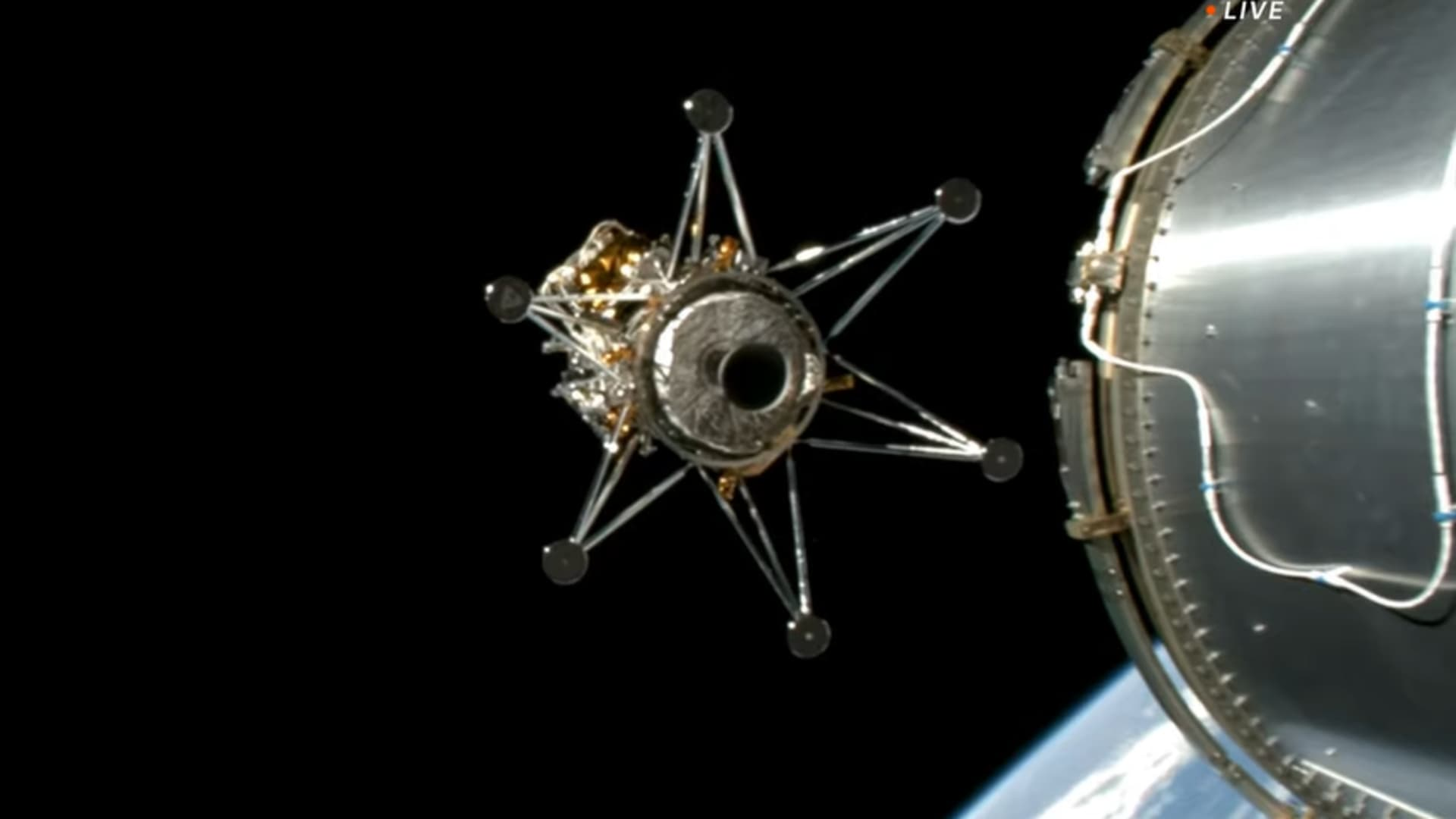

Intuitive Machines' Nova-C “Odysseus” lander deploys from the upper stage of SpaceX's Falcon 9 rocket to begin the IM-1 mission.

nasa television

Very similar Intuitive machines spaceship, its stock has been flying to the moon last week.

In just over a month since hitting record lows, and with its IM-1 mission en route to the lunar surface, Intuitive Machines shares have risen more than 300% since the beginning of January. It's a rally that Wall Street analysts describe as fueled by retail investors' enthusiasm for the space company's progress toward an unprecedented goal.

Shares of the Texas-based lunar company, appropriately symbolized “LUNR,” now trade at around $9 per share, a far cry from January lows of around $2. At one point this week, as IM-1 progressed through milestones before its landing attempt, shares reached more than $13 in trading.

“We have never seen a publicly traded company go through [a moon landing attempt]. So this is new, not only for investors, but also for us analysts,” Cantor Fitzgerald's Andrés Sheppard told CNBC.

Sheppard compared Intuitive Machine's attempted landing, scheduled for Thursday night, to a biotech company awaiting FDA approval for a new drug: “It's a bit of a binary outcome,” Sheppard said.

While Sheppard said he could see Intuitive's stock price rising to about $15 a share if the landing was successful, he warned that a last-minute mishap could drag the stock down.

And in the event of a further increase, he noted, “that valuation is certainly ahead of the company's financials,” as “people are getting caught up” in the excitement and possible story of the IM-1 landing on the moon. , said.

Intuitive Machines stock trading around its IM-1 lunar mission.

Intuitive went public via a SPAC merger less than a year ago and has spent most of that time trading below its debut price. Only a handful of Wall Street analysts cover the billion-dollar space company. Of the companies listed by FactSet that cover Intuitive Machines, all four analysts have bought equivalent ratings for the stock, and all four have seen the stock surpass their pre-release price targets.

Sign up here to receive weekly editions of CNBC's Investing in Space newsletter.

Beyond the technological and financial progress that IM-1 represents for Intuitive Machines, analysts noted excitement over what could be the first U.S. moon landing in more than 50 years, as well as the first by a corporate entity, rather than of a government agency. .

“We can see how these applications in space can capture the imagination and vision of investors…hopefully it's successful as I think it will do a lot for the space industry as a whole,” Benchmark analyst Josh Sullivan told CNBC. .

Along with Canaccord Genuity analyst Austin Moeller, Sullivan and Sheppard were unanimous in their reads that retail investors, not institutional ones, are driving Intuitive Machines' current rally. Sheppard said his firm estimates that about 80% of last week's trading was done by retail traders.

“There's a lot of momentum behind this driven by the retail community,” Sheppard said.

Sullivan also cited global news coverage of Intuitive's mission as another driver, giving the company broader exposure.

“Successful milestones are adding up to a point where [a moon company] It's becoming a commercial reality and I think it's starting to catch on,” Sullivan said.

Passing milestones

IM-1 has made steady progress across the 16 milestones the company outlined ahead of launch. However, Intuitive is not only overcoming the technological hurdles that come with a first space flight, but also checking boxes to receive payment from its largest customer even before attempting the landing.

Intuitive Machines and NASA leaders show a mockup of the company's Nova-C lunar lander during a presentation on May 31, 2019.

Aubrey Gemignani/NASA

Canaccord's Moeller noted that IM-1 has now reached more than 90% of the milestones required for payment under its $118 million contract with NASA. Remaining payment milestones include safe landing and successful collection of research data aboard the spacecraft.

But, as Sullivan noted, IM-1 represents more than simply receiving payment for an existing contract.

“It's really about demonstrating a track record of success in the very harsh environment of space, so that in the future, when they go to NASA… the likelihood of them winning those very large contracts increases substantially,” Sullivan said.

A key element of NASA's Commercial Lunar Cargo Services (CLPS) program is the competitive nature among companies bidding to deliver cargo on future lunar missions. One of Intuitive Machines' competitors, Astrobotic, had a crippling problem during its inaugural lunar mission last month that prevented the company from attempting a landing.

Both companies, among others, have already obtained NASA contracts for additional missions. Analysts see Intuitive's progress so far as a key differentiator in future offerings.

“Even if the mission is not successful [in landing], they have two additional missions that are already under contract. “The next one is supposed to launch in a few months and they'll be able to take the data and what they've learned from this mission, which has been pretty successful so far, and apply it,” Moeller said.