India’s economy is booming. Stock prices are through the roof, among the best performers in the world. Government investment in airports, bridges and highways, and clean energy infrastructure is visible almost everywhere. India’s total output, or gross domestic product, is expected to rise 6 percent this year, faster than the United States or China.

But there is a problem: investment by Indian companies is not keeping pace. The money that companies invest in the future of their businesses, in things like new machines and factories, is stagnating. As a fraction of India’s economy, it is contracting. And as money flies into India’s stock markets, long-term foreign investment has been declining.

The green and red lights flash at the same time. At some point soon, the government will need to reduce its extraordinary spending, which could weigh on the economy if private sector money does not recover.

No one expects India to stop growing, but a 6 percent increase is not enough to meet its ambitions. Its population, now the largest in the world, is growing. His government has set a national goal of catching up with China and becoming a developed nation by 2047. That kind of leap will require sustained growth of around 8 or 9 percent annually, most economists say.

The missing investment could also present a challenge to Narendra Modi, prime minister since 2014, who has focused on making India an easier place for foreign and Indian companies to do business.

Modi is in campaign mode, facing elections in the spring and mobilizing the nation to celebrate his successes. The slow pace of investment is not something foreign executives, bankers or diplomats like to discuss, for fear of appearing naysayers. But investors are playing it safe as the economy points out strengths and weaknesses.

One point of widespread agreement is that India should benefit from China’s slowdown, which has been driven by an unfolding housing crisis. China’s geopolitical tensions with the West present another opportunity for India, motivating foreign companies to shift production in China to other countries.

Sriram Viswanathan, managing partner of Celesta, a Silicon Valley venture capital fund, born in India, describes that investors “want to fill the gap that has been created in the supply chain.”

“I think that is the opportunity for India,” he said.

The World Bank has applauded India’s commitment to infrastructure spending, which increased during the pandemic when the private sector needed to be rescued. The government has since doubled down, paying for physical improvements to rickety roads, ports and power supplies that once discouraged business investment.

But the World Bank, whose mission is to boost developing economies, says it is critical that those billions of government spending trigger an explosion of corporate spending. Its economists talk about a “pull effect,” which occurs when, for example, a new port next to a shiny new industrial park attracts companies to build plants and hire workers. Last year, the bank said it anticipated an imminent crush, as it had predicted for nearly three straight years.

“To accelerate the growth of confidence, public investment is not enough,” Auguste Tano Kouamé, World Bank director for India, said at a press conference in April. “Deeper reforms are needed to get the private sector to invest.”

The lack of confidence helps explain why stock markets are breaking records, even as foreign investors are avoiding buying into the Indian economy through new companies and acquisitions.

Stock markets in Mumbai, India’s business capital, are worth nearly $4 trillion, up from $3 trillion a year ago, making them more valuable than those in Hong Kong. India’s small investors have been a big part of that, but trading stocks is quick and easy, compared to buying and selling companies. A recent annual average of $40 billion in foreign direct investment has dropped to $13 billion last year.

One of the reasons companies are watching and waiting to make investments is Modi’s powerful national government.

On the one hand, businesses crave stability in political leadership, and India has rarely, if ever, had such an entrenched leader. He destroyed the main opposition party in three big elections in December in the Hindi-speaking heartland and appears a shoo-in for re-election this year. And Modi is openly pro-business.

Its government plays a markedly interventionist role in managing the economy, in a way that can make it dangerous for companies to place their bets.

In August, the government announced sudden restrictions on the import of laptops, to stimulate domestic production. That sent businesses that depend on them into a tailspin, and the measure was withdrawn almost as quickly. Likewise, in July, the government hit online gambling companies with a 28 percent retroactive tax, destroying a $1.5 billion industry overnight.

Companies close to Modi and his political circle have fared especially well. The most prominent examples are Mukesh Ambani’s Reliance Industries and Adani Group, conglomerates that reach into numerous areas of Indian life. Their combined market power has become gigantic in recent years: Each company’s flagship shares are worth about six times more than when Modi became prime minister.

Some smaller businesses have been subject to high-profile raids by tax enforcement agencies.

“If you’re not the two A’s” (Adani or Ambani), it can be treacherous to navigate India’s regulatory paths, said Arvind Subramanian, an economist at Brown University who worked under the Modi government as chief economic adviser from 2014 to 2018. “Domestic investors feel a little vulnerable,” he added.

The last nine years of Modi government have improved many things in the business environment for all. Crucial systems work better, many types of corruption have been controlled and trade has been digitized It has opened new fields of growth.

“What’s really complex and interesting about this Modi phenomenon is that there is a lot of hype, grandstanding and manipulation,” Subramanian said. “But it is based on a core of achievements.”

Still, foreign officials charged with bringing billions of investment capital to India complain that much of the traditional pain of doing business in India persists. The most cited is that of bureaucracy. Too many officials are involved at all levels of approval, and it remains painfully slow to obtain legal rulings, much less enforce them.

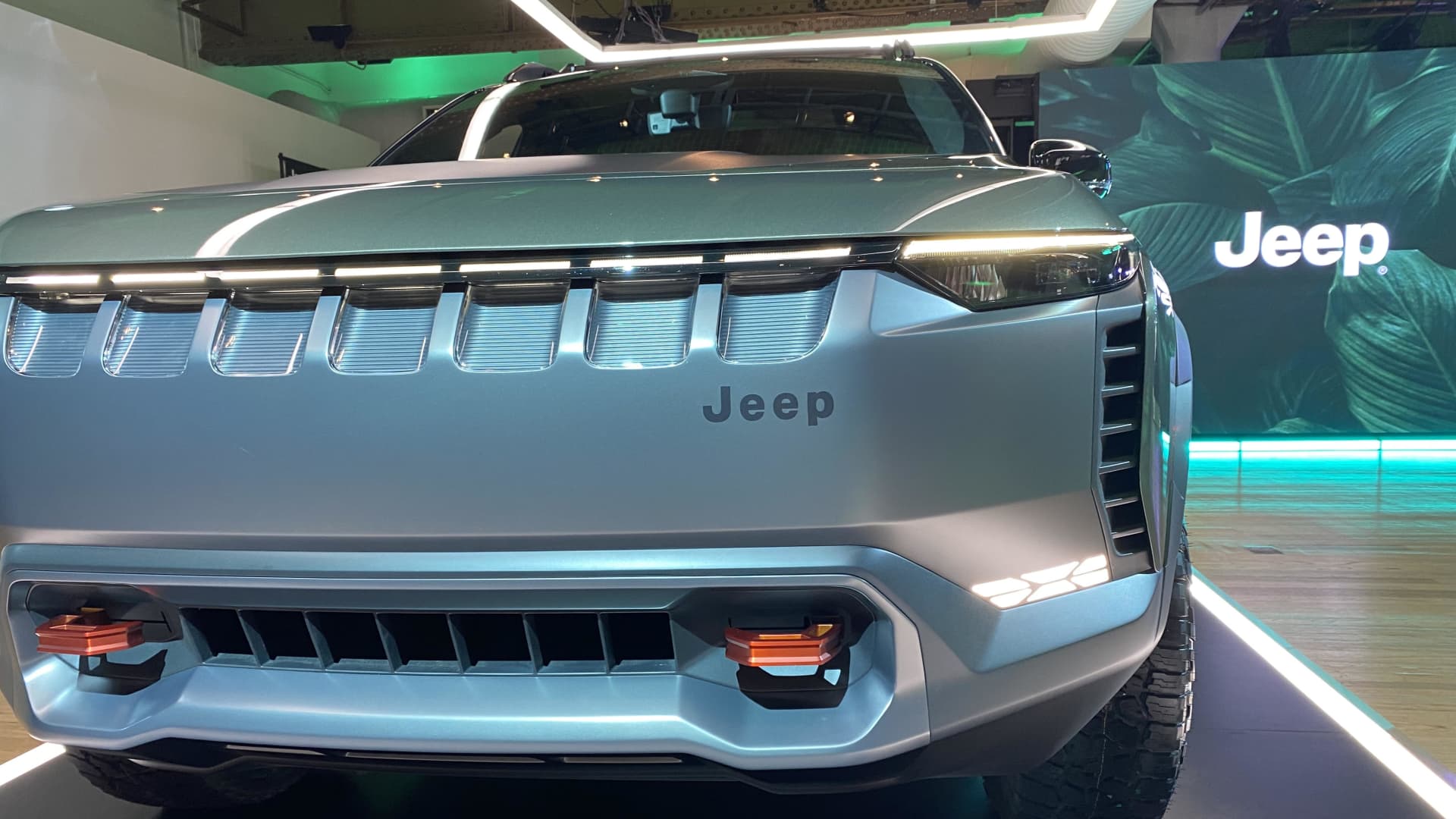

Another factor holding back long-term investment is an underlying weakness in “India’s growth story.” The most powerful source of demand, the one coveted by foreign investors and domestic companies, is among the wealthiest consumers. In a population of 1.4 billion, about 20 million Indians are doing well enough to buy European consumer products, build luxury homes and strengthen the top tier of the automotive sector.

Most of the rest of the population is struggling with inflation in food and fuel prices. Banks are extending credit to consumers of both types, but less so to businesses, which fear that the vast majority of their customers will tighten their belts in the years to come.

“At the moment, there is no evidence that investors are comfortable with India,” Subramanian said.

But he remains hopeful. Annual growth, even if it is less than 6 percent, is nothing to sneeze at. New and improved infrastructure should eventually attract more private investment. And the benefits of consumer wealth, although unevenly distributed, could eventually generate more income.

The biggest wild card is whether India can wrest a significant share of the global business from China. The most prominent example is Apple, the $3 trillion mega-company, which is slowly shifting part of its supply chain away from China. Its expensive iPhone barely has 5 percent of the Indian market. But currently about 7 percent of the world’s iPhones are made in India, and JPMorgan Chase has estimated that Apple intends to take that figure to 25 percent by 2025. At that point, all sorts of things become possible. for India.

“We must keep an open mind,” Subramanian said.