U.Today – , the largest cryptocurrency by market cap, plummeted to an intraday low of $58,528 on Monday, the steepest drop since mid-April, as ongoing pessimism over the number of rate cuts weighed on sentiment. for cryptocurrencies.

The cryptocurrency crash earlier this week came amid questions about the Federal Reserve's scope to quickly cut interest rates from a two-decade high.

Amid the current market situation, Fed officials recently made crucial comments that would have significant implications for cryptocurrencies.

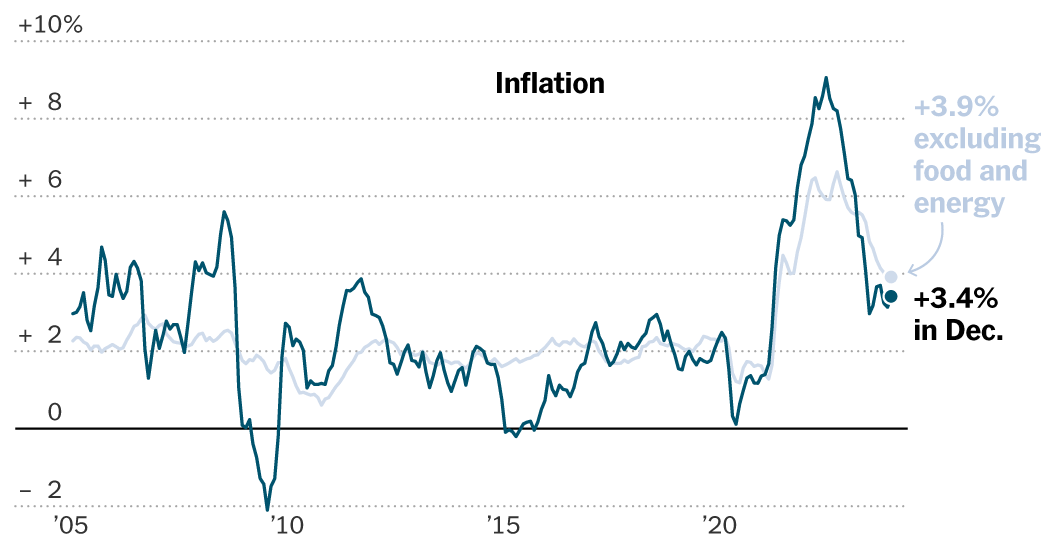

Federal Reserve Governor Michelle Bowman said on Tuesday that the time was not yet appropriate to begin cutting interest rates, dampening hopes of U.S. interest rate cuts. She also stated that if inflation does not go down, she will consider raising interest rates.

These comments reflect a prevailing sentiment at the central bank, where most policymakers have stated in recent weeks that while they still anticipate inflation will return to the Fed's 2% target, they need more evidence.

The S&P 500 erased gains after Federal Reserve Governor Michelle Bowman made her comments.

This is how the cryptocurrency market responded

Bitcoin and cryptocurrencies, however, posted a muted, barely impassive response. Bitcoin bounced above $62,000 on Tuesday, reaching highs of $62,400.

Cryptocurrencies are also broadly up, with a handful of crypto assets in the green at the time of this publication. Frog-themed cryptocurrency Pepe was trading up 9%, and Dogwifhat (WIF) was also up 7.30%. Notcoin (NOT) is up 13% in the same time period.

Although slightly lower, Bitcoin moved little over the past 24 hours, rising 0.97% to trade at $61,595 at the time of publication.

Bitcoin hit a high of $73,798 in March, but is lagging traditional investments like stocks, bonds and gold this quarter. The 200-day moving average, which is currently around $57,738, is considered a possible support zone for the price in case of further declines.

In the coming days, investors and market participants will closely monitor the Federal Reserve's policy decisions and their implications for cryptocurrencies.

This article was originally published on U.Today