A new contender for Paramount Global has emerged.

Media mogul Barry Diller is considering acquiring National Amusements Inc., the company owned by Shari Redstone and the controlling shareholder of Paramount, CNBC's David Faber reported Tuesday.

From Diller CAIan Internet media and publishing company, has signed a confidentiality agreement and is seeking information from National Amusements' data room, Faber said Tuesday. IAC could make a near-term decision to make a bid for National Amusements, which would give it a majority stake in Paramount, he said, citing sources.

The discussions come weeks after National Amusements halted talks with Skydance over a proposed merger with Paramount.

After months of negotiations with a consortium that included David Ellison’s Skydance and private equity firms RedBird Capital and KKR, the deal was called off pending Redstone’s approval. National Amusements, which Redstone controls, owns 77% of Paramount’s Class A stock.

Before calling off the proposed merger, National Amusements had agreed to the financial terms of the deal, CNBC reported. The proposed deal would have seen Redstone receive $2 billion for National Amusements, and Skydance would buy nearly 50% of Paramount’s Class B shares at $15 each, or $4.5 billion. Skydance and RedBird had also agreed to contribute $1.5 billion in cash to Paramount’s balance sheet to help reduce debt.

Terms of IAC's potential offer are not known, but it would likely have to be more than $2 billion, Faber reported Tuesday. The New York Times was first to report Diller's interest in Paramount.

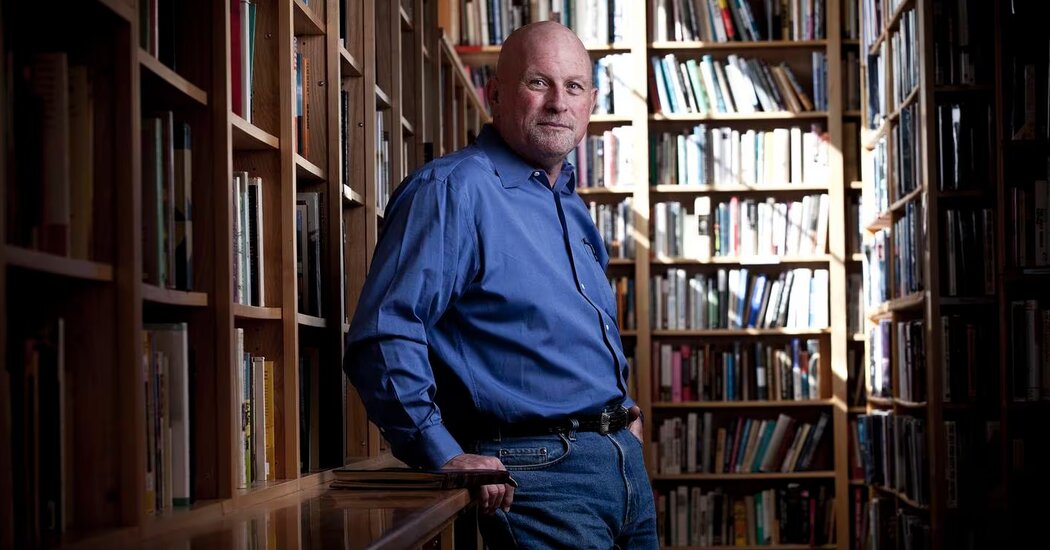

Diller, 82, is currently chairman of IAC and Expedia and has a long career in the media industry, having served as chairman and chief executive of Paramount Pictures in the 1970s and 1980s. After Paramount, he served as chairman of 20th Century Fox, where he greenlit Fox shows including “The Simpsons.”

Diller has been outspoken about the need for traditional media companies like Paramount to stop chasing Netflix in the streaming wars and are focusing on their broadcast networks and pay TV.

During the Hollywood strikes last summer, he said that despite the elimination of cable TV services, traditional pay TV remains profitable, unlike most streaming companies. He called on traditional media to re-establish traditional networks.

Diller attempted to acquire Paramount Pictures in the 1990s, but ran afoul of Sumner Redstone, Shari Redstone's father, who now controls the company.

Since then, Paramount has changed and grown in a number of ways. The company now comprises the film studio, as well as the CBS broadcast network, a portfolio of cable networks such as MTV and BET, and the Paramount+ and Pluto streaming services.

Although other suitors have reportedly been interested in acquiring Paramount, the company has been focused on restructuring its business.

Now led by the so-called CEO Office (CBS CEO George Cheeks, Paramount Media Networks CEO Chris McCarthy and Paramount Pictures CEO Brian Robbins), Paramount has focused on exploring streaming joint venture opportunities with other media companies, cutting $500 million in costs and divesting non-core assets.