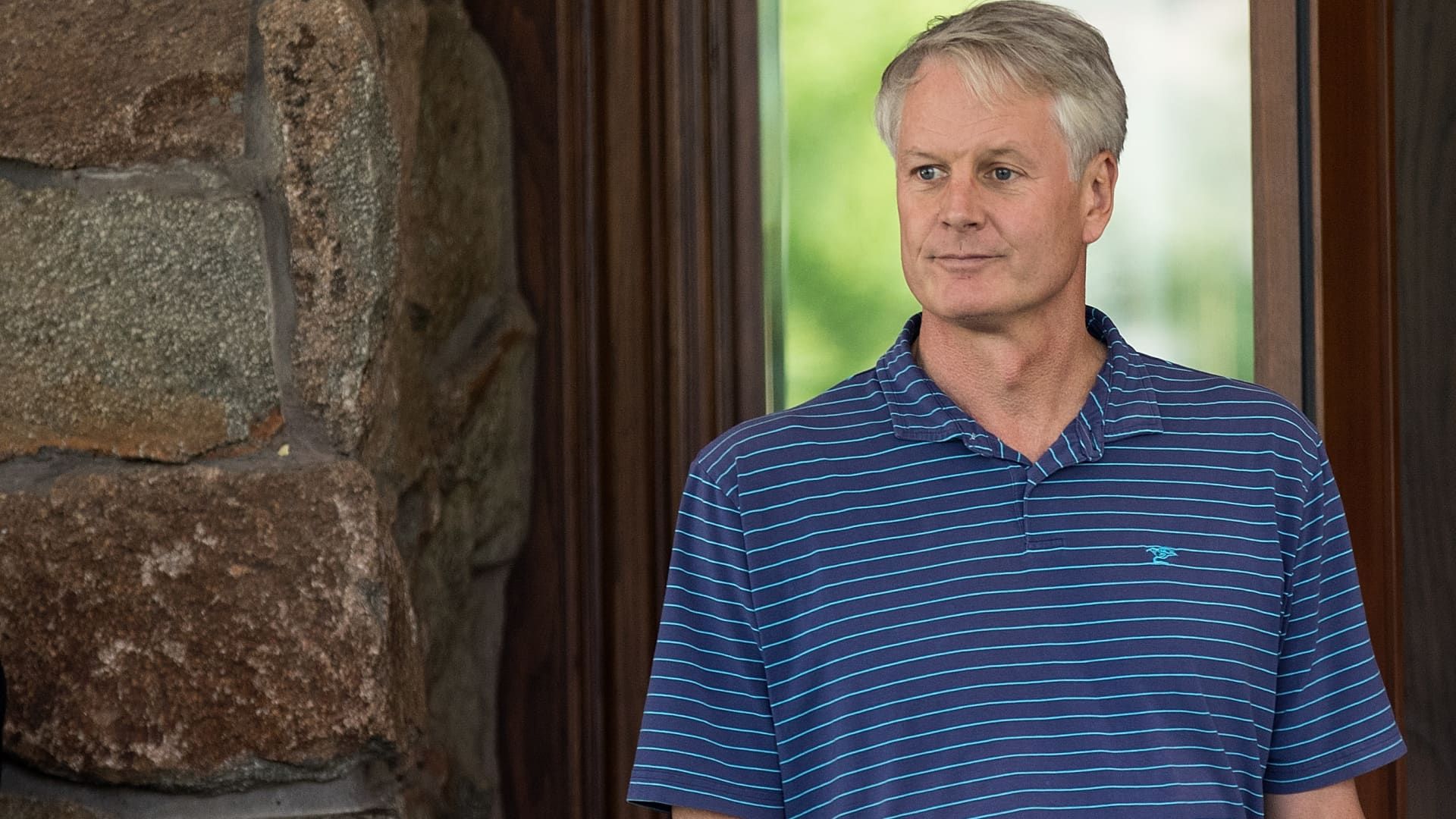

John Donahoe attends the first day of the annual Allen & Company Sun Valley Conference in Sun Valley, Idaho.

Drew Angerer | Getty Images

Nike CEO John Donahoe appears to be walking a tightrope.

The former top executive of eBaywho has been at the helm of Nike since January 2020, is beginning to lose the confidence of Wall Street after the company closed a mediocre fiscal year with more bad news.

On Thursday, Nike warned that sales in its current quarter were expected to decline by a staggering 10%, far worse than the 3.2% drop LSEG had projected, after recording its slowest annual sales growth in 14 years, excluding the Covid-19 pandemic.

The company also said it expects fiscal 2025 sales to decline to mid-single digits when it previously expected them to grow.

Nike shares fell 20% on Friday, the day after the quarterly report was released. The company's market value was around $114 billion.

As Wall Street digested the gloomy outlook for the world's largest sportswear company, at least six investment banks downgraded Nike's stock. Analysts at Morgan Stanley and Support went a step further and questioned the direction of the company.

“The guidance for FY25 (the 5th downward consensus revision in 6 quarters) extends growth turnaround prospects through 2025 (perhaps Q4FY25 or spring '25 at the earliest), calling for investors to bank on the success of untested styles and look through an uncertain outlook at the consumer discretionary backdrop in 2HCY24 until momentum can recover in 2HCY25,” wrote Stifel analyst Jim Duffy. “The credibility of the management is seriously questioned and the possibility of a regime change at the management level adds more uncertainty.”

Nike shares have underperformed the S&P 500 during CEO John Donahoe's tenure.

Since Donahoe took over as Nike's chief executive, its stock has fallen about 25%, according to intraday trading on Friday, significantly underperforming Nike's stock. S&P 500 and the XRT – the retail-focused ETF – which posted gains of around 69% and 67% in that period, respectively.

Nike CFO Matt Friend on Thursday attributed the guidance cut to a number of factors. Some, like weakness in China and difficult exchange rate headwinds, are outside Nike's control, but others are problems it created directly under Donahoe's leadership.

The company expects wholesale orders to be slow as it expands new styles, cuts back on classic franchises and works to repair its relationships with key retail partners after spending the past few years cutting them in favor of a direct-selling strategy.

At the same time, loyal customers who shop on Nike's website are no longer opting for new pairs of Air Force 1s, Air Jordan 1s or Dunks, the company's flagship franchises. Critics say sneaker lines have dominated the retailer's offering for too long and alienated customers looking for new styles and innovative designs from a host of emerging competitors.

Nike was forced to win back some of its most essential customers: runners. As the retailer focused on its direct sales strategy at the expense of innovation, more pugnacious competitors like On Running and Hoka grabbed market share.

“It was almost silly that towards the end of the call they talked about running being a key sport that consumers participate in… We have known this for a long time, we know that the consumer changed their mind after the pandemic, how they are a lot more active,” Jessica Ramirez, senior research analyst at Jane Hali & Associates, told CNBC, adding that a management change at Nike is “very necessary.”

“After lockdown, we saw the consumer embrace running and take it seriously, and there was an everyday runner, and Nike didn't really respond to that,” he said. “I think when management doesn't deliver on key consumer shifts, there's a problem with their business… something changed and they missed the mark.”

Kevin McCarthy, senior research analyst at Neuberger Berman, told CNBC's Scott Wapner on Thursday that the company needs a change in management and speculated that Donahoe's employment contract could expire soon.

“Everything that you've suggested is wrong with this company seems to impact execution, management and everything else,” McCarthy said on CNBC's “Closing Bell.”

“They have a couple of internal candidates right now who are very capable… you also have a couple of former Nike candidates who have been in the discussion, and then you also have other competitors who have been discussed. But I think the leadership of this company is supposed to change in the next six months.”

To be fair to Donahoe, the Covid-19 pandemic began in earnest in the US less than two months after he took office, and he had to deal with closed stores, remote workers, and a rollercoaster of shifting preferences and capabilities. of consumers.

While the company's stock may be down, Nike's annual sales have grown 37% under his leadership, from $37.4 billion in fiscal 2020 to $51.36 billion in fiscal 2024.

If you ask Phil Knight, founder of Nike and chairman emeritus, Donahoe is doing very well.

“I have seen Nike's plans for the future and I wholeheartedly believe in them,” the 86-year-old told CNBC in a statement. “I am optimistic about Nike's future and John Donahoe has my unwavering confidence and full support.”