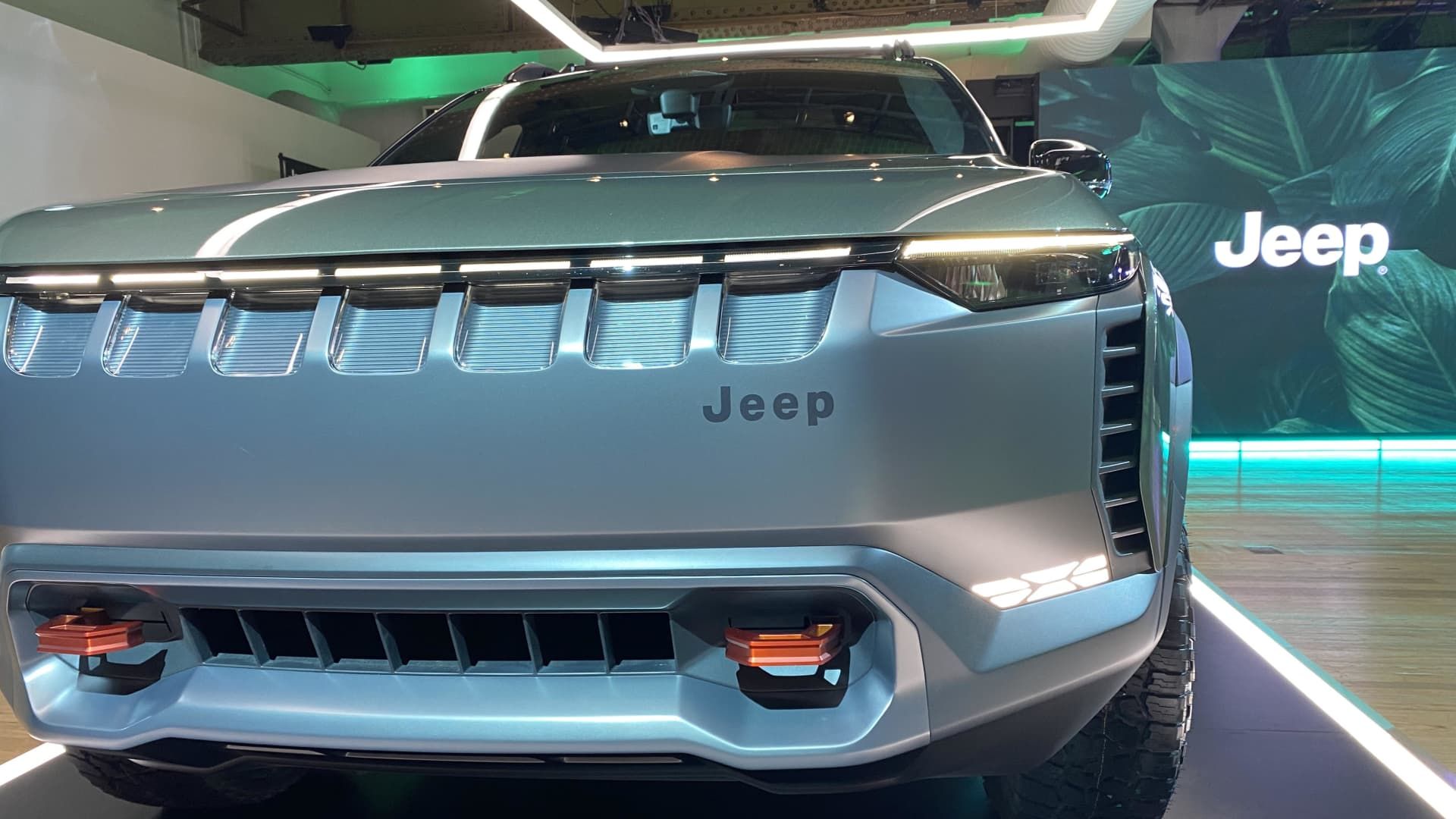

Jeep Wagoneer S Trailhawk EV Concept

Michael Wayland / CNBC

DETROIT — Stellantis'The Jeep brand is known for climbing difficult terrain, but its latest challenge of achieving 1 million vehicle sales nationwide by 2027 will be a very difficult hill to climb.

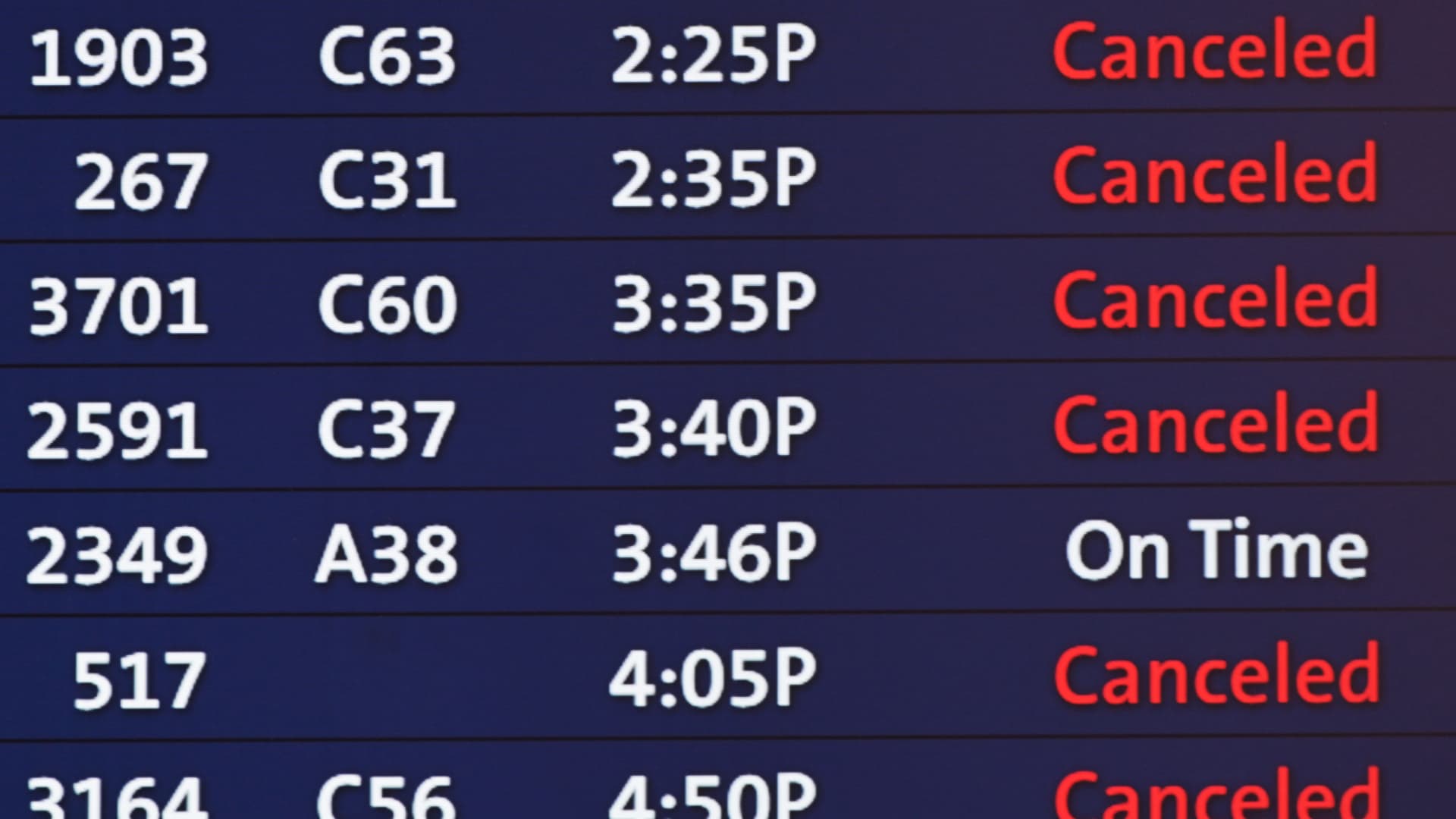

Jeep, a coveted brand in the auto industry, has been in a sales slump in the U.S. that has included five years of annual sales declines, and 2024 is on track to potentially become the sixth.

However, Jeep CEO Antonio Filosa believes the brand's worst days are behind it and that it is still within reach of its 1 million unit sales target. The company is executing a turnaround plan for the quintessentially American SUV brand that he says is already starting to bear fruit after a 9% sales drop in the US during the first six months of the year.

The plan includes cutting prices across its lineup, including high-volume models like the Jeep Compass and Grand Cherokee SUVs; implementing special offers like incentives or 0% financing; and increasing marketing and advertising spending, Filosa said. It will also include an upcoming roadshow with dealers to address additional issues and concerns.

Such actions can cut into profits, but average transaction prices for the brand have skyrocketed from less than $40,000 in 2020 to more than $50,000 this year, according to Cox Automotive. Jeep’s average transaction price has been above the industry average since 2021, Cox reports.

“The good thing is that the actions we implemented in the previous months are also resulting in significant growth in the United States,” Filosa told CNBC during a virtual interview on Monday.

Filosa's comments came a day before the president of Stellantis' National Distributors Council wrote a scathing open letter to Stellantis CEO Carlos Tavares over the company's sales losses and other business decisions.

Stellantis sold more than 1.5 million vehicles last year in the U.S., a decline of about 1% from 2022, compared with an industry-wide increase of 13% in 2023.

Jeep Sales

Filosa said Jeep, which reports sales quarterly, saw its U.S. sales rise last month — up 28% from August 2023 and 55% from July. Jeep also reduced its vehicle inventory by about 25,000 units during that time. But the brand has a long way to go to achieve a noticeable turnaround in sales.

Jeep U.S. sales plummeted 34% from an all-time high of more than 973,000 SUVs sold in 2018 to fewer than 643,000 units last year. While most automakers saw sales increase last year, Jeep declined about 6%.

The New York Stock Exchange welcomes The Jeep Brand (NYSE: STLA) to the podium on May 31, 2024. To honor the occasion, Antonio Filosa, Chief Executive Officer, joined by Lynn Martin, Chairman, NYSE Group, rings The Opening Bell®.

NYSE

The latest declines come after the company last year ended production of the base-model Renegade and the compact Cherokee SUV, two mainstream models with peak U.S. sales of about 300,000 units annually between 2016 and 2019.

“The loss of the Jeep Cherokee… and Jeep Renegade has been a major blow to us,” Filosa said. “Our market coverage dropped from an average of 80% to 45%.”

Filosa said Jeep expects to regain market share “very quickly” and return to 80% market share coverage, which includes the segments in which Jeep competes, by the end of next year, when it will introduce an unnamed replacement for the Cherokee as well as new electrified models.

Thinking about the future

In addition to finalizing new models, Stellantis brands like Jeep have focused on profits over market share during Tavares' tenure as CEO.

Tavares has been on a cost-cutting mission since the company was formed through a merger between Fiat Chrysler and France's PSA Group in January 2021. It's part of his “Dare Forward 2030” plan to boost profits and double revenue to 300 billion euros ($325 billion) by 2030.

As part of that plan, Jeep aims to sell about 1.5 million SUVs worldwide by 2027, including 1 million in the U.S.

To achieve those goals, Tavares said earlier this year that he had allowed some leniency on some pricing, incentives and other financial targets after speaking with the company's dealers.

Filosa said he is continuing those efforts by meeting with dealers to discuss recovery initiatives. He will participate in a dealer tour beginning next month with the brand's new North American head, Bob Broderdorf.

Stellantis CEO Carlos Tavares pictured next to a Jeep Avenger at the Paris Motor Show on October 17, 2022.

Nathan Laine | Bloomberg | Getty Images

Jeep, which is the largest seller of plug-in hybrid electric vehicles in the U.S., also has several new vehicles coming. The brand will launch the all-electric Wagoneer S later this year, followed next year by a Jeep Wrangler-inspired “Recon” off-roader and plug-in, range-extended versions of its larger Wagoneer and Grand Wagoneer off-roaders.

In view of this type of vehicle, Jeep has increased its investment in media by 20% compared to the first half of the year, according to the car manufacturer.

“Now is the time to boost and accelerate sales to recover as much as possible [they] to do. Next year, obviously, we will talk about growth, since we have new products. … I think [next year] “It will be a completely different story,” Filosa said.

Jeep is also trying to boost the quality and reliability of its vehicles, which have historically fallen below average in third-party ratings. It said this includes delaying the launches of its upcoming Wagoneer S and Recon by four to six weeks.

But building problem-free vehicles is easier said than done in the auto industry. Jeep confirmed Monday that it is cooperating with U.S. auto safety regulators in an investigation into more than 781,000 new Jeep Wrangler and Gladiator SUVs after reports of fires under the hood.

2024 Jeep Wagoneer S EV

Jeep

Filosa confirmed he was aware of the investigation but declined to provide further details. Earlier this year, Tavares highlighted quality problems within the automaker, specifically at a plant in suburban Detroit that makes the Ram 1500.

“We are closely monitoring the quality of the Jeep Wagoneer S at the plant, as well as the Jeep Recon,” Filosa said. “The only order I have to deliver to the plants is to deliver the vehicle when it is in perfect quality.”

The new all-electric SUVs will be produced at Stellantis' Toluca, Mexico, assembly plant. The company has not confirmed a production location for the replacement for the Cherokee SUV, which was produced at a now-idle plant in Illinois.