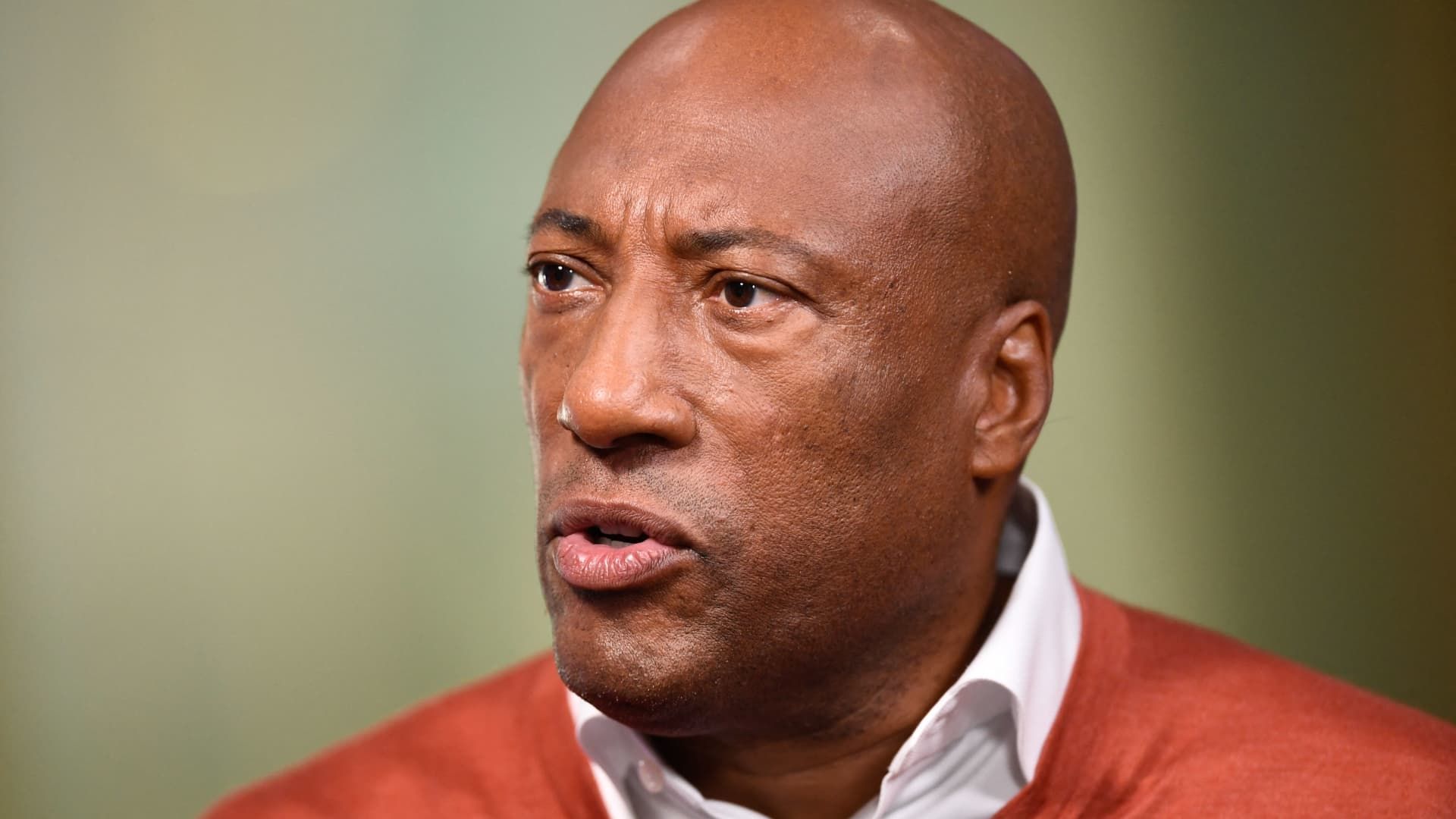

Byron Allen, founder, chairman and CEO of Allen Media Group, speaks during the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022.

Patricio T. Fallon | AFP | fake images

Byron Allen, the media mogul who is offering $14 billion for Paramount Globaltold CNBC on Wednesday that he has the money to finance a deal, despite skepticism surrounding his deal.

“We have more than enough capital available to us. The real challenge is the certainty of closure,” Allen said.

“This agreement lives or dies on the [Federal Communications Commission]”he added.

Allen, founder and CEO of a media group that owns dozens of television networks across the United States, offered $30 billion for all of Paramount's outstanding shares, including debt and equity.

Allen Media Group said in a statement that the offer “is the best solution for all Paramount Global shareholders, and the offer should be taken seriously and pursued.”

Allen has a long track record of making bids on major media assets. But bidding does not mean buying.

Its recent media buying deals have not materialized into sales. The Wall Street Journal reported Wednesday that Allen offered $18.5 billion for Paramount last year and was rejected.

Allen told CNBC that he has not received a response from Paramount to his most recent offer.

Shari Redstone, who controls Paramount through her company National Amusements, has been open to closing deals in recent months in an effort to merge or sell the company that houses brands such as CBS, Showtime, Nickelodeon and the movie studio of the same name. .

CNBC reported last week that David Ellison's Skydance Media and its backers were exploring a deal to take Paramount Pictures or the entire media company private.

In December, CNBC also reported that Paramount had entered into preliminary talks with Warner Bros. Discovery merging the two media giants in a deal that could have faced regulatory hurdles.

Allen's bid for Paramount is the most ambitious of the deals the media mogul has attempted to complete. Here are some of his recent deal attempts:

- In December, Allen renewed his attempt to buy Paramount-owned Black Entertainment Television and VH1 for a combined $3.5 billion.

- In November, Bloomberg reported, it was weighing an offer to buy television stations from EW Scripps.

- In September, Allen made an offer to buy ABC and several other broadcast networks. disney for $10 billion after Disney CEO Bob Iger opened the door to the sale of the company's linear television assets.

- In 2022, he explored a bid to purchase the Washington Commanders of the National Football League.

- In March 2020, it offered $8.5 billion to buy the television station owner. tegna.

Allen told CNBC by phone Wednesday that he lost several deals because the property changed course in wanting to sell. He highlighted his $300 million acquisition of The Weather Channel in 2018 and extensively defended his record, invoking baseball Hall of Famer Babe Ruth.

“Let's talk about Babe Ruth. Is he considered one of the greatest baseball players of all time? And he struck out half the time,” Allen said. In reality, Ruth struck out 1,300 times in 8,399 at-bats, a 15% strikeout rate.

Allen's bids for linear television assets come as the media landscape shifts away from traditional television toward streaming. Almost all major media companies have launched services to compete with the streaming giant. Netflix.

Paramount reported in its third-quarter earnings report that its streaming platform, Paramount+, grew its subscriber count to 63 million. However, Paramount's direct-to-consumer products have failed to generate profits like Netflix has. The division reported adjusted losses of $238 million for the third quarter.

Paramount will release its fourth quarter results on February 28.

Allen told CNBC that he wants to buy Paramount for its linear networks, which he said is the most challenging part of the company.

“These are still great businesses if you know how to run them properly,” Allen said.

Paramount shares rose nearly 7% on Wednesday and have risen more than 35% over the past three months as deal talks intensified. However, the stock is more than 40% away from its 52-week high of $25.93 per share reached in February 2023.

—CNBC's Alex Sherman and Julia Boorstin contributed to this report.

Don't miss these CNBC PRO stories: