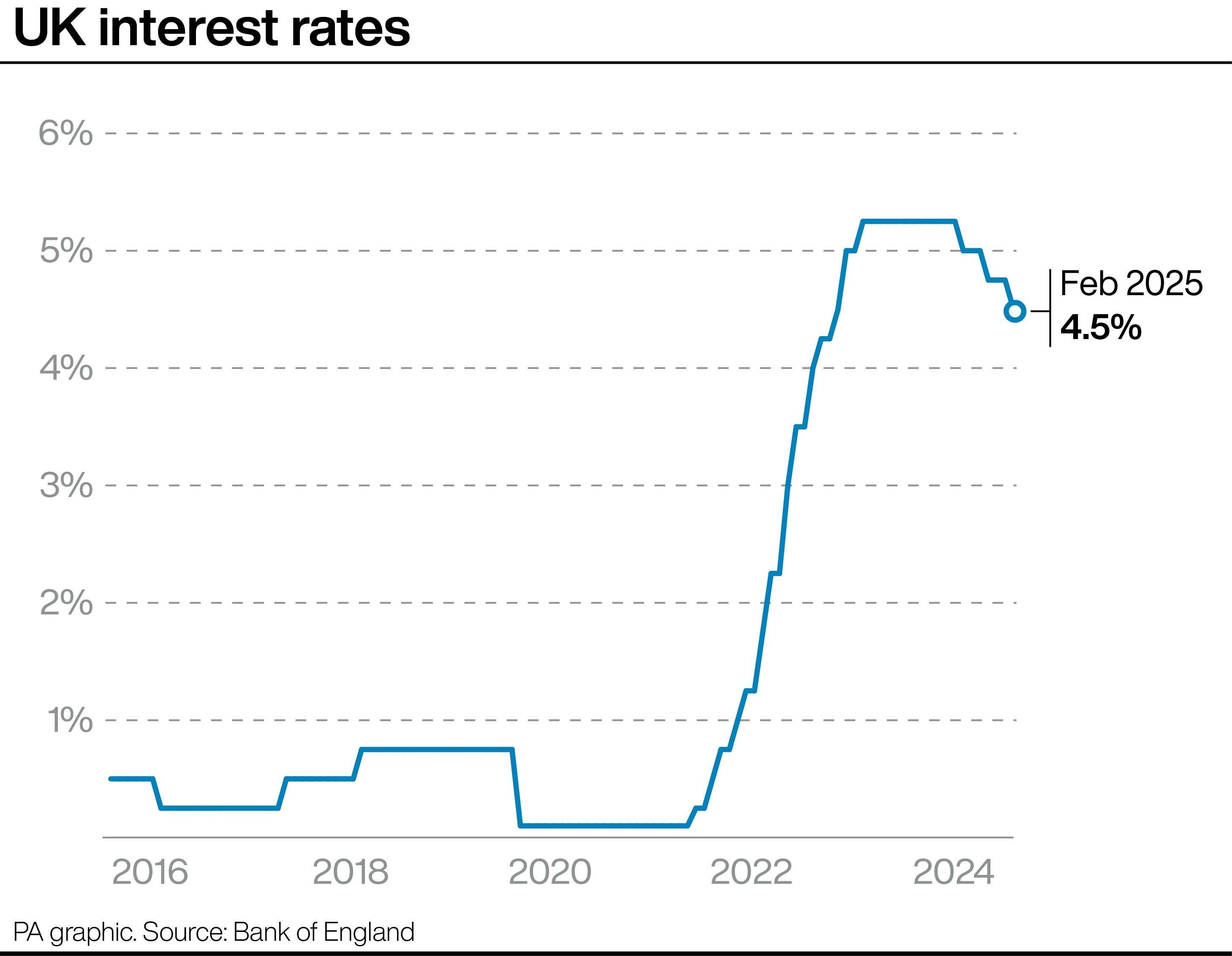

However, the bank gave it a very necessary impulse, since it announced a cut in interest rates of 4.75 percent to 4.5 percent. In addition to providing relief for companies, the cut will help thousands of people in mortgages that will see the monthly payments there. An owner with a £ 300,000 tracker mortgage will see monthly payments that fall around £ 43 of £ 1,710 to £ 1,667.

The tariff cut is the first good news for a chancellor who has been harassed by bad economic figures since he assumed office and has also been subject to speculation about whether he can survive in the treasure.

However, in less good news for Mrs. Reeves, the bank reduced its growth forecast for the United Kingdom economy to 0.75 percent for this year, below the previous estimates of 1.5 percent, before accelerating Again in 2026 and 2027. Cent in the fourth quarter of 2024 and will increase only 0.1 percent in the first quarter of 2025.

Paul Johnson, director of the influential group of experts of the economy The Institute of Fiscal Studies (IFS), described the Bank of England as a “quite pessimistic forecast.”

Johnson published on X, previously Twitter: “OBR is generally much more optimistic than the bank, but if it moves in a similar direction that will mean problems for the chancellor.”

And, in his evaluation, the bank governor Andrew Bailey warned that the commercial tariffs of the United States, even if they are not directly imposed on the United Kingdom, could affect growth.

“If there were rates that contribute to a fragmentation of the world economy, that would be negative for the growth of the world economy. I hope that does not happen, but that could happen,” Bailey said.

“The impacts on inflation are much more ambiguous.”

The bank's announcement follows Mrs. Reeves's main speech last week, where she doubled her economic growth agenda in an attempt to relaunch her economic plan with proposals to unleash mass construction projects throughout the United Kingdom, including a new track at Heathrow airport.

Downing Street supported the Chancellor, repeating a promise that she will remain in the role of this whole Parliament.

Speaking on a visit to Lancashire, Prime Minister Sir Keir Starmer said that people would have “more money in their pockets”, since he welcomed the decision of England's bank to reduce interest rates.

The prime minister told the announcers: “I think it is important to see what happened. The interest rate has decreased, that is the third fall in interest rates since July.

“That is good news because for many people who look at this it means that they will have more money in their pockets. Salaries are climbing more than inflation, so again people feel better. The minimum wage has increased.”

He added: “We are absolutely determined to grow the economy, and I do not mean a line in a graph, I mean that people feel better.”

But the chancellor in the shadow, Mel Stride, said that although the cut in interest rates “will be good news” for families and companies, warned that the weakest growth predictions of the hope of England showed that “Trust is falling and the work budget is feeding inflation.”

It is likely that the “disastrous work budget means less target cuts this year than expected,” he added.

Democratic liberal treasure spokeswoman, Daisy Cooper, said the new growth forecast should be a “attention call for the chancellor” and asked her to disburse her “wrong national insurance walk” in employers next month and leave their Negative to “negotiate an aid of the United Kingdom- EU Customs Union.”

Anna Leach, chief economist of the Institute of Directors (IOD), urged Mrs. Reeves to reconsider “additional charges” in companies last year, in particular “changes of pernicious taxes that affect family businesses, farms and no DOM” and employment regulations.

The budgetary decisions of Mrs. Reeves had “significantly undermining the commercial impulse” and will affect private investment levels in the coming years, “he said.

And he added that the forecasts presented a “worrying perspective for the United Kingdom”, with inflation and growth down “the risks of stagning remain on the table.”

The Bank's Monetary Policy Committee (MPC) voted from 7 to 2 to reduce rates. Two MPC members voted for a greater cut of 0.5 percent.

The reduction of the interest rate has been welcome throughout the political spectrum, as well as by companies and unions.

Tuc general secretary Paul Nowak said: “This rate cut is very necessary to help get the economy out of the stagnation. The bank must now continue to move with more cuts to support homes and companies in the coming months.

“The lowest indebtedness costs will relieve household pressures, help families with their weekly budgets and leave them with more spending. And it will make it more affordable than companies invest and grow. ”

Alpesh Paleja, an attached chief economist, CBI, said: “The cut of today's interest rates was in line with our expectations and reinforces our vision of a gradual loosening in monetary policy during this year.”

But he warned: “However, the monetary policy committee has to balance more and more conflicting objectives. CBI surveys show that business growth and hiring expectations have weakened. But inflation expectations are recovering, exacerbated by the increase in employment costs derived from the October budget.

“Therefore, although we still expect some more rates cuts this year, the risks for this prognosis are now balanced in any direction. The incoming data in the coming months will be key to determining how the MPC will move below. ”

In response to bank ads, Downing Street said that investing in the NHS was “good for the economy and good for growth.”

In the increase in projected inflation, NO 10 pointed out the last prognosis by the Office of Budget Responsibility (OBR) that would remain close to the 2 percent target.