Consumer price data released Thursday showed Federal Reserve officials, the White House and American households that inflation continued to slow in late 2023, ending a year in which price increases plaguing Families and authorities were seriously chilled.

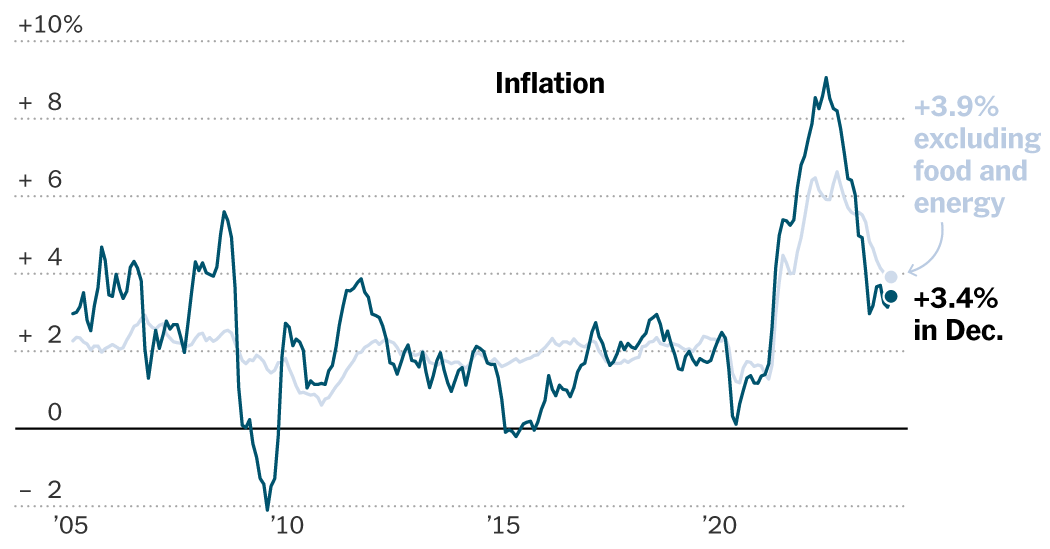

Overall, prices rose faster in December than in November on a year-on-year basis: 3.4 percent versus 3.1 percent previously, which was more than economists had forecast in a Bloomberg survey.

But after excluding volatile food and fuel prices to get a sense of the underlying inflation trend, a measure of “core” prices rose 3.9 percent in the year to December, up from 4 percent previously. That was the first time the underlying index fell below 4 percent since May 2021.

The data underscores that while inflation remains faster than usual (and monthly increases are still likely as gasoline prices and other volatile costs fluctuate), the measure is moving toward a normal pace. This is likely to be good news for central bankers and President Biden after nearly three years of rapid price increases that have raised costs for consumers and strained the budgets of many households.

“We've seen how the data can be spotty,” said Gregory Daco, chief economist at EY-Parthenon. “The important dynamic is really at the core level, and what we're seeing at the core level in three or even six months is really encouraging.”

Some of the underlying details could keep Fed officials cautious as they look ahead to 2024. A slowdown in rents for new leases is filtering into the broader housing market only gradually. And while the costs of some goods and services are cooling noticeably, prices for products like vehicle insurance continue to rise quite sharply.

But many economists do expect inflation to continue to moderate in the coming months as an expected cooling in housing price increases materializes and as the broader economy returns to a more normal pattern.

Whether that happens will determine what comes next from Federal Reserve officials.

Federal Reserve officials have raised rates sharply to slow economic growth and try to control inflation: its main policy rate now sits between 5.25 and 5.5 percent, up from nearly zero at early 2022. But with inflation cooling, central bankers could begin reducing interest rates to more normal levels this year.

Your task now is to balance two objectives. On the one hand, they want to ensure that inflation is completely under control. On the other, they don't want to keep borrowing costs too high for too long, risking a recession that would cost jobs and increase unemployment.

Policymakers have signaled they could cut interest rates three times in 2024. They are not yet willing to completely rule out the possibility of another rate hike before reversing course, but investors and many economists believe their next move will be reduce rates. maybe as soon as March.

For the Federal Reserve, Thursday's report was a reminder to tread carefully, said Oscar Muñoz, chief U.S. macroeconomic strategist at TD Securities. He expects central bankers to wait until May to reduce borrowing costs, giving themselves more time to see that inflation is truly due.

“They need to be a little more patient,” Muñoz said.

Fed officials themselves have pushed back in recent weeks on expectations of imminent rate cuts.

“If we do not maintain sufficiently tight financial conditions, there is a risk that inflation will rebound and reverse the progress we have made,” said Lorie Logan, president of the Federal Reserve Bank of Dallas, in a speech on January 6.

For consumers, slowing inflation means that the prices of many everyday purchases (from goods like furniture to services like rent) no longer rise as sharply. In fact, some products are falling in price, although for the most part price levels are still higher than a few years ago.

Wages are rising at a solid pace, which should help consumers catch up. Average hourly earnings have risen faster than the overall consumer price index since last summer, on an annualized basis. In fact, since February 2020, consumer prices and average hourly earnings have increased by about the same amount.

As consumers gain ground, they are also becoming slightly more optimistic. Several measures of consumer confidence have shown improvements recently, and while the share of households saying their financial situation is worsening has increased relative to 2019, it has declined in recent months.

And in the White House, the moderation of inflation – and improving sentiment among Americans – is a welcome development.

“We end 2023 with inflation reduced by almost two-thirds from its peak,” Biden said in a statement after the publication. “Despite what many forecasters predicted a year ago, inflation has fallen while growth and the labor market have remained strong.”

Economists will now be watching the release of the personal consumption expenditures index, which the Federal Reserve officially targets when it says it is targeting annual inflation of 2 percent. The measure pulls some data from the Consumer Price Index, but is released with a longer delay and is scheduled to be released on January 26.

Omair Sharif, founder of Inflation Insights, said that because of the way the data is calculated, the continued cooling is likely to be especially pronounced on that Fed's preferred measure.

And in the Consumer Price Index, he does expect house prices to cool in the coming months, a key step in fighting inflation to the end.

“I think we're on the cusp” of the long-awaited moderation in housing costs, he said, noting that a measure that tracks residential rent fell in December. “They were very close.”