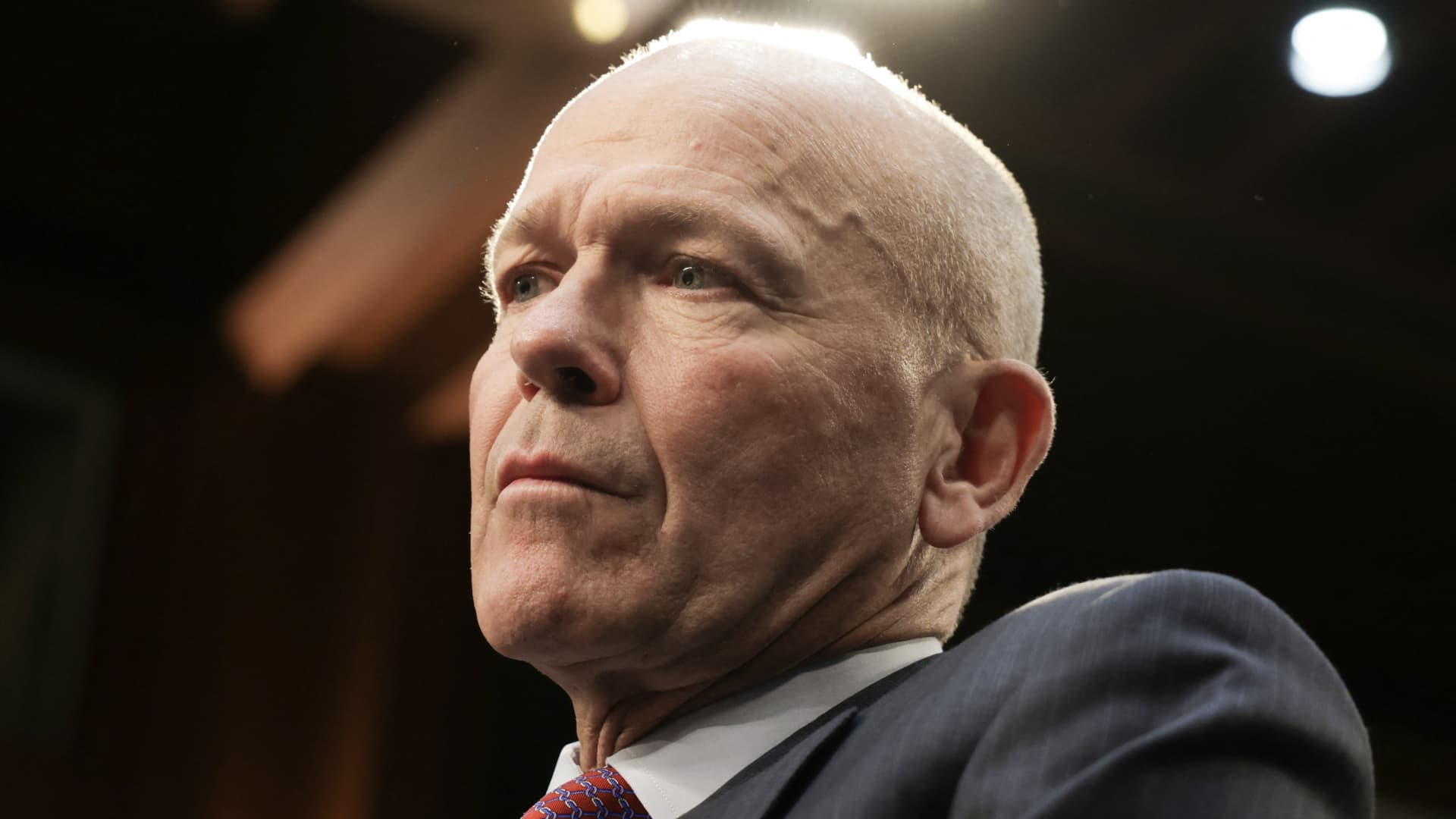

U.Today – Well-known gold bull and bearish Peter Schiff has claimed that he believes the trend in Bitcoin may intensify and pointed out a critical support level that Bitcoin investors should make sure not to miss. In the event of a breakout, his chart suggests that digital gold may lose up to 60% of its value.

At the moment, the Bitcoin price is slightly below the 200 EMA. This level has always been a reliable stopper for a long-term trend, which makes it significant. Breaking below this mark could signal a more serious downtrend and significant price declines. The bearish outlook has been reinforced by resistance at the 50 EMA, which is located at $63,634, and the 100 EMA, which is located at $63,315.

While the overall trend remains weak, the RSI at 31 indicates that Bitcoin is approaching oversold territory, suggesting a potential near-term recovery. Peter Schiff’s analysis of Bitcoin often leans heavily towards bearish extremes despite the fact that it is based on traditional market skepticism.

If Bitcoin breaks its current support, a prediction of, say, a 60% drop in value could be considered alarmist. A 60% drop would suggest a drop to around $23,000, which might not be consistent with previous price patterns, although further drops are still possible. Despite those drops, Bitcoin has been showing some resilience, but obviously not enough.

As a result of adoption trends and investor optimism, Bitcoin has previously recovered from similar declines. Despite recent declines, institutional interest in Bitcoin has not waned.

Institutions continue to support Bitcoin by investing in it and developing products linked to it, indicating their confidence in its long-term potential. Market sentiment is subject to sudden changes. Positive news can quickly alter the narrative and drive up costs. Clearer regulation or improved technology are two examples of this.

This article was originally published on U.Today