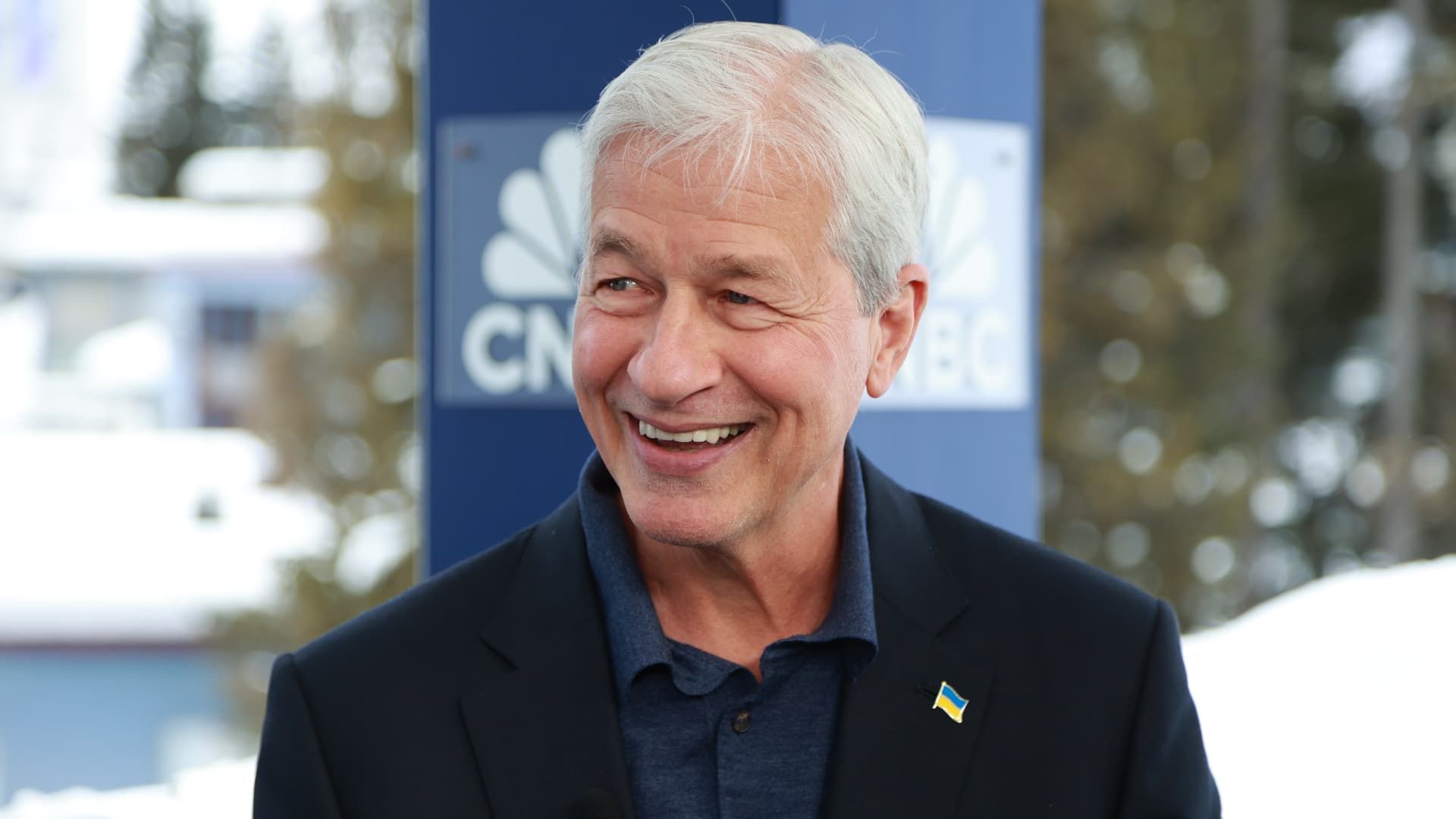

Jamie Dimon, chairman and CEO, president and CEO of JPMorgan Chase, speaking on CNBC's Squawk Box at the World Economic Forum annual meeting in Davos, Switzerland, on January 17, 2024.

Adam Galici | CNBC

JPMorgan Chase CEO Jamie Dimon isn't worried about added competition from a swollen company. capital one if its acquisition for 35.3 billion dollars Discover Finance gets approval.

“My opinion is that we let them compete,” Dimon said. “Let them try it and if we think it is unfair we will complain.”

Dimon, speaking to CNBC's Leslie Picker from a conference in Miami, acknowledged that if regulators approve the Capital One-Discover deal, his bank will be eclipsed as the country's largest credit card lender. But that didn't stop him from praising Capital One CEO Richard Fairbank.

“It doesn't really worry me, but we keep track of everything he does,” Dimon added.

The deal has two main components: the credit card business and the payments network, Dimon said.

“The credit card business… will be bigger and [have] more scale,” Dimon said. “They're very good at it. “I have enormous respect for Richard Fairbanks and Capital One.”

It's unclear whether Capital One can create a true alternative to dominant card networks Visa and Mastercard with this deal, Dimon said.

He added that Capital One will have an “unfair advantage over us” in debit payments, due to the fact that legislation known as the Durbin Amendment caps debit fees for big banks, but not for Discover or American Express.

“Of course, I have a problem with that,” Dimon said. “You know, why should they be allowed to price debit differently than we price debit just because of a law that was passed?”

This story is developing. Please check for updates.