Federal student loan borrowers who initially took out smaller loan amounts may be eligible for earlier debt cancellation.

Starting in February, people enrolled in the Biden administration's new income-driven repayment plan, known as SAVE, who originally borrowed $12,000 or less for college and have made at least 10 years of qualifying monthly payments, will see immediately eliminated any remaining debt, Education Department officials said. he said on Friday.

The SAVE plan, which reduces payments for millions of borrowers, opened its enrollment doors last August. But some of its benefits, such as the shortened path to forgiveness, would not take effect until July 2024. Most other income-based repayment plans, where payments are readjusted each year based on income and household size, they forgive any remaining balance after a set number of years, usually 20.

SAVE cuts that term in half for people who initially borrowed $12,000 or less and reduces the repayment schedule for those who originally borrowed $21,000 or less. For every $1,000 over $12,000, a borrower can receive forgiveness after one additional year of payments. For example, if someone originally borrowed $13,000 in loans, any remaining balance would be forgiven after 11 years of payments.

The department said it was strongly encouraging those who originally borrowed $12,000 or less to apply for the SAVE program as soon as possible.

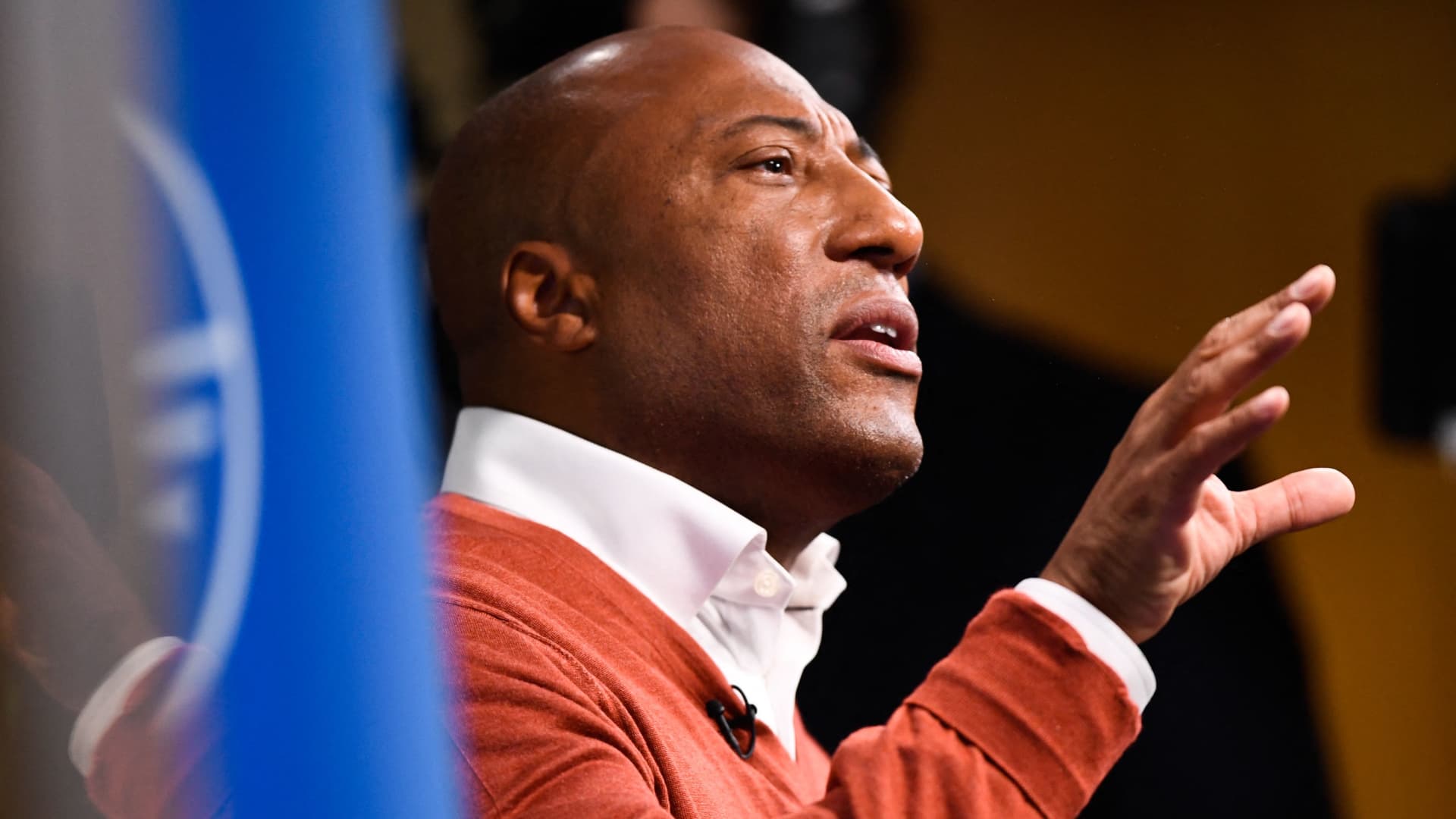

“Today's announcement will help struggling borrowers who have been making loan payments for years, including many who never graduated from college,” said James Kvaal, deputy secretary of the Department of Education.

It was not immediately clear how many people would be eligible, but the administration said it was reaching out to federal borrowers whose balances and payment terms indicated they could benefit. In February, the department will begin notifying SAVE enrollees whose loans are being forgiven. Borrowers will not have to apply for relief.

Most federal student borrowers have direct loans, which are necessary to enroll in the SAVE program; People with other federal loans will need to take an extra step.

Abby Shafroth, director of the student loan borrower assistance project at the National Consumer Law Center, noted that borrowers with a Perkins loan or what's known as an FFEL loan (the acronym stands for Federal Family and Education Loan) They can enroll in SAVE to receive the potentially shortened repayment term, but first they must consolidate their debt into a direct loan.

“And when they file their consolidation application, they will be able to apply for SAVE at the same time,” Ms. Shafroth said.

About 6.9 million borrowers are enrolled in the SAVE plan, including 2.9 million who are new to an income-based repayment plan, as well as 700,000 who switched from another plan, the Department of Education said. The rest were already in the plan that SAVE replaced (known as REPAYE, or the Revised Pay What You Earn program).

Among those enrolled in SAVE, 3.9 million have no monthly payment, administration officials said, while others with monthly bills pay about $117 less than they would under REPAYE.

Restarting federal student loan payments for more than 28 million borrowers after a 42-month pandemic pause has not been easy, particularly for those trying to enroll in the SAVE program. Many have had their payments miscalculated and others have experienced long wait times and other problems.

Administrators had 1.25 million pending applications at the end of October, more than 450,000 of which had been pending for at least a month. Senior administration officials said most of the backlog had been cleared and borrowers' applications were being processed in a more timely manner.