NEW YORK — In federal court on Monday, famed fashion designer Michael Kors spoke out about the daunting challenge of staying relevant in a world where brands can rise and fall based on viral TikTok videos and photos of handbags on the arms of celebrities like Taylor Swift and Beyoncé.

Kors kicked off a week of testimony in the Manhattan antitrust trial as a Federal Trade Commission lawsuit seeks to block TapestryThe firm's $8.5 billion acquisition of Capri. If the deal is approved, six fashion brands would be merged into one company: Coach, Kate Spade and Stuart Weitzman from Tapestry, and Versace, Jimmy Choo and Michael Kors from Capri.

On Monday, the FTC subpoenaed Kors, who founded his namesake brand in 1981 at age 22 and still serves as its chief creative director, to testify. In his remarks, however, Kors described how even legacy brands like his can struggle and lose the interest of shoppers.

“Sometimes you'll be the most attractive thing in the neighborhood,” he said. “Sometimes you'll be lukewarm. Sometimes you'll be cold.”

He acknowledged that his eponymous brand has fallen out of favor and is in need of a revamp.

“I think we've reached the point of brand fatigue,” he said.

The FTC has argued that the combined companies, particularly with Coach and Michael Kors under the same ownership, would create a handbag giant with the power to raise prices for customers while offering them the same or worse products.

Separately, attorneys for Tapestry and Capri have challenged the FTC’s descriptions of a consolidated handbag market. They have said competition has increased as customers consider both higher-priced luxury brands and lower-priced fast-fashion brands, and can shop on online-only platforms and secondhand marketplaces.

The trial comes at a time when consumers are balking at high prices and when the outcome of the closely watched U.S. presidential election could change the federal agency's strategy.

Shares of Capri, which includes Michael Kors, reflect the tougher times described by designer Kors. As of Monday afternoon, the company's shares had fallen about 24% so far this year. That lags far behind the roughly 18% gains for the firm's stock. S&P 500 Index and Tapestry's increase of approximately 17%.

In its most recent fiscal quarter, which ended in late June, Michael Kors' revenue fell 14.2% on a reported basis, or 13.3% on a constant currency basis, compared with the same period a year ago.

Kors said he continues to study the fashion industry and draws inspiration from spending time in stores, talking to customers or observing people in places like airports. Even as an industry veteran, he said he must move with agility.

For example, she said she learned about Aupen, a newcomer to the handbag industry, when she saw a photo of Taylor Swift holding one of the company's bags. When she went to the company's website, it crashed, she said.

“This shows the power that women like this have,” she said.

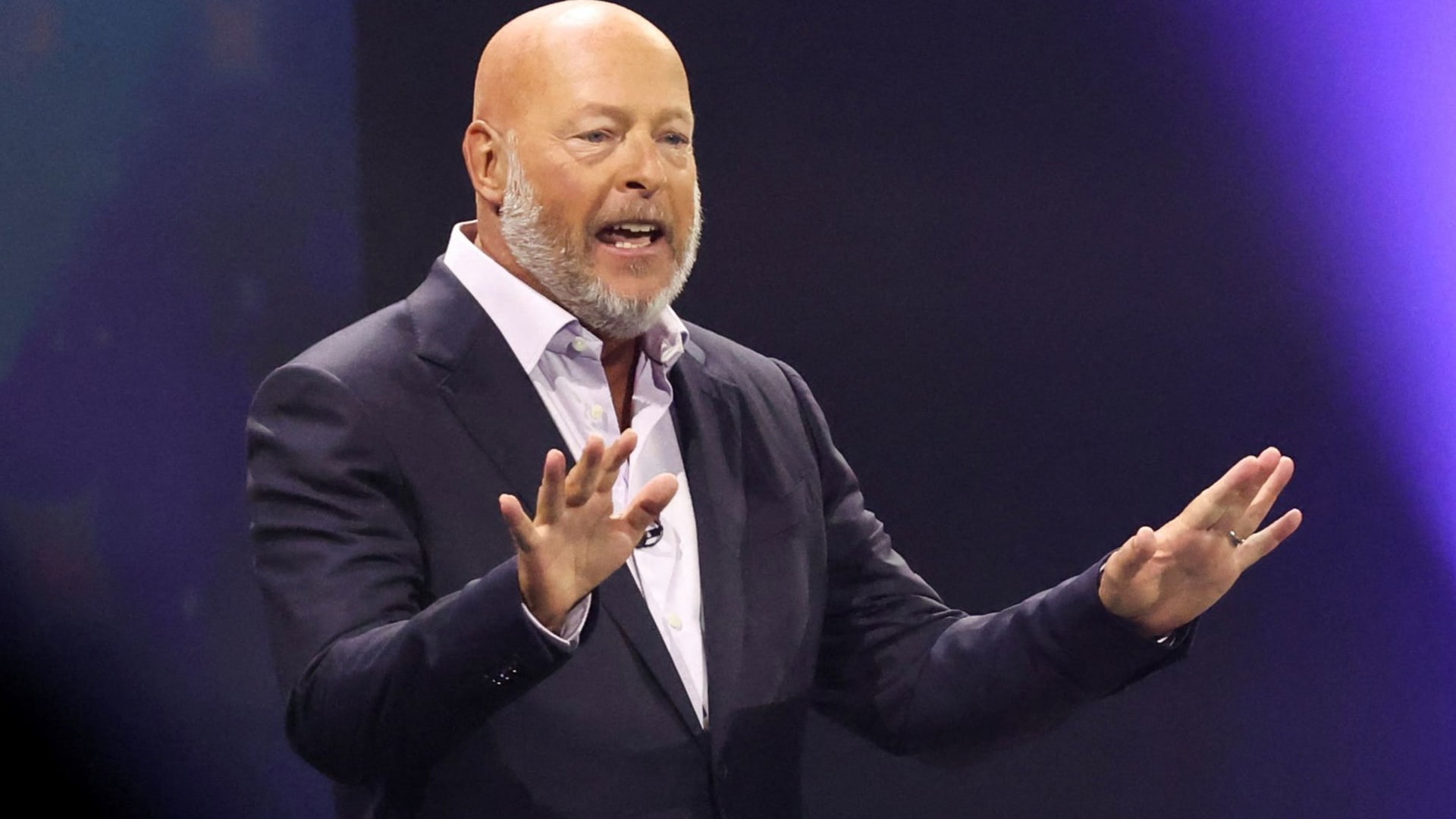

In another testimony on Monday, the former Macy's Chief Executive Jeff Gennette said retailers also feel it when brands lose some of their luster. Gennette, who retired early this year, said the department store's sales suffered because it leaned too heavily on the Michael Kors brand. He said the discounting of Michael Kors handbags contributed to “a negative spiral that Macy's was going through when I was there.”

The antitrust trial is expected to conclude Tuesday with testimony from economists, including one from the FTC and one from the companies.