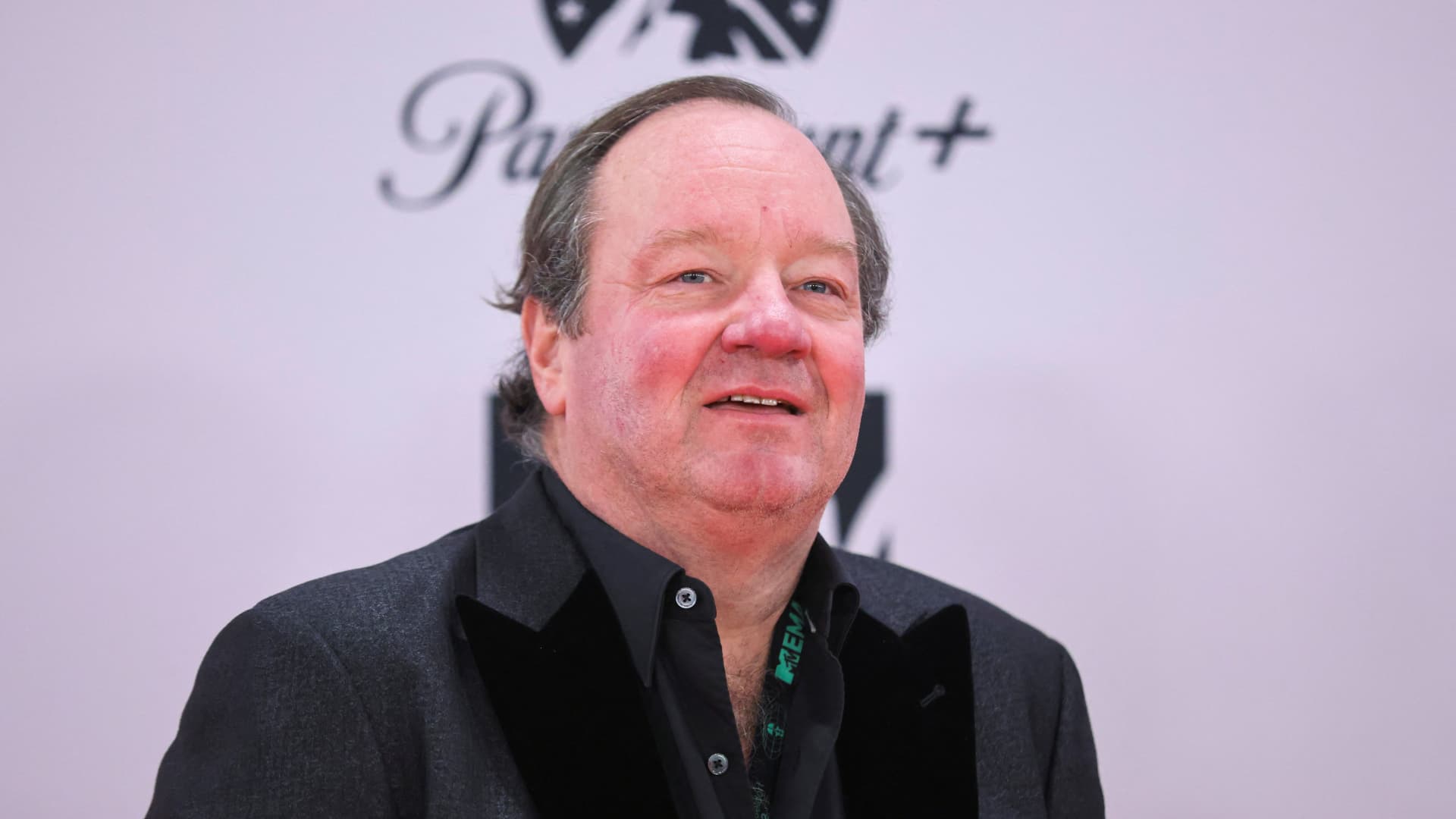

U.Today – Renowned maximalist Max Keizer has commented on the news that the US banking sector is “entering a new dark age.” He believes this may be happening in line with what Satoshi Nakamoto may have predicted when he built Bitcoin 16 years ago.

“Exactly as Satoshi planned”

Sternlicht said he expects U.S. regional and community banks to begin failing one or two each week. There are more than 4,000 such banks in the US.

The main reason for this, according to Sternlicht, is that the Federal Reserve has been raising interest rates and will now not begin to lower them, as announced during the recent FOMC meeting. Therefore, among those who “will be hit” will be the real estate sector and the local banks that work with it. As in 2009, real estate lending will probably be affected now, the billionaire expects.

Overall, experts believe that the US Federal Reserve is currently stuck between allowing a banking crisis (if they keep rates high) and allowing inflation to grow stronger and out of control (if they start easing interest rates). interest). High rates will therefore keep inflation more or less in check, while crucial sectors of the economy, which have a heavy dependence on loans, cannot survive in a higher rate environment, even if at first glance they seem that way. strong enough for that.

Max Keizer believes this is going “exactly as Satoshi planned.”

Keizer supports Robert Kiyosaki's “failure predictions”

Kiyosaki advocated investing in Bitcoin, as well as physical gold and silver, predicting that the prices of these assets will skyrocket in the near future. Notably, Kiyosaki tweeted this year that he expects BTC to hit $100,000 in September.

Remove ads

.

Keizer acknowledges that Kiyosaki has generally been right that the U.S. economy is going downhill at a rapid pace.

This article was originally published on U.Today.